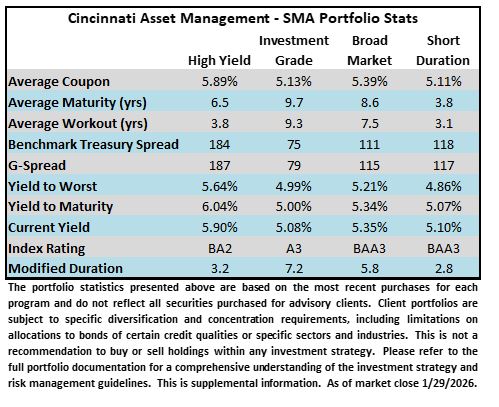

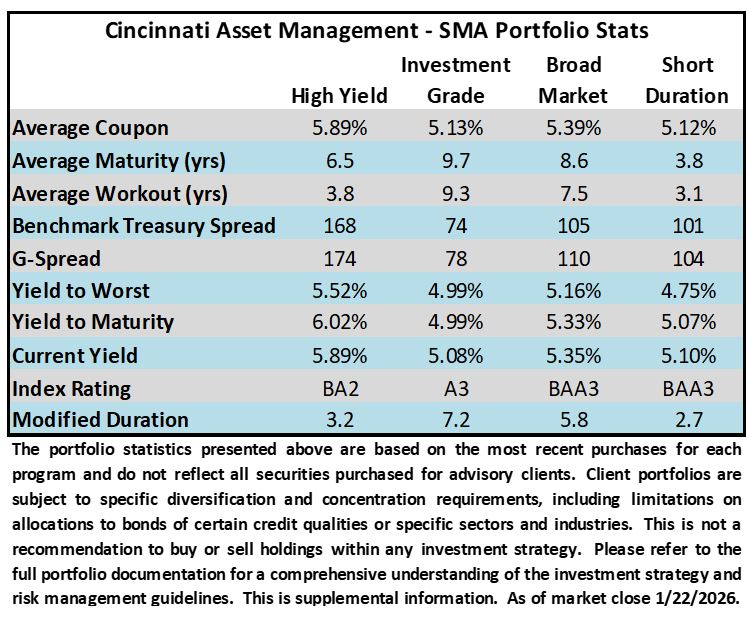

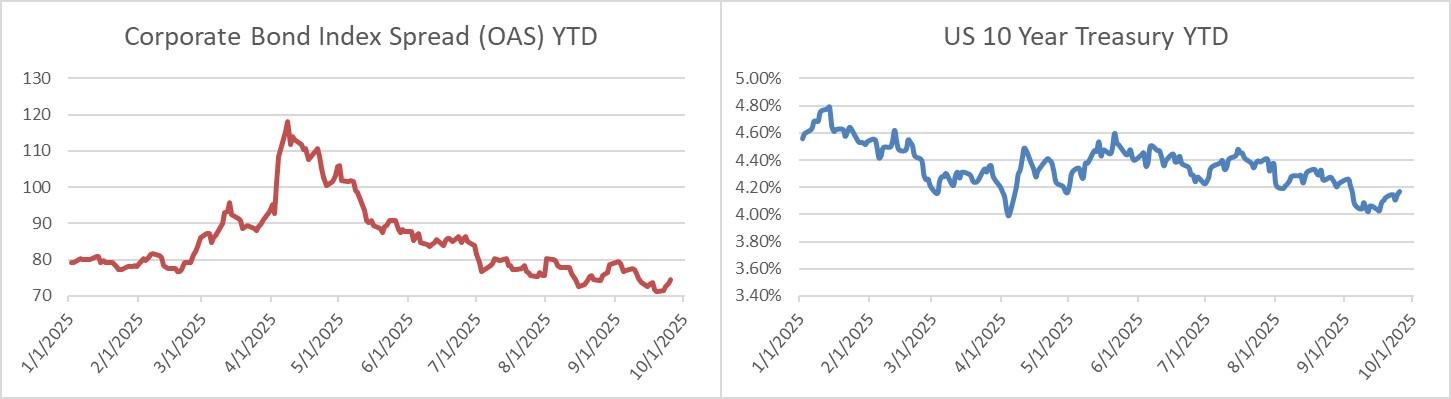

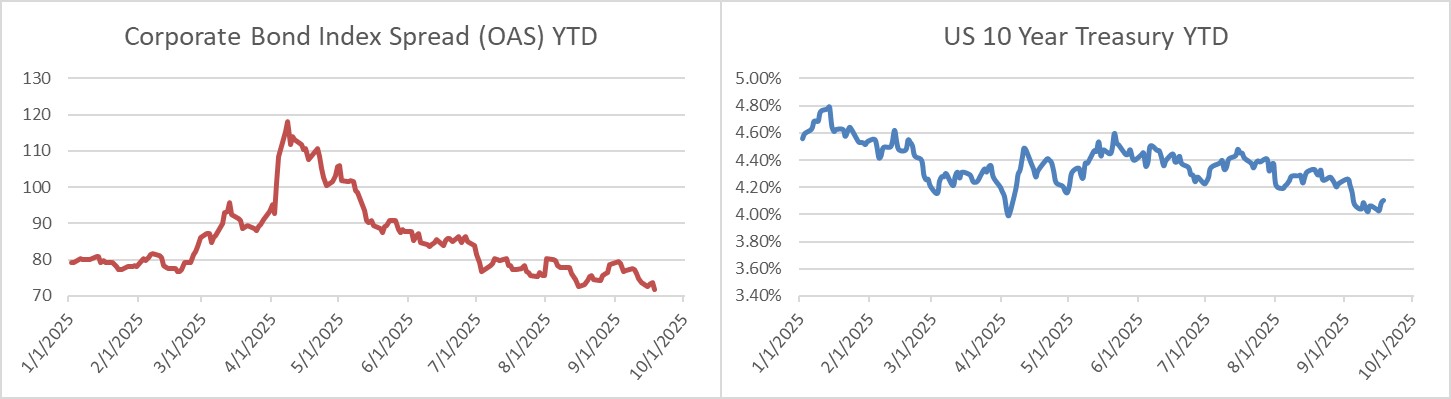

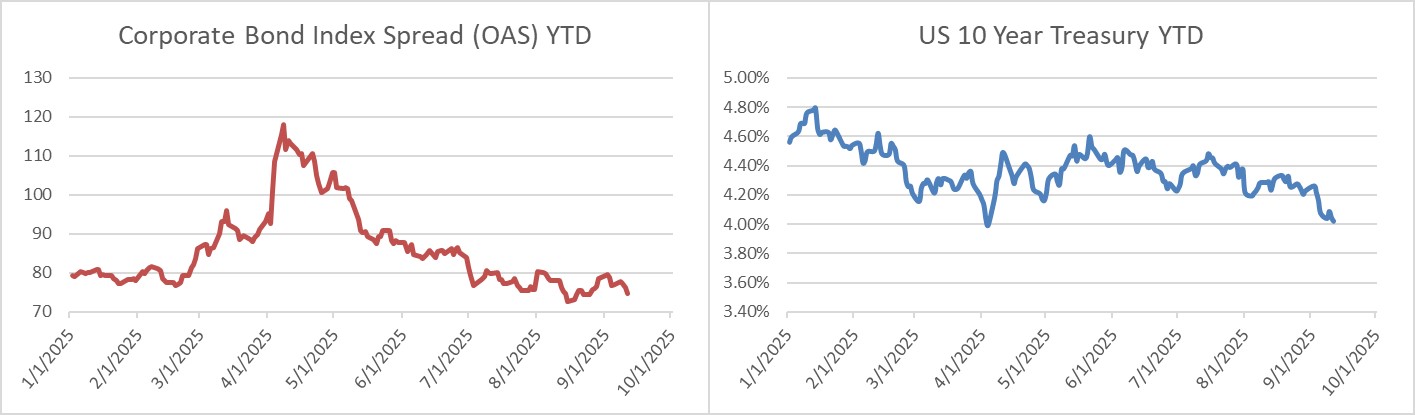

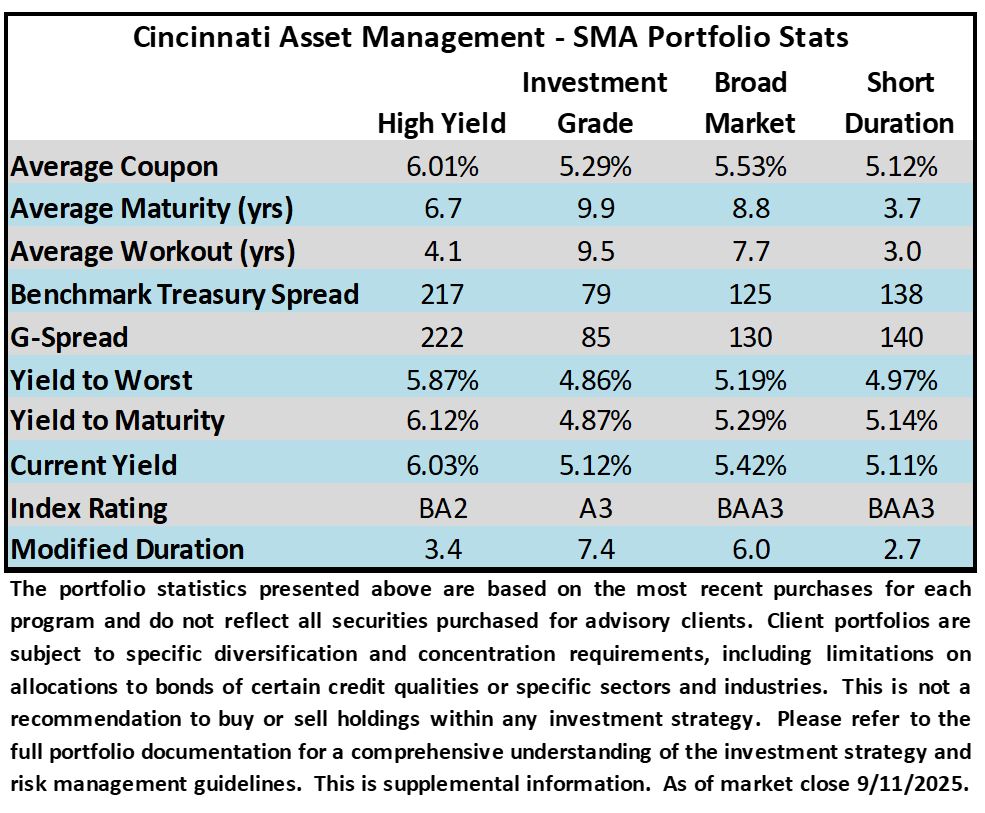

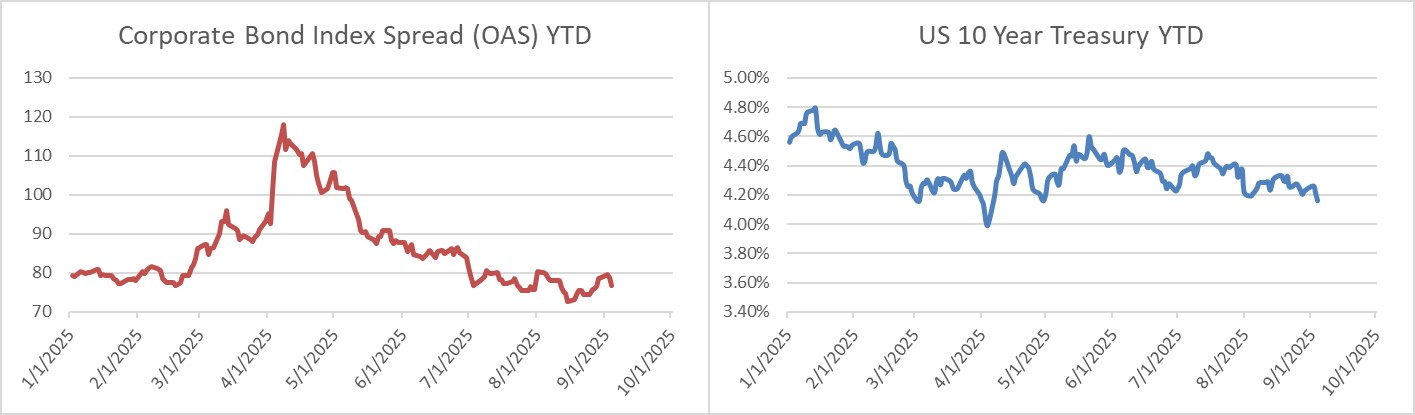

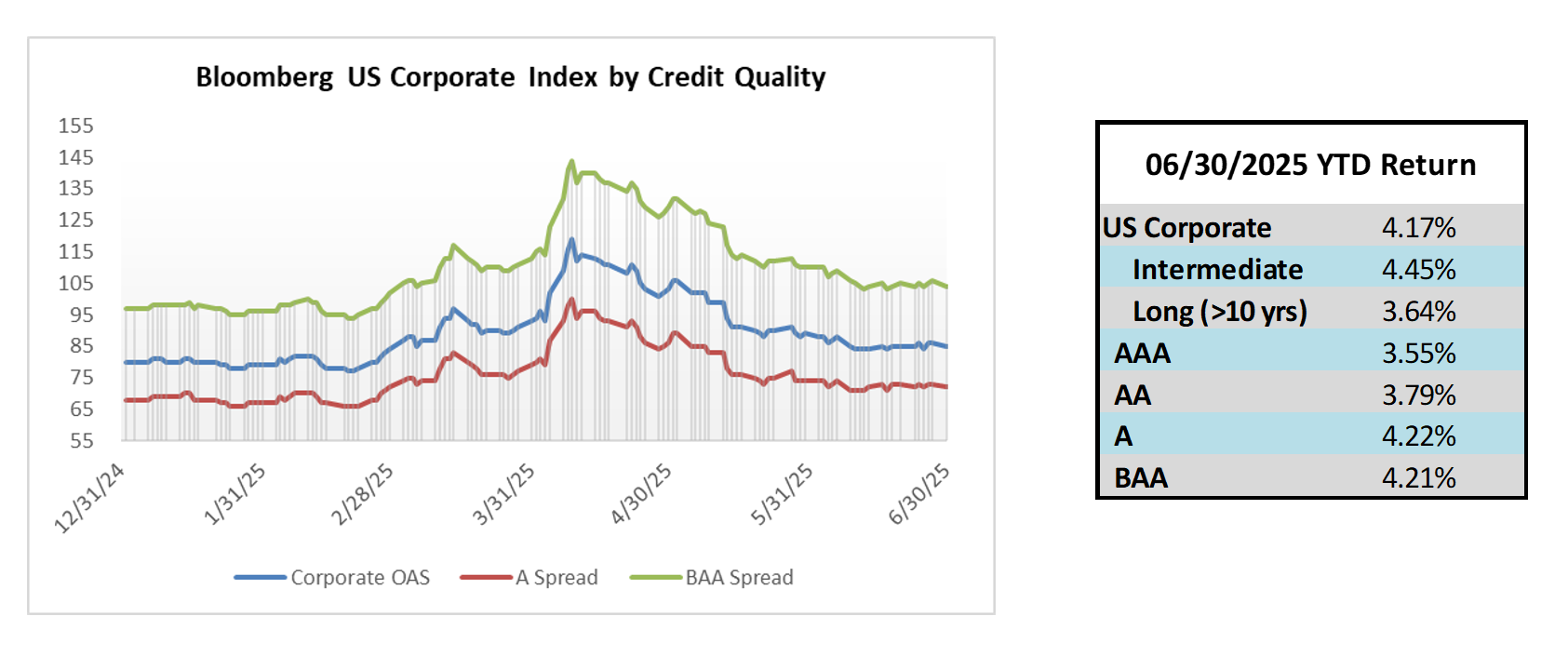

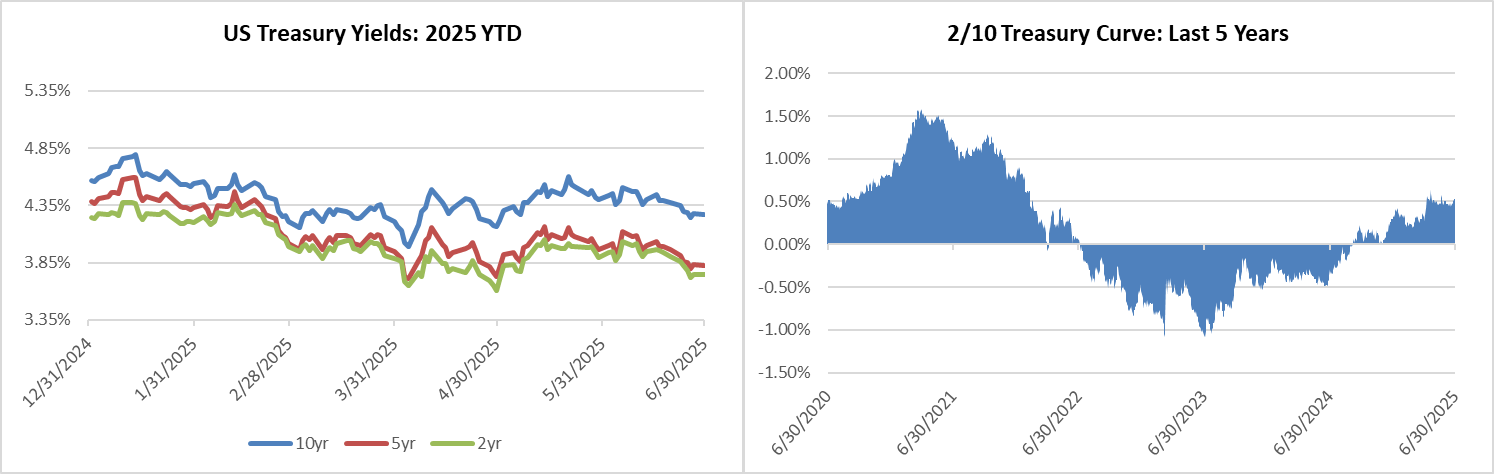

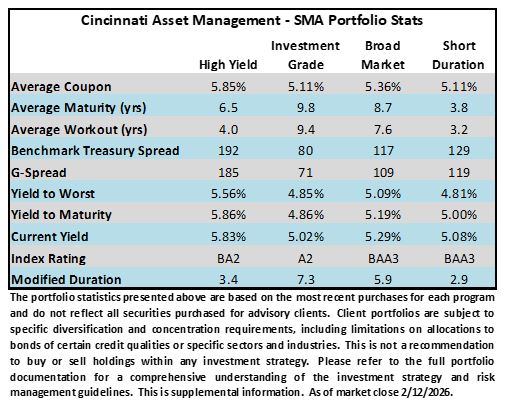

Credit spreads drifted wider this week and the tape is somewhat weak on Friday morning. The AI disruption trade was in full force during the period throughout the equity markets and some portions of the leveraged loan and high yield credit markets, while IG credit remained relatively unscathed. The OAS on the Corporate Index closed at 77 on Thursday February 12th after closing the week prior at 75. Recall that the index stood at 78 at the beginning of 2026. The 10yr Treasury closed last week at 4.21% and had closed at 4.10% on Thursday. The 10yr is wrapped around 4.06% as we go to print on the back of Friday’s cooler than expected CPI print. Through Thursday, the Corporate Bond Index year-to-date total return was +1.08% while the yield to maturity for the index was 4.77%.

Points of Interest

There were two economic releases of great interest this week. On Wednesday the delayed non-farm payroll report for the month of January showed much better job growth than expected with 130k jobs adding during the period relative to expectations of 65k. The unemployment rate also ticked lower for the second consecutive month down to 4.3% versus the survey of 4.4%. However, there was some bad news as well with the release of the BLS’s revised employment numbers for the full year 2025. The revision was over 400,000 lower taking the total number of jobs added during the prior year to just 181,000. This is an average of just over 15k jobs added per month in 2025 which is a weak number any way you slice it. The labor market is not yet bad but is has increasingly become a “low hire low fire” environment and it has clearly lost some steam over the past 24 months. The good news is that wages have continued to be supportive of consumer spending.

On Friday morning the CPI report offered a positive surprise in terms of inflation. For the month of January YoY CPI moved from +2.7% in the prior period down to +2.4% while economists were looking for +2.5%. This sparked a small rally in Treasuries sending yields lower though part of the move in rates could be related to the malaise in the equity markets this week as it pertains to the AI pain trade.

Primary Market

The primary market was on the screws this week as $40bln in new debt priced which also happened to be the consensus estimate. We had thought we would need a hyperscaler to print a deal in order to reach that number and this is precisely what happened as Alphabet came to market with a $20bln deal that accounted for half of the weekly calendar. Next week syndicate desks are looking for $25bln in new supply but we would not be surprised to see this number eclipsed if Treasuries hold current levels. Year-to-date new issue supply stood at $309bln through the end of the week.

Flows

In what has been a recurring theme, it was another robust week of inflows. According to LSEG Lipper, for the week ended February 11, short and intermediate investment-grade bond funds reported a net inflow of +$4.32bln. This was the 11th consecutive week of inflows. 2026 year-to-date flows into investment grade were +$25.2bln. This is double the number of YTD flows to this point in 2025.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.