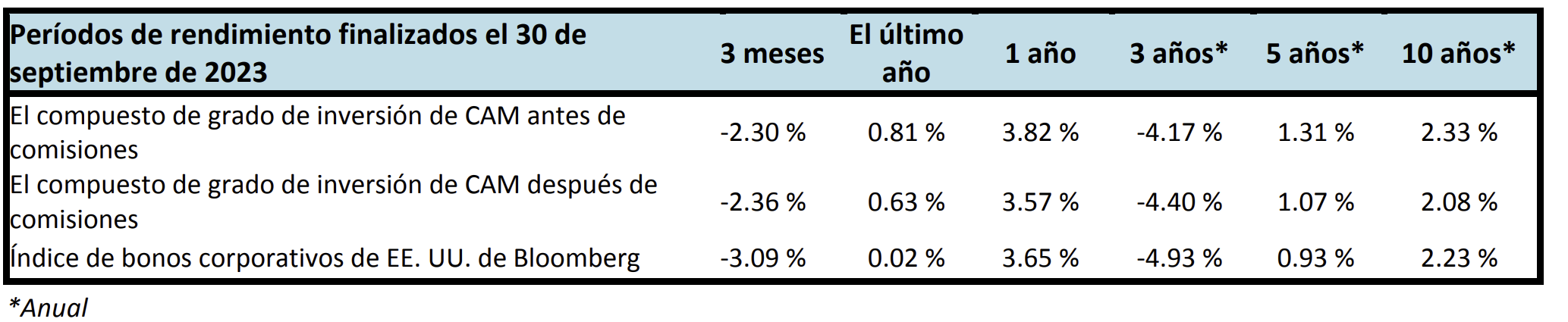

El segundo trimestre del año fue similar al primero. Los diferenciales de crédito se mantuvieron en un rango ajustado y los rendimientos obstinadamente más altos de los bonos del Tesoro continuaron siendo una pesadilla para los rendimientos totales. Los inversores han comenzado a aceptar que la vara para un ciclo de flexibilización es alta aunque últimamente los datos han sido más cooperativos para ayudar a la Reserva Federal a alcanzar ese objetivo. Seguimos creyendo que el entorno actual es oportunista para los inversores en bonos pero puede requerir paciencia. El crédito IG probablemente será un carry trade hasta que la Reserva Federal comience a bajar la tasa de referencia. Los rendimientos elevados y los cupones más altos podrían ser una ventaja para los inversores que utilizan los bonos como mecanismo para preservar el capital.

Resumen del segundo trimestre

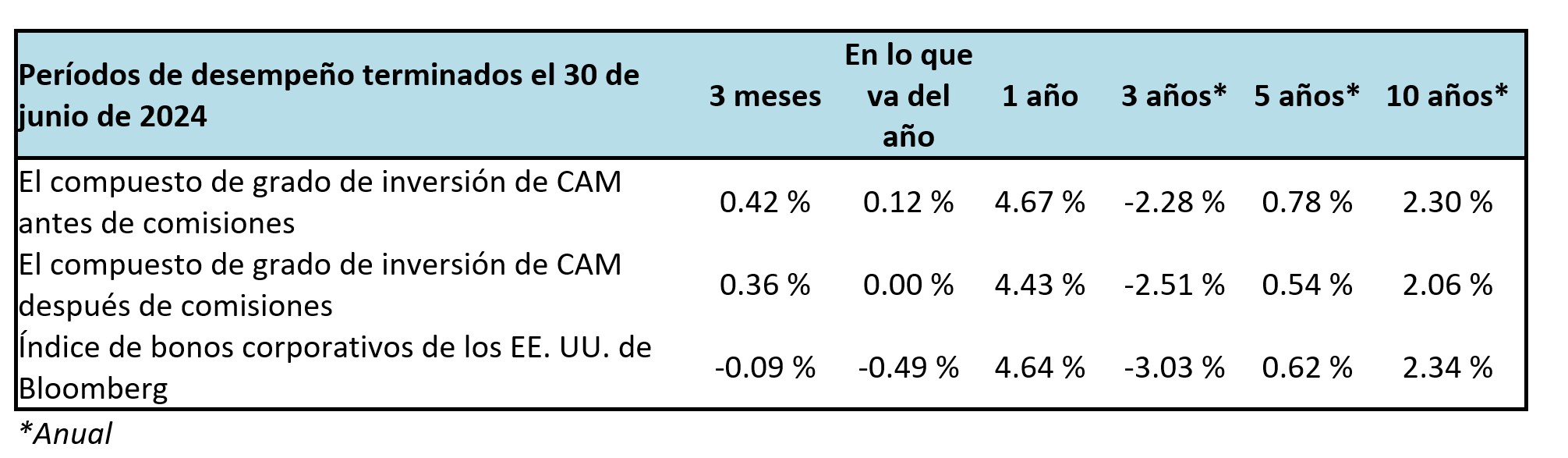

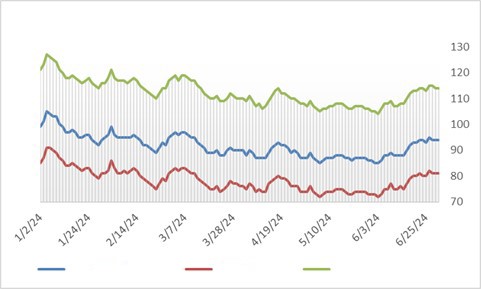

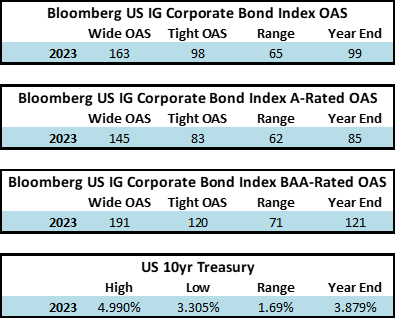

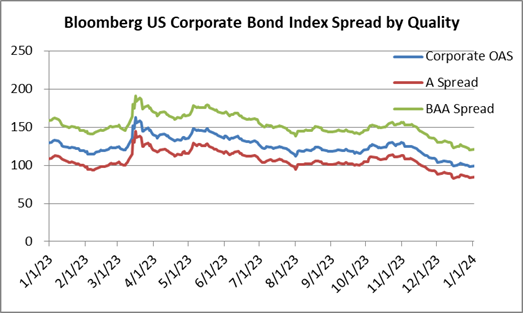

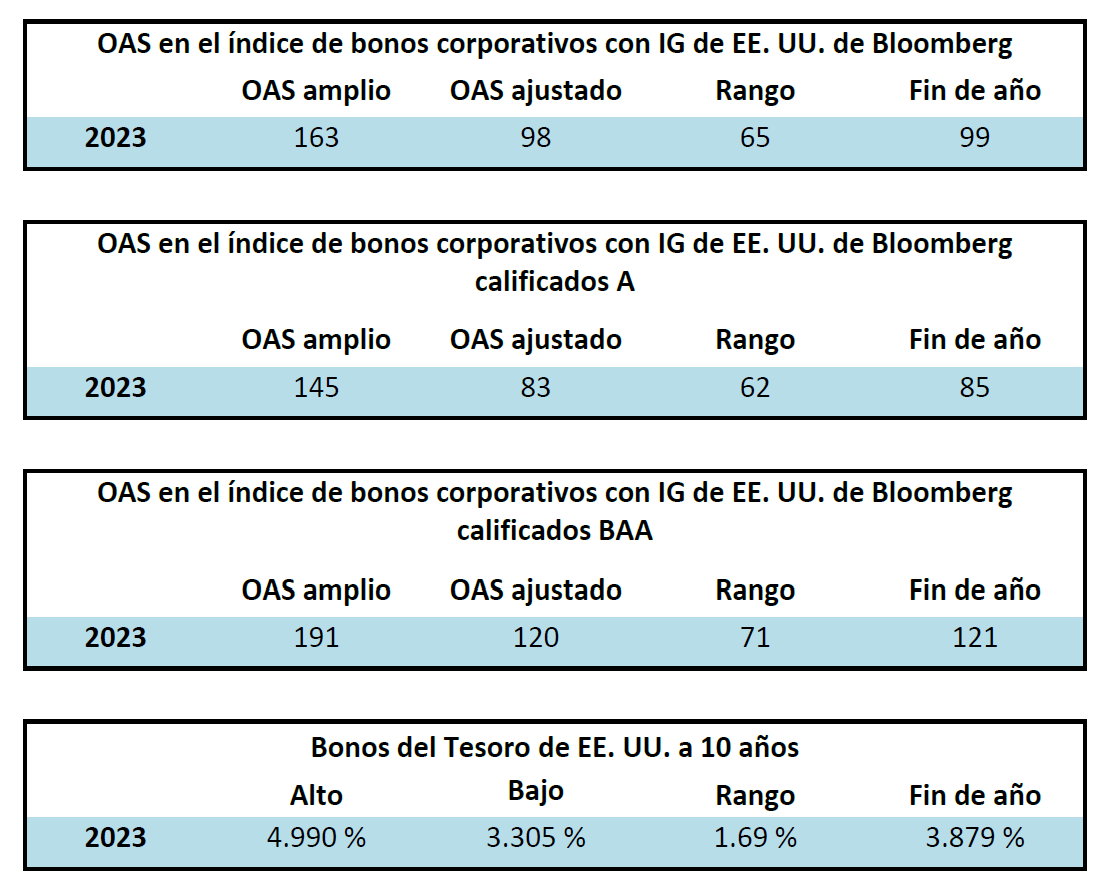

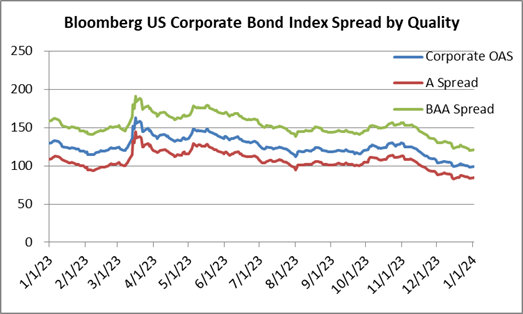

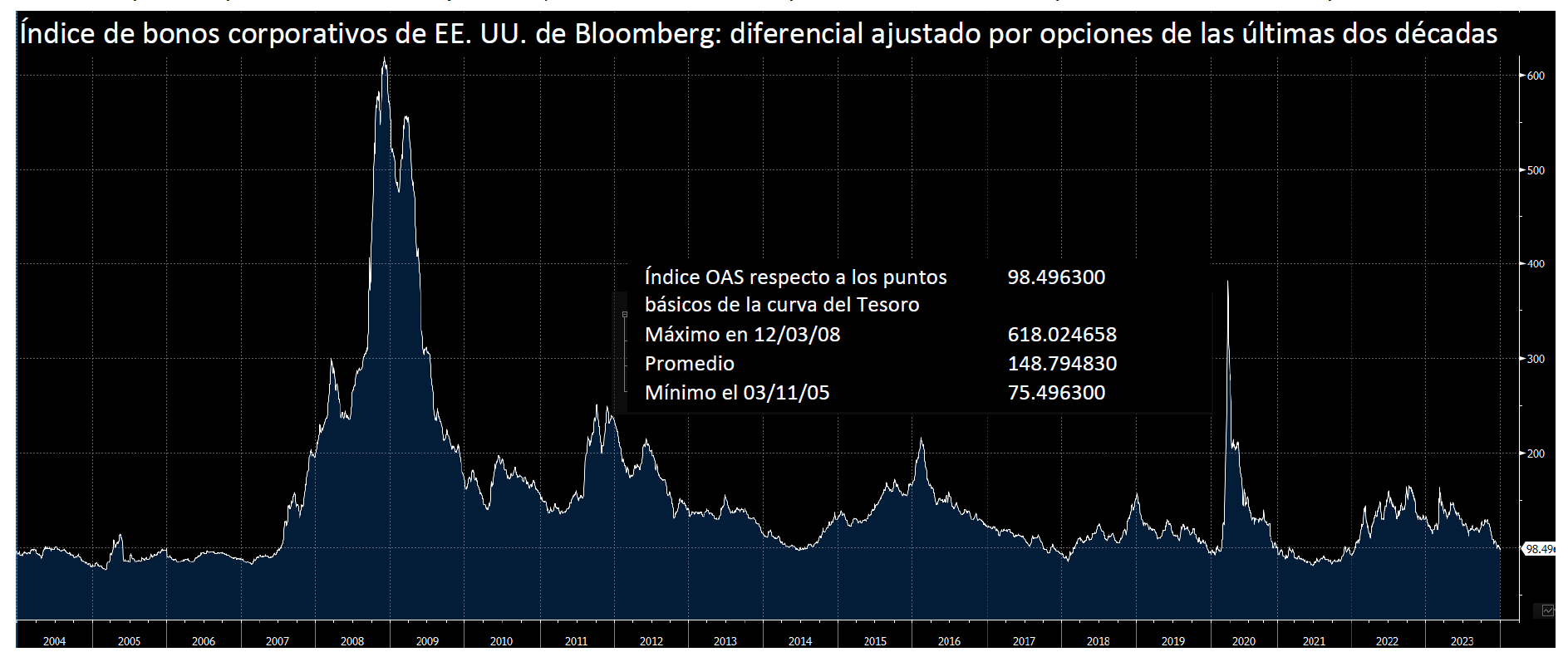

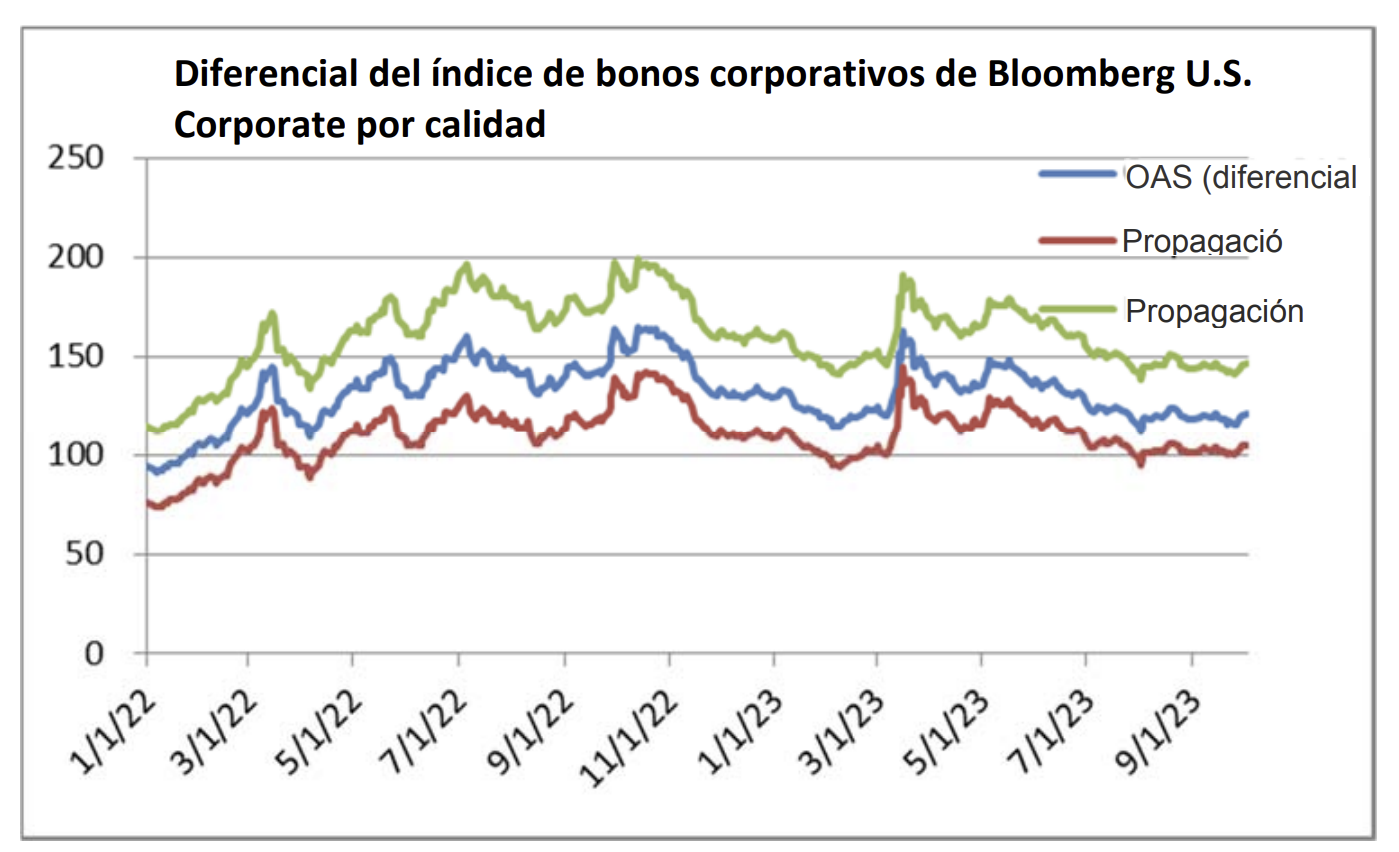

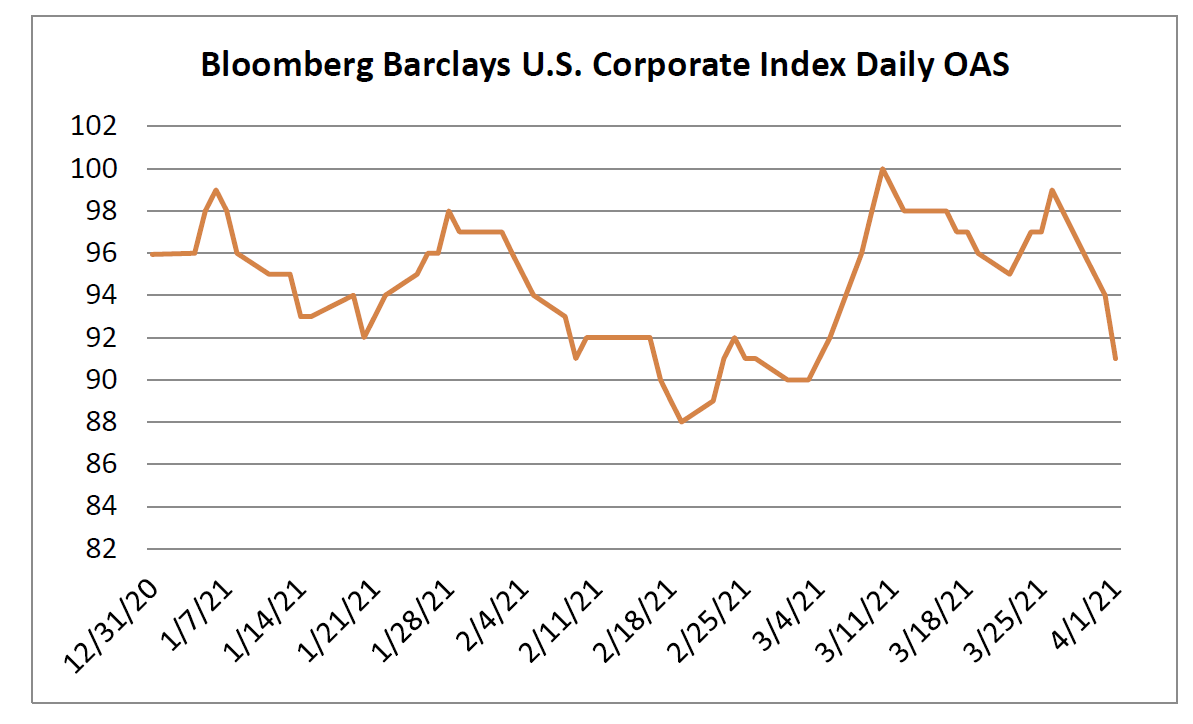

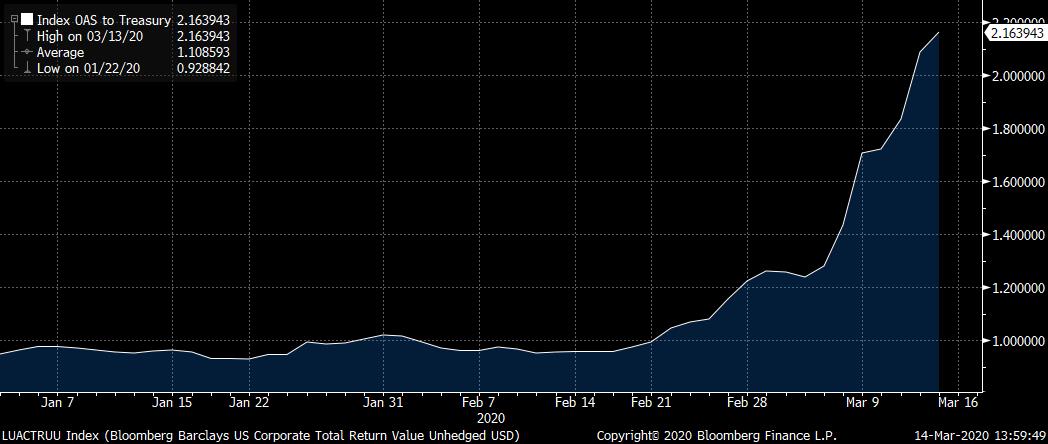

El diferencial ajustado por opciones (OAS) en el Índice de bonos corporativos de EE. UU. de Bloomberg abrió el segundo trimestre en 90 y cotizó en un ajustado 85 a principios de junio antes de terminar el trimestre con un diferencial de 94. Recordemos que el índice comenzó 2024 con un diferencial de 99 y brevemente llegó a cotizar a 105 a principios de enero antes de comenzar su marcha más ajustada. Los diferenciales se negociaron en una banda estrecha durante el segundo trimestre donde el OAS corporativo para el índice estuvo dentro de un rango de solo 10 puntos básicos durante el período.

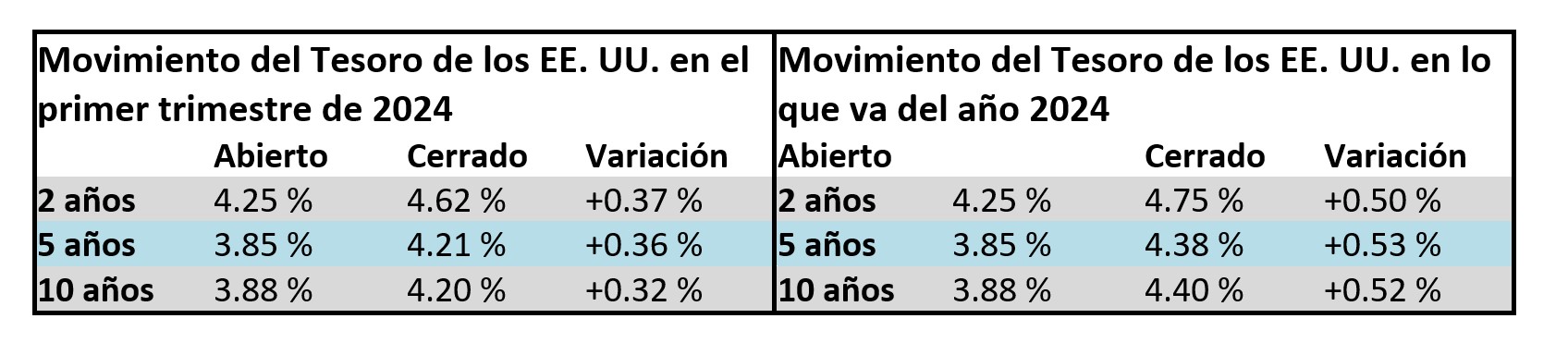

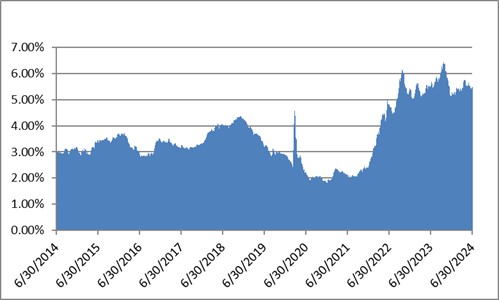

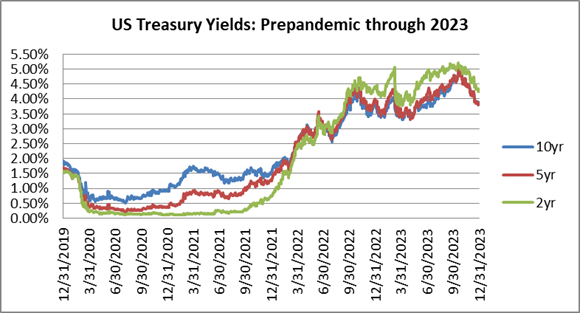

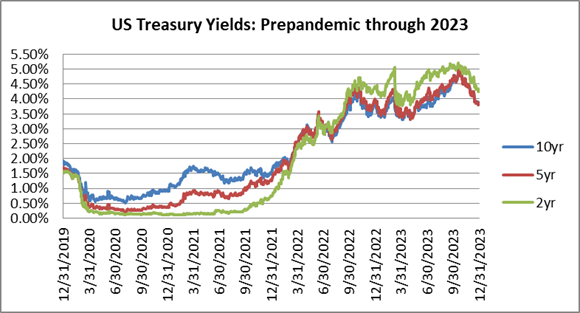

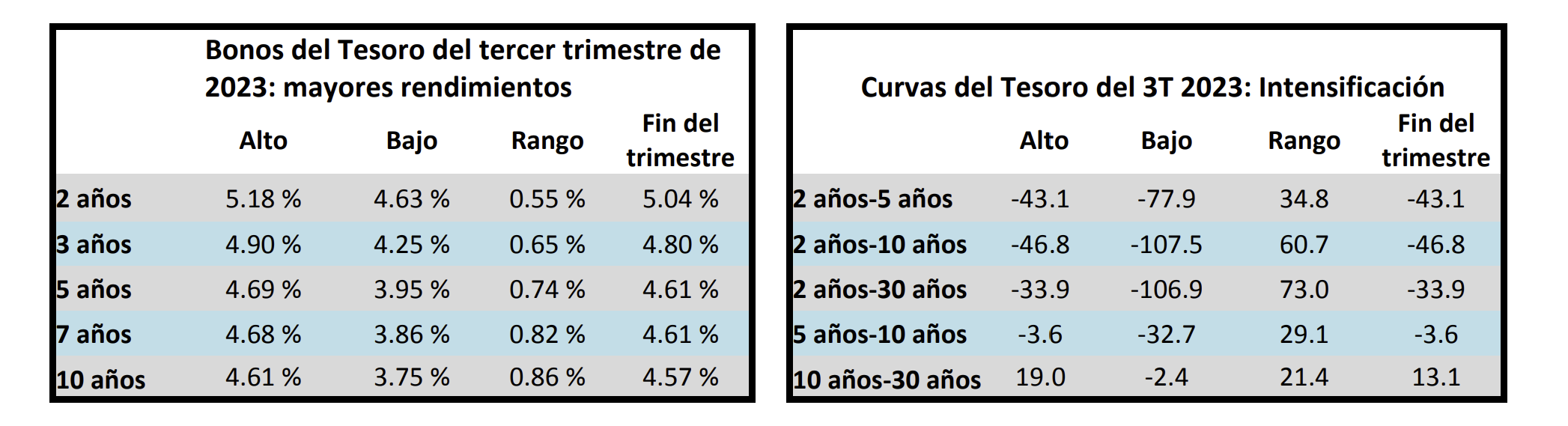

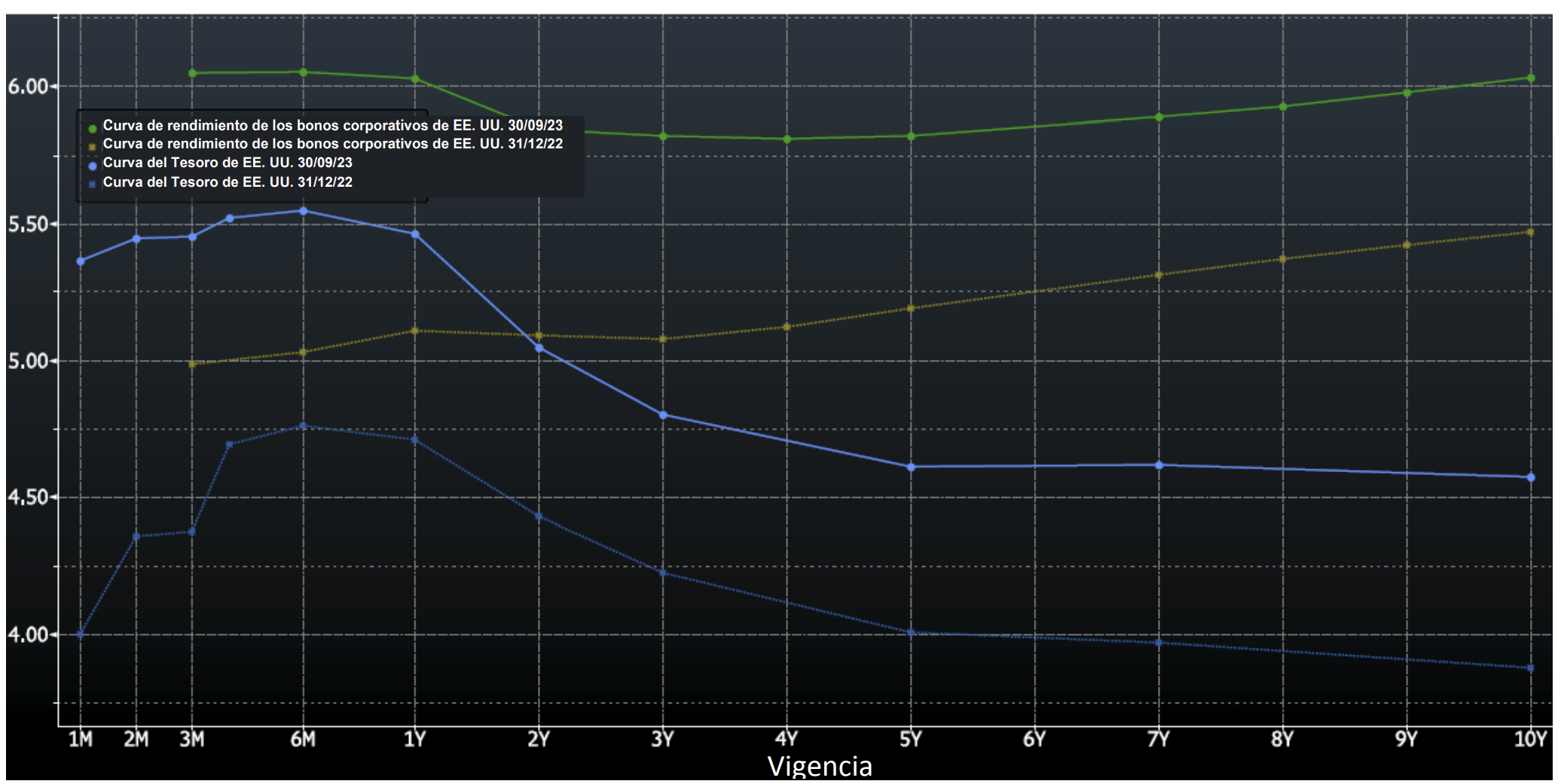

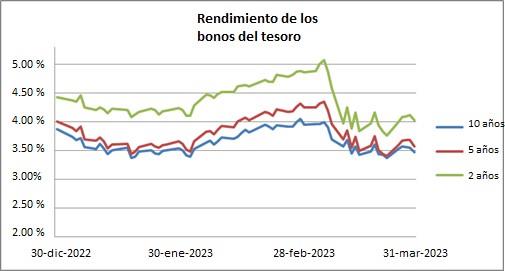

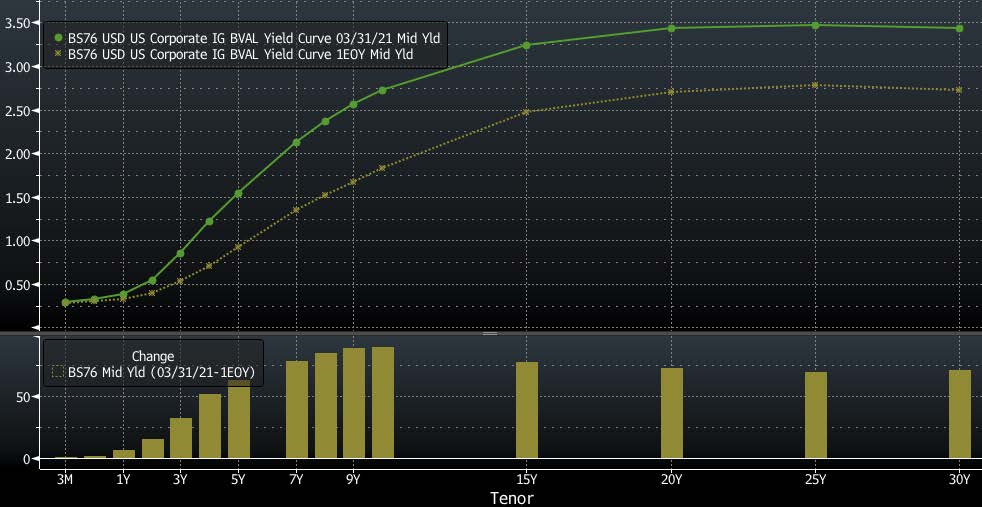

Los rendimientos de los bonos del Tesoro continuaron subiendo en el segundo trimestre lo que ha sido la razón principal por la que los rendimientos totales del índice IG fueron modestamente negativos en lo que va del año. Los rendimientos fueron mayores durante el primer trimestre y esa tendencia continuó durante el segundo trimestre.

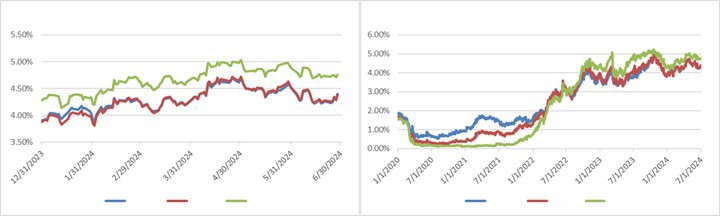

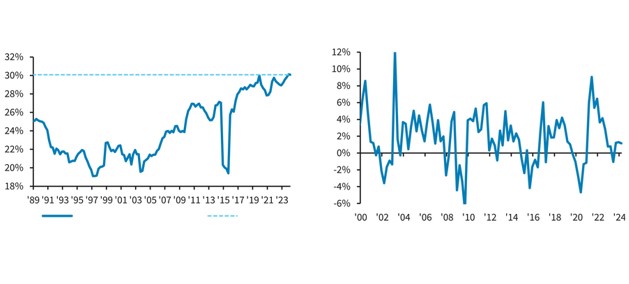

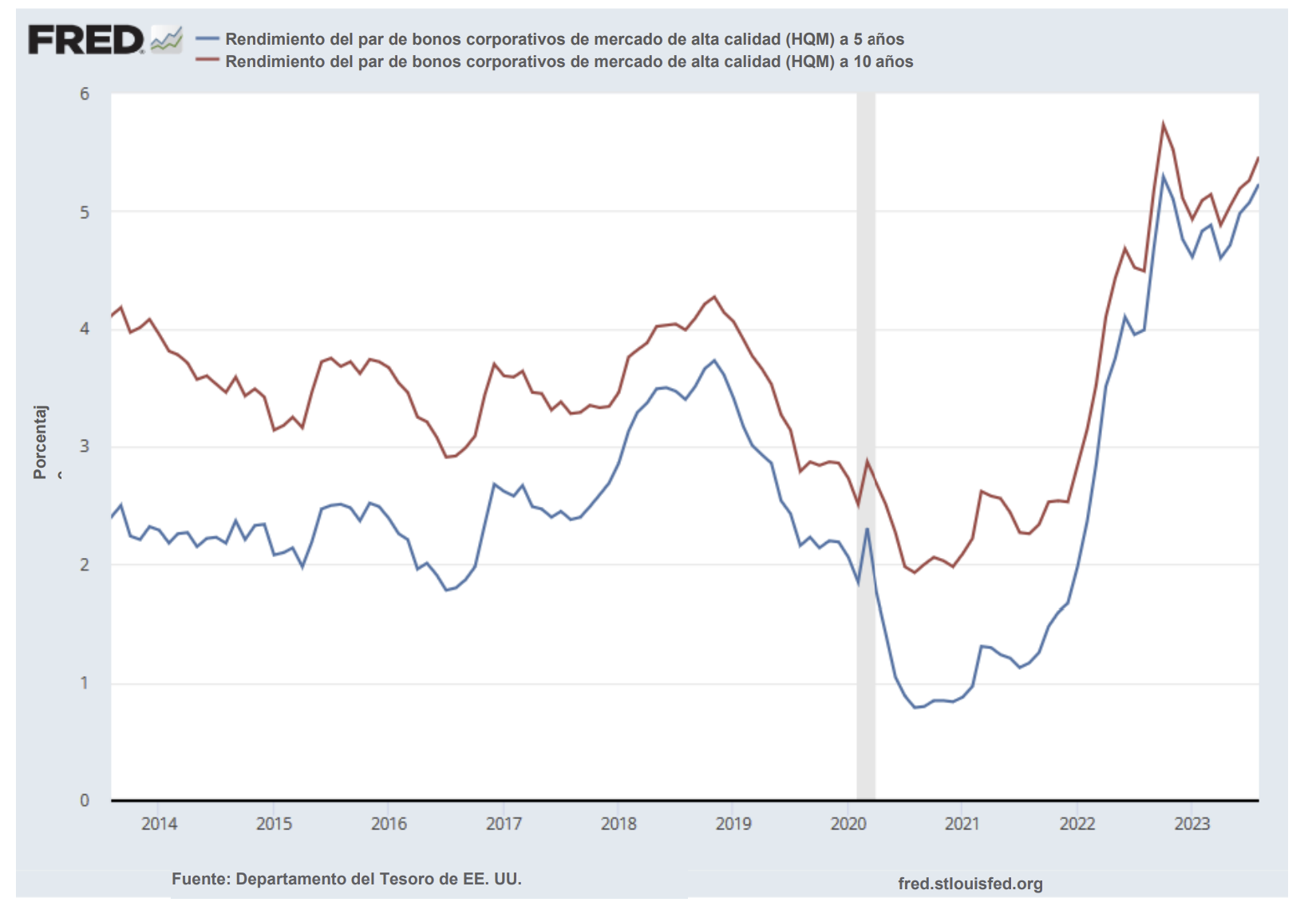

El siguiente gráfico ilustra dónde estaban los rendimientos de los bonos del Tesoro antes y durante la pandemia de coronavirus: significativamente más bajos en aquel entonces en comparación con el presente.

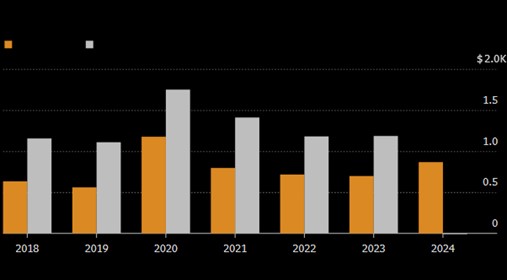

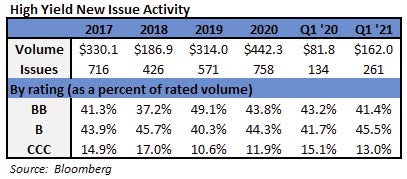

La emisión corporativa se mantuvo sólida durante el segundo trimestre pero no pudo seguir el ritmo récord del primer trimestre. El volumen de nuevas emisiones en lo que va del año fue de 867.000 millones de dólares al final del segundo trimestre. Hay varias razones detrás del entorno sólido para la emisión y el entusiasmo de las empresas por emitir deuda. Por el lado de la demanda las entradas de capitales para la clase de activos con grado de inversión han sido fuertes con más de 200.000 millones de dólares en fondos de bonos sujetos a impuestos hasta finales de mayo (los datos de flujos de junio aún no estaban disponibles al momento de esta publicación). Además las compañías de seguros han sido fuertes compradores de bonos gracias a los aumentos de las tasas de las primas y los fondos de pensiones han estado asignando fondos a una variedad de clases de activos de renta fija mientras buscan reequilibrar sus carteras para dar cuenta del sólido desempeño de las acciones en 2023 y en el primer semestre de 2024. Los compradores extranjeros también han estado participando en el mercado corporativo estadounidense a medida que el BCE y algunos otros bancos centrales de Europa y otros lugares han comenzado a flexibilizar sus tasas de referencia lo que ha hecho que los bonos denominados en dólares sean más atractivos que los bonos de algunas otras monedas. Desde el punto de vista de los prestatarios aunque los rendimientos totales que pagan son elevados en comparación con el pasado reciente los diferenciales son ajustados. La mayoría de los balances con grado de inversión son lo suficientemente saludables como para pedir prestado a las tasas actuales y el costo de la deuda es razonable y está dentro de los marcos de asignación de capital para muchas empresas más fuertes. Otro factor que impulsa la emisión es la incertidumbre futura: muchos equipos de gestión preferirían pedir prestado fondos ahora en un entorno de volatilidad relativamente baja. Una elección presidencial en Estados Unidos, un potencial ciclo de flexibilización de la Reserva Federal y una economía que podría comenzar a mostrar la tensión de tasas más altas podrían hacer que sea más difícil o costoso acceder a capital en la segunda mitad del año.

Los indicadores crediticios de grado de inversión se mantuvieron sólidos al final del primer trimestre. Los márgenes de EBITDA estuvieron muy cerca de los máximos históricos y el crecimiento del EBITDA siguió siendo positivo aunque a un ritmo más lento que el trimestre anterior. Sin embargo no todo fue color de rosa ya que los saldos de efectivo cayeron ligeramente y el apalancamiento neto aumentó lo que tuvo un impacto negativo en la cobertura de intereses. Nos sentimos satisfechos con la salud del crédito corporativo de IG en términos generales pero como gestores activos buscamos invertir en empresas con indicadores crediticios estables o en mejora y evitamos aquellas que tienen dificultades para obtener resultados.

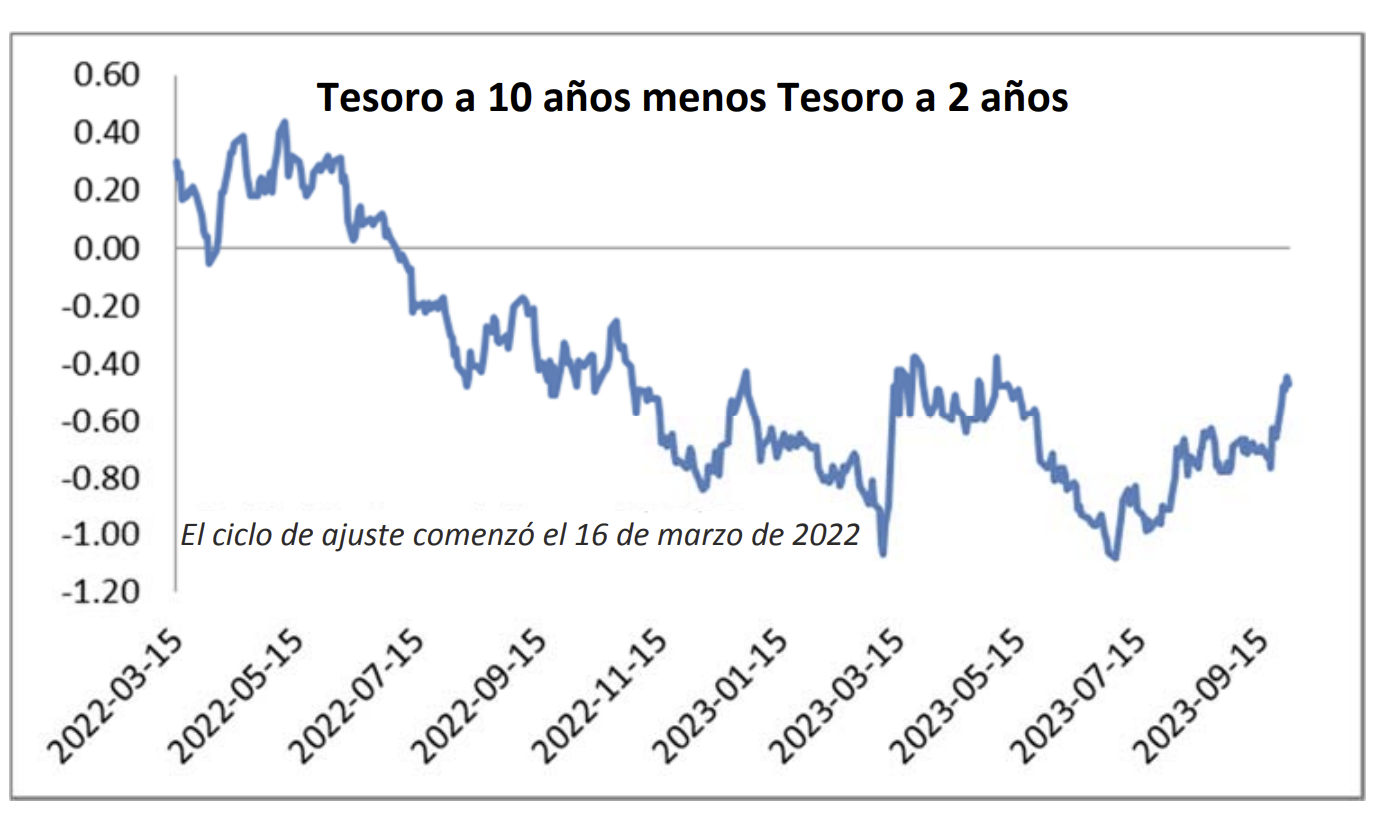

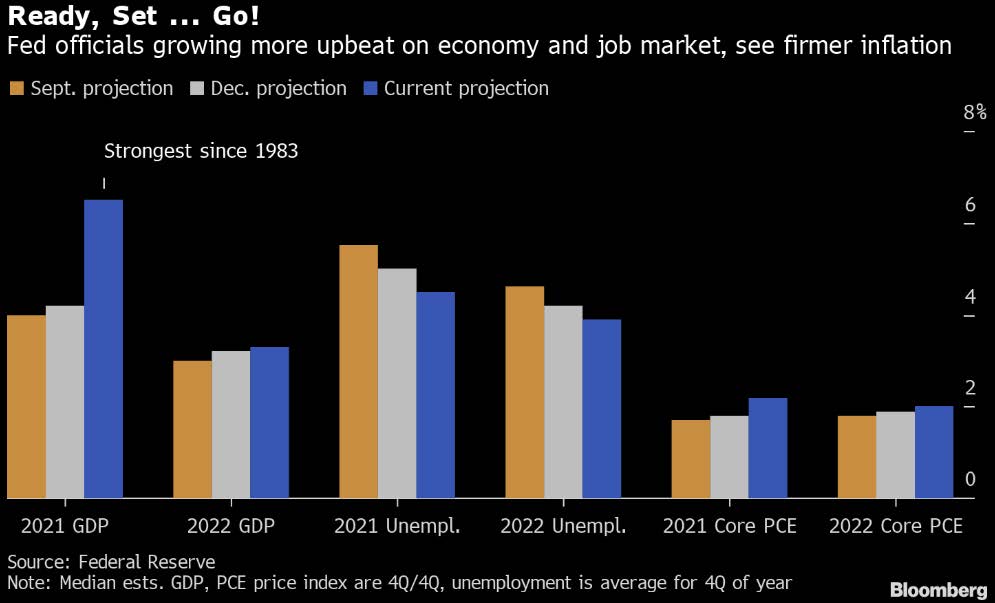

Actualización de la Reserva Federal: todavía en espera

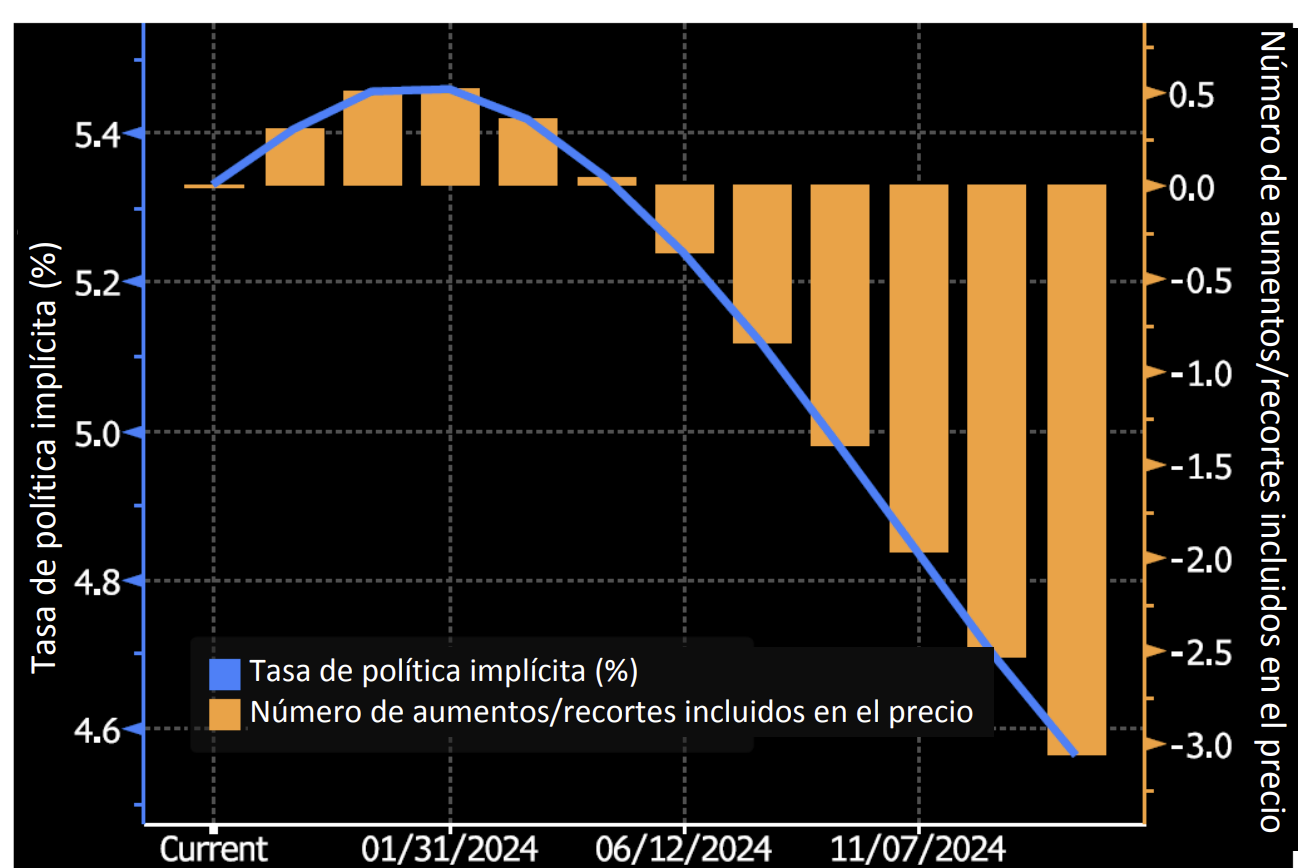

Las opiniones de los inversores han evolucionado y ahora se encuentran en una posición mucho más realista con respecto a un posible ciclo de flexibilización en comparación con el nivel en el que comenzaron el año. Recordemos que en aquel momento los mercados de futuros de tipos de interés implicaban hasta siete recortes de 25 puntos básicos en las tasas. Las propias proyecciones de la Reserva Federal han sido más pragmáticas que las de los inversores. El consenso medio del gráfico de puntos de la Reserva Federal mostró expectativas de tres recortes de tasas en su actualización de diciembre de 2023 y luego nuevamente en su actualización de marzo de 2024. La Reserva Federal moderó sus expectativas en junio de 2024 con un nuevo ajuste de los puntos que mostró una decisión ajustada entre uno o dos recortes en la segunda mitad de 2024. De los 19 miembros del FOMC ocho esperaban dos recortes, siete proyectaban uno y cuatro creen que no habrá ninguno en absoluto. Los inversores han accedido y los futuros de tipos de interés al final del segundo trimestre mostraban una probabilidad del 56% de un recorte en julio y una probabilidad del 75% de un recorte en diciembre. A la Reserva Federal le encantaría unirse a la lista de bancos centrales que han recortado las tasas que incluye al BCE, Canadá, la República Checa, Hungría, Suecia y Suiza pero este es un FOMC que comprende y aprecia los errores del pasado. Seguimos esperando uno o dos recortes en 2024 aunque cabe señalar que solo quedan cuatro oportunidades para que esto suceda porque el FOMC no se reúne en agosto ni en octubre. Seguimos creyendo que cuanto más espere la Reserva Federal para recortar más probable será que se produzca una desaceleración económica y estamos gestionando la cartera teniendo esto en cuenta.

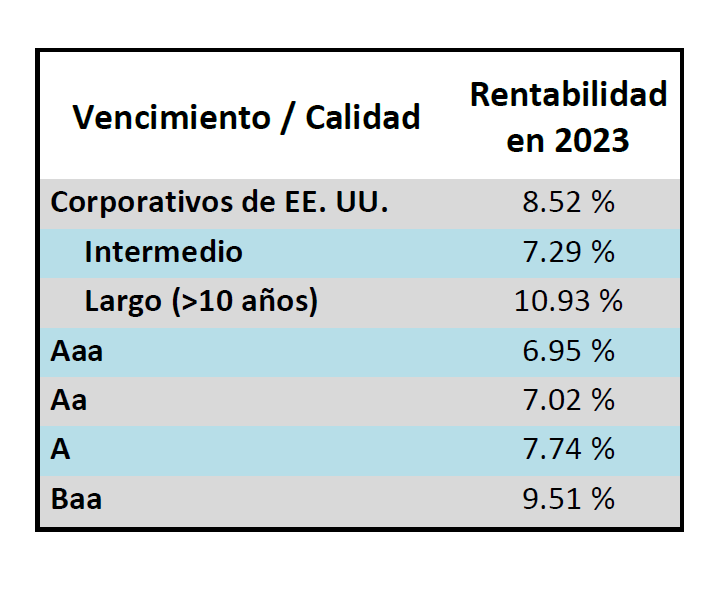

Cupón versus retorno total

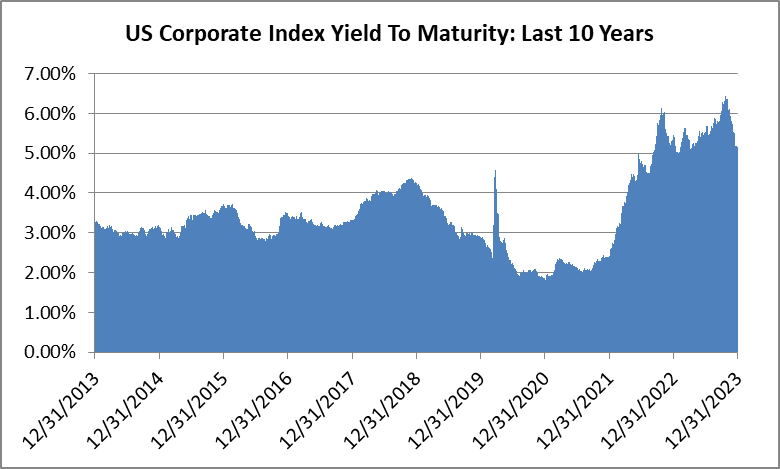

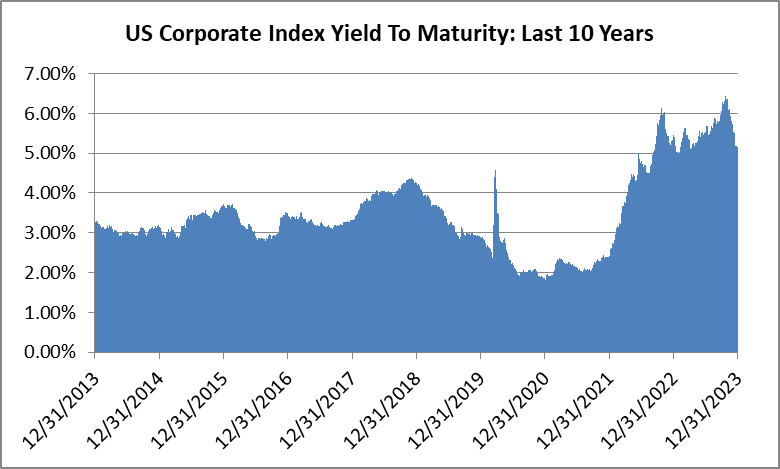

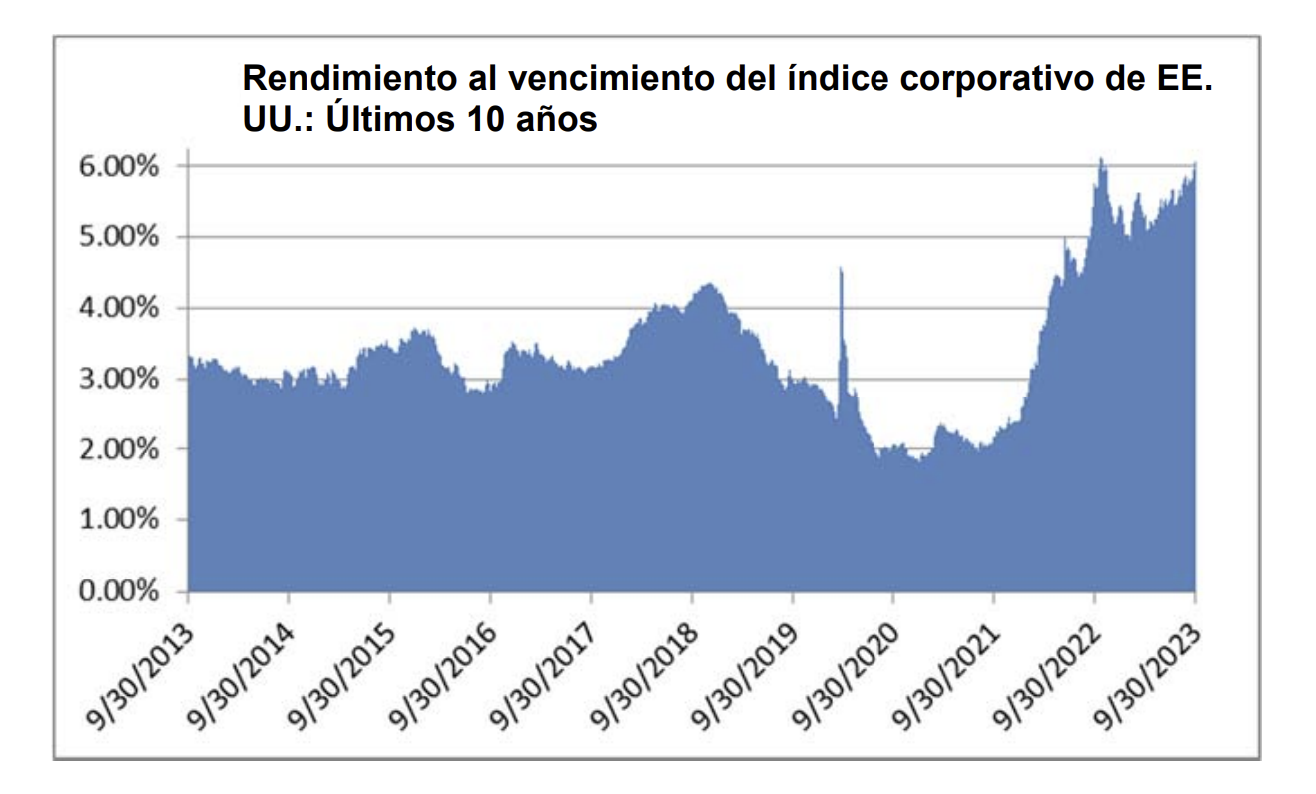

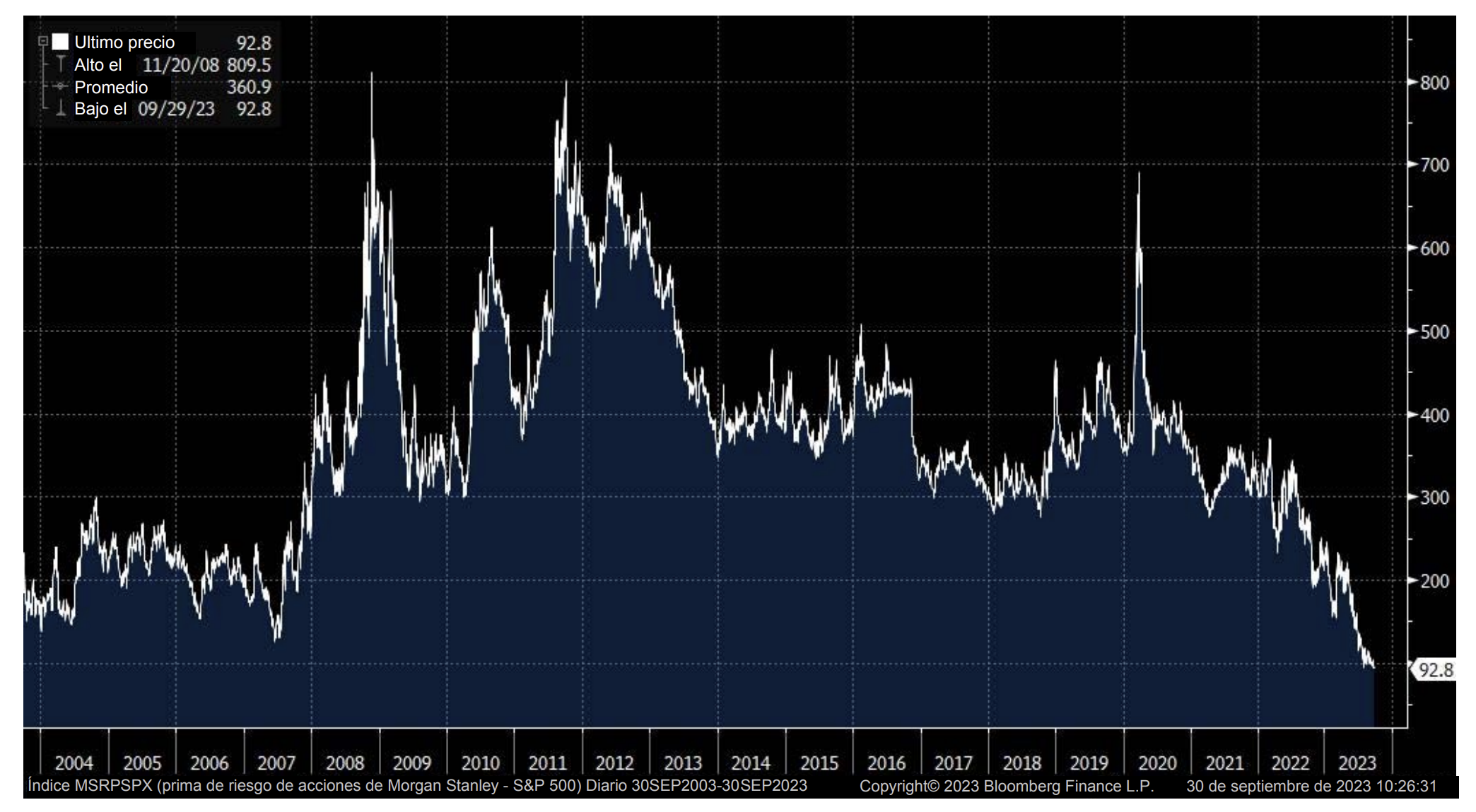

Con la Reserva Federal en un patrón de espera ¿qué significa para el crédito con grado de inversión? Creemos que ha creado un entorno en el que la mayor parte de los rendimientos de los inversores en el corto plazo vendrán en forma de cupones mientras se les paga para esperar el probable inicio de un ciclo de flexibilización y la normalización de la curva de rendimiento. El cupón promedio del índice al final del segundo trimestre fue del 4.2% frente al 3.9% y el 3.6% a finales de junio de 2023 y junio de 2022 respectivamente. Pero esto no cuenta toda la historia ya que el cupón para deuda de vencimiento intermedio que se está emitiendo hoy prácticamente tiene garantizado un cupón más alto que el promedio que es artificialmente bajo debido a la cantidad de deuda que se emitió durante la era de tasas de interés ultrabajas. Una mejor manera de observar el cupón disponible para los inversores en el mercado hoy es utilizar el rendimiento promedio al vencimiento (%YTM) del índice como indicador del cupón. El YTM% promedio terminó el segundo trimestre en 5.48% lo que es una buena aproximación de lo que le costaría a una empresa promedio con calificación de grado de inversión emitir deuda hoy.

Hemos seguido insistiendo en este punto durante los últimos trimestres: como ilustra el gráfico anterior durante la última década ha habido oportunidades limitadas para que los inversores desplieguen capital con estos rendimientos y cupones. En un ejemplo simplificado si un inversor tiene una cartera de bonos con un cupón promedio del 5% y los precios de los bonos en esa cartera no cambian en absoluto durante el año entonces ese inversor obtiene un rendimiento total en un año del 5% en forma de ingresos por cupón. En nuestra opinión un cupón superior al 5% para el crédito IG es muy atractivo y brinda al inversor una buena oportunidad de generar rentabilidades totales positivas a lo largo del tiempo así como un mayor grado de protección contra las caídas que no estaba disponible hace unos años cuando las tasas de interés eran mucho más bajas.

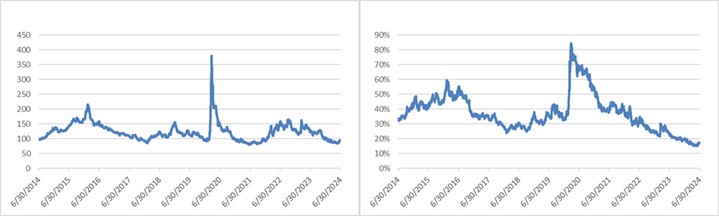

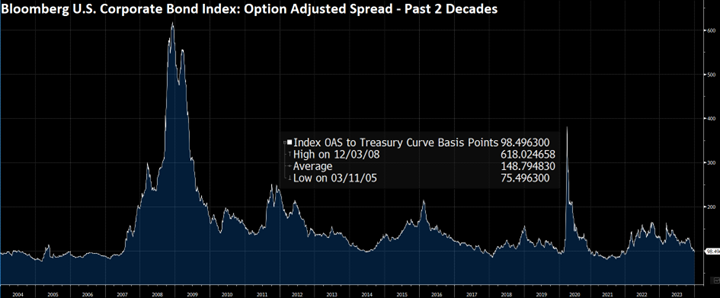

Diferenciales frente a rendimientos

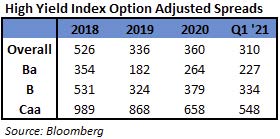

Aunque los rendimientos están cerca del extremo superior de su rango histórico, los diferenciales están cerca del extremo ajustado. Los dos gráficos siguientes muestran el nivel de diferenciales para el índice así como el porcentaje de la parte del rendimiento del índice que está representada por el diferencial de crédito. Por ejemplo, si un inversor compra un bono corporativo con grado de inversión con un diferencial de 100 puntos básicos sobre el Tesoro a 10 años al 4.40% entonces el rendimiento de ese bono corporativo es del 5.40% y el 18.5% de ese rendimiento proviene del diferencial crediticio. Los diferenciales ajustados y los rendimientos elevados de los bonos del Tesoro han creado un entorno en el que una porción relativamente pequeña de la compensación general de los inversores se deriva actualmente del diferencial.

El diferencial de crédito es la compensación que recibe un inversor a cambio de asumir el riesgo crediticio de poseer un bono corporativo en lugar de no asumir ningún riesgo crediticio por poseer el Tesoro subyacente (la tasa libre de riesgo). Hay algunas razones por las que los diferenciales son ajustados hoy en día. En primer lugar las condiciones financieras para los prestatarios con calificación de grado de inversión son buenas y analizamos algunas de esas métricas anteriormente en esta nota. En segundo lugar la tasa de incumplimiento de las empresas con calificación de grado de inversión ha sido históricamente demasiado baja por lo que es típico que los diferenciales sean ajustados cuando la economía está creciendo y los balances corporativos son saludables. Por último un entorno de rendimientos elevados de los bonos del Tesoro puede prestarse a diferenciales de crédito ajustados. Esto se debe a que existe una gran base de compradores en el mercado de grado de inversión que se preocupan más por los rendimientos totales que por los diferenciales. Estos inversores pueden tener un rendimiento fantasma o una tasa de rentabilidad que deben liquidar para una inversión lo que los hace agnósticos respecto de los diferenciales pero más sensibles a los rendimientos. Como gestores de bonos profesionales los diferenciales son muy importantes para nosotros porque los utilizamos para evaluar el valor relativo de los bonos individuales cuando los evaluamos para su compra o venta. Ya sea que le importe la distribución el rendimiento o ambos; la conclusión es que actualmente los inversores están siendo bien compensados por poseer crédito IG en forma de cupones y rendimiento incluso si los diferenciales son ajustados.

Previsión para la segunda mitad

La segunda mitad del año podría ser volátil con varios acontecimientos importantes en el horizonte. Por primera vez en mucho tiempo estamos empezando a ver focos de incertidumbre económica legítima. Por un lado la economía ha sido resiliente. Pero persisten dudas sobre la capacidad de perseverancia económica frente a un ciclo prolongado de ajuste financiero que comenzó en marzo de 2022. El consumidor impulsa la economía estadounidense y ha seguido gastando pero ¿cuánto tiempo podrán seguir haciéndolo ahora que se ha agotado el exceso de ahorro y con una tasa de ahorro actual que ha sido constantemente negativa? Los datos del mercado laboral se han debilitado ligeramente en los últimos meses pero la tasa de desempleo todavía está cerca del extremo inferior de su rango histórico. No somos de los que gritan y no creemos que estemos al borde de un malestar económico pero hoy vemos mucho menos margen de error para la economía que en cualquier otro momento desde antes de 2020. Muchos consumidores se encuentran al límite de su capacidad de protección y un retroceso en los salarios y/o el empleo podría llevar a la economía a una recesión. En este contexto estamos poblando las carteras de inversores en consecuencia y tratando de evitar empresas e industrias que sean de naturaleza discrecional. Seguimos asumiendo riesgos apropiados pero sólo si la compensación es proporcional. Gracias por nuestro continuo interés. Esperamos colaborar con usted mientras navegamos juntos por los mercados crediticios. Como siempre comuníquese con cualquier pregunta o tema de discusión.

Esta información solo tiene el propósito de dar a conocer las estrategias de inversión identificadas por Cincinnati Asset Management. Las opiniones y estimaciones ofrecidas están basadas en nuestro criterio y están sujetas a cambios sin previo aviso al igual que las declaraciones sobre las tendencias del mercado financiero que dependen de las condiciones actuales del mercado. Este material no tiene como objetivo ser una oferta ni una solicitud para comprar, mantener ni vender instrumentos financieros. Los valores de renta fija pueden ser vulnerables a las tasas de interés vigentes. Cuando las tasas aumentan el valor suele disminuir. El rendimiento pasado no es garantía de resultados futuros. El rendimiento bruto de la tarifa de asesoramiento no refleja la deducción de las tarifas de asesoramiento de inversión. Nuestras tarifas de asesoramiento se comunican en el Formulario ADV Parte 2A. En general las cuentas administradas mediante programas de firmas de corretaje incluyen tarifas adicionales. Los rendimientos se calculan mensualmente en dólares estadounidenses e incluyen la reinversión de dividendos e intereses. El índice no está administrado y no considera las tarifas de la cuenta, los gastos y los costos de transacción. Se muestra con fines comparativos y se basa en información generalmente disponible al público tomada de fuentes que se consideran confiables. No se hace ninguna afirmación sobre su precisión o integridad.

La información suministrada en este informe no debe considerarse una recomendación para comprar o vender ningún valor en particular. No hay garantía de que los valores que se tratan en este documento permanecerán en la cartera de una cuenta en el momento en que reciba este informe o que los valores vendidos no hayan sido vueltos a comprar. Los valores de los que se habla no representan la cartera completa de una cuenta y en conjunto pueden representar solo un pequeño porcentaje de las tenencias de cartera de una cuenta. No debe suponerse que las transacciones de valores o participaciones analizadas fueron o demostrarán ser rentables o que las decisiones de inversión que tomemos en el futuro serán rentables o igualarán el rendimiento de la inversión de los valores discutidos en este documento. Como parte de la educación de los clientes sobre la estrategia de CAM podemos proporcionar información de vez en cuando que incluya referencias a tasas y diferenciales históricos. Los ejemplos hipotéticos que hacen referencia al nivel o cambios en las tasas y diferenciales tienen únicamente fines ilustrativos y educativos. No pretenden representar el desempeño de ninguna cartera o valor en particular ni incluyen el impacto de las tarifas y gastos. Tampoco toman en consideración todas las condiciones económicas y de mercado que habrían influido en nuestra toma de decisiones. Por lo tanto las cuentas de los clientes pueden experimentar o no escenarios similares a los mencionados en este documento.

En nuestro sitio web se encuentran disponibles las divulgaciones adicionales sobre los riesgos materiales y los posibles beneficios de invertir en bonos corporativos: https://www.cambonds.com/disclosure-statements/

i Bloomberg, junio 28 2024 “High-Grade Bond Sales on Easter Pause After Record First Quarter”

ii Bloomberg WIRP, marzo 29 2024 “Fed Funds Futures”

iii Bloomberg WIRP, junio 29 2024 “Fed Funds Futures”

iv Raymond James & Associates, junio 28 2024 “Fixed Income Spreads”

v Barclays Bank PLC, junio 13 2024 “US Investment Grade Credit Metrics, Q2 2024 Update: No Concerns”

vi J.P. Morgan, julio 3 2024 “US High Grade Corporate Bond Issuance Review”

vii Bloomberg ILM3NAVG Index, junio 28 2024 “Bankrate.com US Home Mortgage 30 Year Fixed National Avg”

viii CNBC, junio 13 2024 “The Federal Reserve’s period of rate hikes may be over. Here’s why consumers are still reeling”