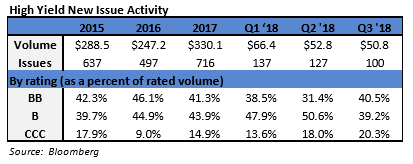

Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were -$2.1 billion and year to date flows stand at -$39.6 billion. New issuance for the week was $5.0 billion and year to date HY is at $158.1 billion, which is -30% over the same period last year.

(Bloomberg) High Yield Market Highlights

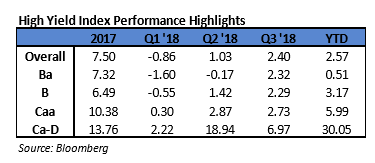

- Junk bond returns took a beating yesterday, with CCCs losing most and yields rising across ratings amid fund outflows, equity volatility and disappointing earnings. This morning’s drop in U.S. equity futures keeps the pressure on.

- Junk bond spreads widened and yields rose across the risk spectrum as equities dropped more than 4% mid week and the VIX jumped 27%

- Stocks recovered a bit, while VIX remains above 20

- October saw the fourth biggest outflow on record and MTD outflow was $5.4b

- While high yield investors turned cautious, lack of supply is supportive

- This was the slowest October since 2015 with $8.4 billion MTD of issuance

- YTD volume at $158b was the lowest since 2009

(Reuters) Leverage rising on US buyout loans after regulation relaxed

- Leverage ratios on private equity-backed deals are rising again as banks compete more aggressively for lucrative private equity loans after regulators relaxed leveraged lending guidelines earlier this year.

- The guidelines were put in place in 2013 to limit systemic risk and prevent a re-run of the financial crisis, but were relaxed in February

- In the first nine months of 2018, the guidelines’ original limit of 6.0 times leverage was exceeded by a record 73.1% of private equity buyout loans, up from 64.2% in 2017. This exceeds the previous peak of the market in 2007 immediately before the financial crisis, when 61.5% of deals were levered at that level, according to LPC data.

- “The shackles have been taken off,” a banker said.

- Strong investor demand for floating rate leveraged loans is exceeding a limited supply of deals as cash continues to pour into the asset class in a rising interest rate environment. Toppy equity markets mean that private equity firms are paying high enterprise valuations, which is producing more highly leveraged loans as banks compete for mandates.

- The most aggressive highly leveraged deals are also setting new records with 41.4% of sponsored deals carrying leverage of more than 7.0 times. This eclipses the market’s previous high in 2007, when 38.5% of deals reached that level.

- When the guidelines came into effect in 2013, deals with debt-to-Ebitda leverage ratios of more than 6.0 times received unwelcome extra scrutiny from regulators including the Office of the Comptroller of the Currency, the Federal Reserve and the Federal Deposit Insurance Corp.

- Regulated banks were instructed to make sure that all the company’s secured debt, or half of total debt, could be paid down within five to seven years and explain any exceptions on ‘criticized’ deals.

- This immediately handed a competitive advantage to institutions not subject to the guidelines, which were able to lead more highly leveraged loans than regulated banks.

- That edge disappeared in September, when the Fed and the OCC said the guidelines are not technically rules, following February’s comments by Comptroller of the Currency Joseph Otting that banks could underwrite outside the guidelines as long as they did so prudently and had capital to support it.

(Bloomberg) NeoTract Welcomes UK Government Announcement to Remove Barriers to Adoption of the UroLift® System

- A new Government scheme announced today selects the UroLift®System as one of seven innovations across all specialisms that are the most transformative for NHS patients

- The UroLift System will now benefit from support from the Accelerated Access Collaborative to rapidly increase its uptake in the NHS. This enables transformative products to reach patients as quickly as possible through streamlined regulatory and market access decisions.

- Neil Barber, Consultant Urologist, Frimley Health NHS Foundation Trust, was the first surgeon to routinely offer the UroLift System on the NHS. Mr. Barber said, “I am very pleased by this news. Having been involved in the initial European randomized clinical trial, the potential benefits of the UroLift System to both patients and the NHS quickly became very clear.

(Bloomberg) At Sell-Off’s Core Is an Earnings Season That’s Consoling No One

- A quarter of the way through earnings season and 10 months into what is sure to be the biggest year for profit growth this decade, the numbers are strong. The market doesn’t care.

- It sounds astonishing: at a time when S&P 500 operating income is surging more than twice the historical average, stocks have gone nowhere, with both the Dow Jones Industrial Average and S&P 500 erasing their annual gain on Wednesday.

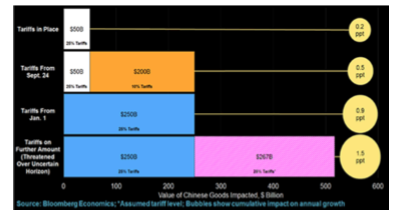

- Confidence in the present is quickly becoming panic about the future, as signs of a tottering real estate market, concern about China’s fragile economy and budding indications of inflation blot out optimism that had lifted the S&P 500 almost 10 percent through September. The VIX is at its highest since February.

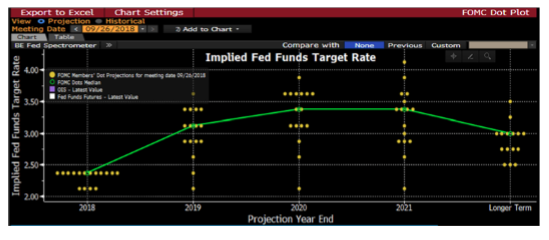

- Aspects of the carnage are different from past corrections. The S&P 500 has declined in 19 of 24 days since peaking in September, with bad days landing at almost twice the frequency of the last three corrections. Unlike earlier selloffs, bulls are fighting the Fed. The central bank has lifted rates eight times since 2015 and given no indication it will let up.

- To the extent earnings matter anymore, it’s not this year’s but next year’s, where forecasts for an 11 percent gain are coming under the strictest of scrutiny. Partly it’s the “peak earnings” argument that says the deceleration to roughly half this year’s rate will leave investors with no reason to buy. But it’s also concern that the estimates themselves won’t hold up.