Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were $1.7 billion and year to date flows stand at $21.7 billion. New issuance for the week was $5.6 billion and year to date HY is at $209.4 billion, which is +33% over the same period last year.

(Bloomberg) High Yield Market Highlights

- S. junk bond returns hit a new peak of 11.853% this year, the highest since 2016, amid a hunt for yield by investors. Junk bonds have rallied for 11 straight days, the longest winning streak since April, according to Bloomberg Barclays index data.

- BB bond returns also rose to a high of 13.433%

- Junk bond yields also fell to 5.56%, approaching a 20-month low of 5.55% hit on Sept. 23

- BB yields are 3.85%, near the record low of 3.82% reached on Oct. 21

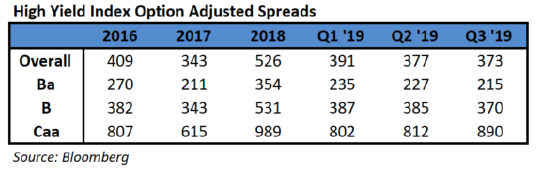

- Spreads were largely unchanged moving in tandem with 5Y UST

- Investors are pouring cash into the asset class.

- The rally may run out of steam Friday as oil prices are lower and stock futures mixed

(Bloomberg) Cracks in Leveraged Credit Are Widening

- S. leveraged credit markets are coming under increasing pressure amid price swings, ratings downgrades and selling by CLOs, according to a report from Morgan Stanley.

- Strategists led by Srikanth Sankaran identified the increased frequency of big price moves in loans and bonds even outside stressed credits, amid a number of pockets of weakness

- In loans, about $48b of notional debt representing 4.2% of the leveraged loan index now trades below 80 cents, compared to $14b and 1.3% a year ago

- The sub-90 cash price bucket also increased to 9.8% from 3.2% in the same period, according to the report

- “Beneath the veneer of relative spread resilience and muted realized defaults, the weak links in the leveraged credit markets are coming under pressure,” the strategists wrote in the report

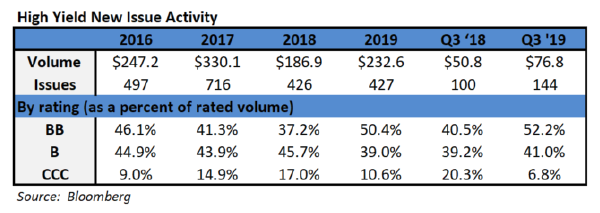

- Selling pressure from CLOs has exacerbated the loan price swings, and willingness to sell is particularly high in CCCs

- “CLO managers are net sellers of large price moves, especially in lower-rated names,” the strategists wrote

(Wall Street Journal) Wave of Financial Stress Hits Low-Rated Companies

- An array of business challenges are hitting low-rated companies across the U.S. economy, driving selling in the bottom tier of the corporate-debt market that contrasts with gains in stocks and other riskier assets.

- In recent months, consumer demands for wireless phones and high-speed internet have helped push one landline telecom company, Windstream Holdings Inc., into bankruptcy protection and another, Frontier Communications Corp., into restructuring talks with its creditors.

- Meanwhile, competition from cheap natural gas and renewable-energy sources has caused at least seven coal producers to file for chapter 11 protection over the past year. Opioid lawsuits and the threat of legislation that would curb surprise medical bills have exposed vulnerabilities at some highly leveraged health-care companies. Retailers continue to be pressured by the shift to online shopping. And a wave of financial distress has again hit the oil patch due in part to persistently low commodity prices.

- Taken together, these developments have caused yields, which rise when bond prices fall, to climb for months on the lowest-rated group of corporate bonds. Unusually, that has happened even as yields have fallen on higher-rated junk bonds.

- Investors and analysts closely watch junk bonds because companies with subpar credit ratings tend to be affected by economic problems sooner than others. Right now, many remain confident that the problems befalling certain companies aren’t symptomatic of broader economic challenges. Still, others worry that cracks at the very bottom of the market shouldn’t be taken lightly and could ultimately spread to a larger group of assets.

- “There are specific names and specific subsectors where things are not working,” said Oleg Melentyev, a credit strategist at Bank of America Corp.

- Melentyev doesn’t think the problems facing the lowest-rated businesses will spill over into the broader market. Still, he said, it is difficult to know for sure because “you have too many yellow signs, warning signs, around.”