2023 Q4 Investment Grade Quarterly

Click here to read the Spanish version / Haga clic aquí para leer la versión en español

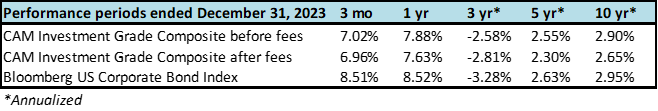

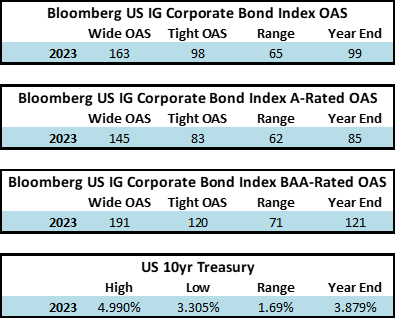

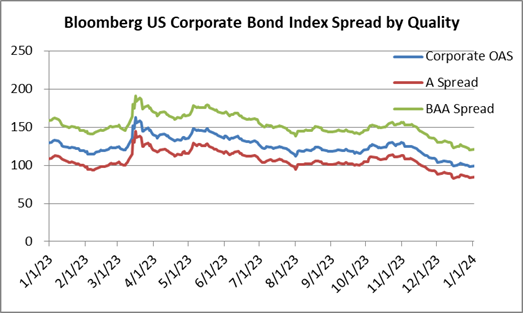

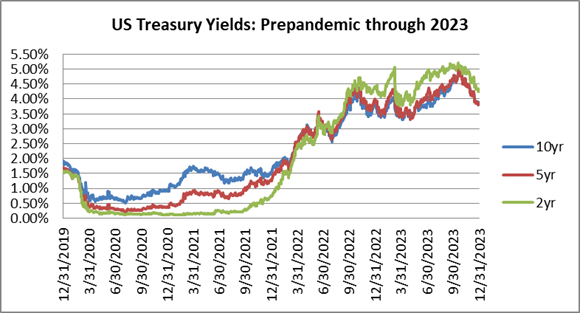

Investment grade credit bounced back in 2023. The year was a powerful demonstration of spread compression and the benefit of the carry associated with higher interest rates. For the full year 2023, the option adjust spread (OAS) on the Bloomberg US Corporate Bond Index tightened by 31 basis points to 99 after it opened the year at 130. Interest rates were volatile during 2023 but Treasury yields at the end of the period finished very close to where they started. The 10yr Treasury ended 2023 at 3.88% which is exactly where it closed in 2022. The 2yr and 5yr Treasuries finished 2023 18 and 15 basis points lower from where they started, respectively.

2023 Year in Review

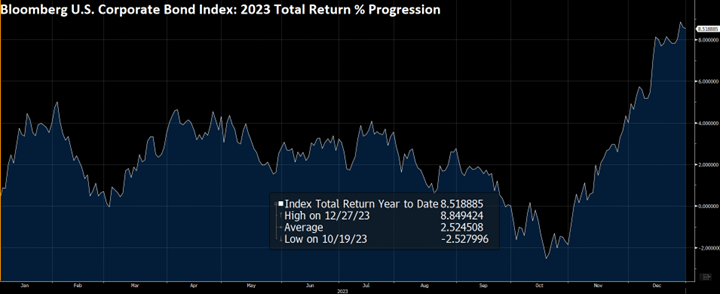

It was a solid year of positive performance for investment grade credit, but there were some bumps along the way. The Corporate Index was in positive territory for all but 2 trading days during the first nine months of 2023 until higher interest rates took a bite out of returns in the first three weeks of October. On October 19, the year-to-date total return for the index was at its low for the year, down to -2.53%, which also happens to be the day that the 10 year Treasury closed at 4.99%, its highest level of the current cycle and its highest yield since July of 2007.

From that point in October it was a one-two punch of tighter spreads and lower interest rates which led to higher returns through year end. The OAS on the index moved from 129 on October 19 to 99 at year end while the 10 year Treasury moved lower from 4.99% to 3.88% over the same time period. As a result of spread compression and lower interest rates, the Corporate Index posted a +11.33% total return from October 19 through the end of 2023. What was the catalyst for such a dramatic turnaround in performance in such a short period of time? We think there are several reasons that investors turned positive on IG credit: cooling inflation, a resilient job market and strong economic growth to name a few. However, the biggest driver of higher returns, in our view, was the likelihood that the Federal Reserve had reached the end of its current hiking cycle. The Fed elected to pause at its September, November and December meetings and its messaging at its most recent meeting suggested that it would not hike again. We have argued throughout the hiking cycle that corporate credit could perform well when it became increasingly clear that the Fed was done raising its policy rate, but the depth and velocity of the 4th quarter rally exceeded our expectations.

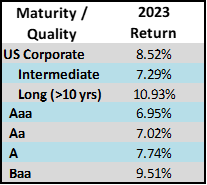

As far as spread performance was concerned, 2023 saw tighter spreads across the board. More than half (4.55%) of the index total return for 2023 (8.52%) was attributable to tighter credit spreads. Lower quality IG-rated credit led the way, especially as credit spreads compressed in the final two months of the year. The best performing industries in 2023 were Media & Entertainment and Oil Field Services. While performance for the laggards was positive, Construction Machinery and Consumer Products were the two largest underperforming industries relative to the Corporate Index. There were no industries within the investment grade universe that came anywhere close to posting a negative annual total return.

2024 Outlook

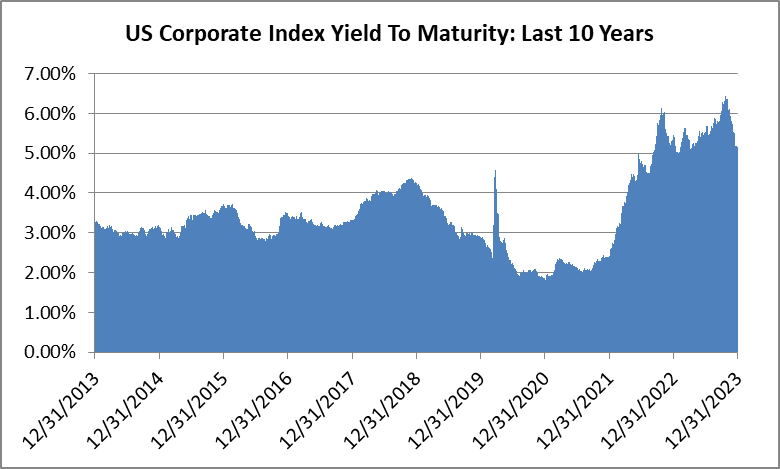

We have a positive stance on the investment grade credit market for the year ahead. The yield of the asset class continues to trade at much higher levels relative to recent history. The average yield on the Index over the past 10 years was 3.45% and it finished 2023 at 5.06%. It is not as attractive today as it was during the October rate selloff when the index closed with a yield above 6.4% but the compensation afforded is still meaningfully higher than in the recent past.

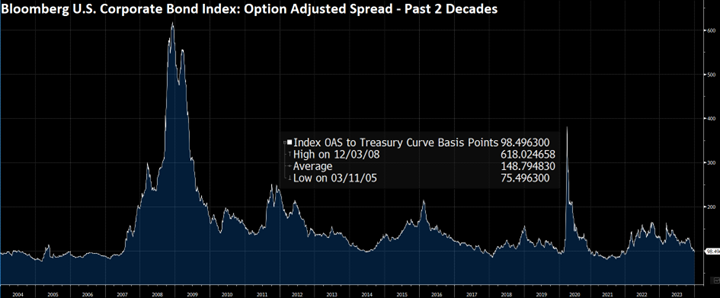

Our positive view of the market as described above refers to the “all-in” compensation for IG which is comprised of the underlying Treasury as well as additional compensation that an investor receives for owning a bond in the form of credit spread. Speaking specifically to the valuation of credit spreads, we are not as positive on spreads as we are on yields given current trading levels and we feel that spreads finished the year near the tighter end of fair value. Looking at the past 20 years of data, the average spread on the index was 149, although this time period includes the GFC when the spread on the index blew out to >600. The low was 75 in March of 2005 and the low for the current credit cycle was 80 in 2021. The spread on the index closed the year at 99 and it is certainly capable of trading sideways at this level for a long period of time and it can even grind tighter from here. But we want to be realistic with our investors about the upside potential in credit spreads. We believe that credit spreads are pricing in a relatively high likelihood of a soft landing and any data to the contrary (read: recession) will lead to wider spreads. The good news is that when you are starting with a >5% yield, there is a comfortable margin of safety available for spread widening while still generating positive total returns. We would also point out that most recessions are accompanied by a move lower in Treasury yields which could serve to offset wider credit spreads.

We have a favorable view of the general health of the credit market and we believe that strong credit metrics are compelling from the standpoint of risk reward. Although peak credit metrics of the current cycle occurred at the end of 2021, the creditworthiness of the IG credit market as a whole is stable and even showing improvement by some measures.i According to research compiled by Barclays, at the end of the third quarter 2023, net leverage for the index was 2.8x, EBITDA margins were 29.6% and interest coverage was 12.7x.1 While leverage and interest coverage were not quite as good as they have been in recent years, they were both at very reasonable levels, showing recent improvement while EBITDA margins have been remarkably stable and were only 0.4% from all-time highs. With few exceptions, investment grade rated companies are in very good shape.

Portfolio Positioning

We focus on the management of credit risk through a bottom up research process; so although we have a macro-view, we spend most of our time thinking about how that broader view may impact individual holdings within client portfolios. As a reminder, we structure each separately managed account in the following manner.

- Diversification: Each individual client or institutional portfolio is initially populated with approximately 20-25 positions. We diversify portfolios by seeking to limit each account to a 20% exposure at the sector level and 15% at the individual industry level, with the exception of the Financial Institutions (Finance) sector. For Finance we limit each account to a 30% exposure because it represents a large portion of the IG index with a 32.97% index weighting at the end of 2023.

- Credit Quality: One of the biggest differentiators between CAM’s portfolio and the Index is our bias toward higher quality credit in that we look to cap each client account at a 30% exposure to BAA-rated bonds. The Index had a 47.14% weighting in BAA-rated credit at the end of 2023 and this figure for the Index has been >50% several times in recent years –this leaves CAM’s portfolio with meaningfully less exposure to lower rated credit relative to the Index.

- Maturity: We will always seek to position the portfolio within an intermediate maturity band that ranges from 5-10 years. Occasionally you will find that we will hold some shorter maturities that mature in less than 5 years. This is especially true during the current environment where certain portions of the Treasury curve are inverted –we want to be patient and allow more time for our sale and extension trades to become economic. We will also occasionally purchase a bond that matures in >10 years but this is not typical and any such purchase will not be materially longer than 10 years. During the invest-up phase we will typically populate new portfolios with maturities that range in tenor from 8-10 years. As an account becomes seasoned we will look to sell bonds at ~5 years left to maturity and then we will redeploy those sale proceeds back into ~10 year maturities. As a result of our intermediate positioning, at year end 2023 our composite had a modified duration of 5.4 relative to the Index duration of 7.3.

The mission of our Investment Grade Strategy is to provide our clients with superior risk adjusted returns. Our goal is to minimize volatility by incurring less credit risk and less interest rate risk than the Index.

Fed Watching

In his prepared remarks following the December FOMC meeting, Chair Powell said that “…our policy rate is likely at or near its peak for this tightening cycle.”ii While he did not specifically rule out additional rate increases it has become increasingly clear that the Fed is unlikely to hike again. Now all attention has turned to the Fed rate-cut narrative which is sure to dominate the business news cycle in 2024. The most recent version of the Fed “dot plot” that was released at its December meeting showed that central bankers expect 0.75% of rate cuts in 2024. One way to look at this is if the Fed moves in 25bps increments then it is expecting to cut rates three times during the year. It is worth noting that the dot plot is simply the best estimate at a given point in time and it does not necessarily mean that the consensus estimate will come to fruition. For example, the dot plot that was released at the September 2023 meeting showed that there would be one additional 25bp rate increase in 2023 but that did not occur.

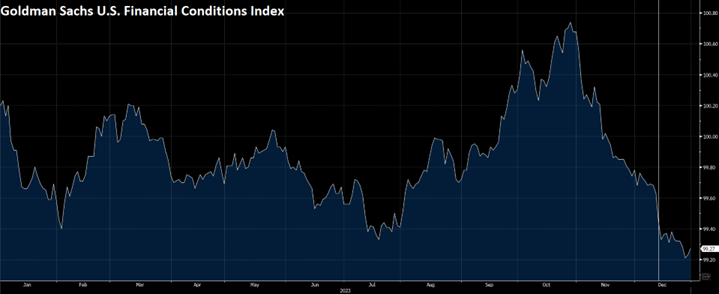

The Fed made a splash at its December meeting with its dovish commentary. One measure we track to gauge market perception is The Goldman Sachs Financial Conditions Index which is a weighted average of short and long-term interest rates, the value of the $USD, credit spreads and the ratio of equity prices to the 10-year average of EPS.

As you can see from the above chart, conditions were tightening rapidly in September and October before they just as quickly started to ease beginning with the November 1 FOMC meeting and then again at the December 13 meeting (denoted by the vertical line on the chart). We do not think it was necessarily a policy mistake but believe that the December press conference was a missed opportunity for Chairman Powell to push back against easing financial conditions, which ended 2023 near the most comfortable levels of the year. The U.S. economy added 4.8mm jobs in 2022 and another 2.7mm jobs in 2023.iii We believe that the bar for near term rate cuts is quite high unless the economy experiences a proportional slowing of job growth in 2024.

This brings us to our final thought with regard to Fed policy. The target range for Fed Funds was 5.25%-5.5% at year end and the Effective Fed Funds rate per data compiled by the New York Fed was 5.33% at the end of 2023. A 75bp move on an effective rate of 5.33% is a percentage decrease of 14%. We question whether the prospect of a move of just 14% is really enough to sustain the exuberance that risk assets experienced in the final two months of 2023. We think that, regardless of what it says, this Fed is determined to avoid repeating the mistakes of the past and that it must have the utmost confidence that inflation will settle at its 2% target before it starts to really move the needle with rate cuts. The best way for the Fed to accomplish this is to keep its policy rate “higher for longer.” An extended period of elevated rates is not necessarily a bad thing for bonds nor is it bad for IG-rated companies with good balance sheets but it could present a headwind for equities and certain sectors of the economy such as commercial real estate. Ultimately we believe “higher for longer” diminishes the prospect of a soft landing and increases the probability that the economy will enter a recession near the end of 2024 or sometime in 2025. The timing of such a call is always the most difficult part.

Moving Forward

Thank you for your continued enthusiasm and support and for trusting us to manage your hard earned capital. We look forward to collaborating with you in 2024.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results. Gross of advisory fee performance does not reflect the deduction of investment advisory fees. Our advisory fees are disclosed in Form ADV Part 2A. Accounts managed through brokerage firm programs usually will include additional fees. Returns are calculated monthly in U.S. dollars and include reinvestment of dividends and interest. The index is unmanaged and does not take into account fees, expenses, and transaction costs. It is shown for comparative purposes and is based on information generally available to the public from sources believed to be reliable. No representation is made to its accuracy or completeness.

The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed do not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable, or that the investment decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

Additional disclosures on the material risks and potential benefits of investing in corporate bonds are available on our website: https://www.cambonds.com/disclosure-statements/

i Barclays Bank PLC, December 11 2023 “US Investment Grade Credit Metrics, Q3 23 Update: Stable”

ii Federal Reserve System Board of Governors Chairman Jerome H. Powell News Conference, December 13 2023 “Federal Reserve System”

iii The Wall Street Journal, January 5 2024 “Job Gains Picked Up in December Capping Year of Healthy Hiring”