Fund Flows & Issuance: According to Wells Fargo, IG fund flows for the week of April 19-April 25 were positive, with an inflow of $3.5bn, driven primarily by ETFs, which posted their largest net inflow in over a year. According to data analyzed by Wells Fargo, IG funds have garnered $56.4 billion in net inflows YTD.

According to Bloomberg, $20.95bn in new corporate debt priced during the week. This brings the YTD total to $413.12bn. Historically, May is typically a robust month for new corporate bond issuance and the general consensus on the street is that issuance will pick up in the month of May as companies exit earnings blackout.

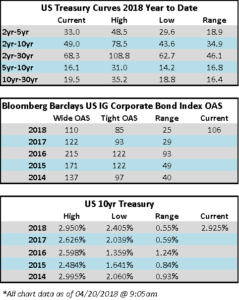

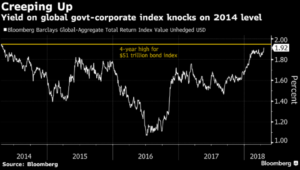

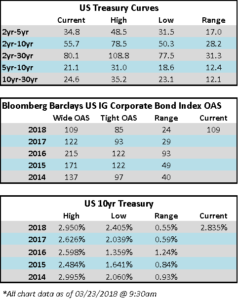

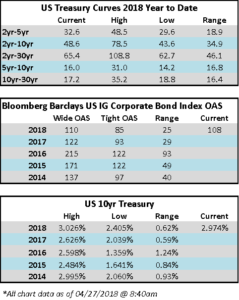

The Bloomberg Barclays US IG Corporate Bond Index closed on Thursday with an OAS of 108, while the 10yr treasury breached the 3.00% threshold this week for the first time since January of 2014.

(Bloomberg) BofA Says Rising Rates Boost Appeal of High-Grade Bonds For Now

- The highest Treasury yield since 2014 is good news for the investment-grade corporate bond market, bringing back investors who’ve been put off by low payouts previously, Hans Mikkelsen, high-grade bond strategist at Bank of America Merrill Lynch, said in phone interview.

- “If you look at credit spreads, rates at these levels are positive for the investment-grade market, especially in the back end of the yield curve,” Mikkelsen said. “This market actually has quite a lot of yield-sensitive investors who buy more when rates go up, which makes it different than other asset classes.”

- These include insurance companies, pension funds, and foreign buyers, which will buy more since the rate rise this time is modest, controlled, and fairly contained, he said. “It would take a much further uptick for them to sell.”

- On the other hand, If returns deteriorate, “there might be more of a negative feedback loop” for bond funds and ETFs, because those funds would typically buy less, Mikkelsen added. “And if we went to 4% within two weeks, that wouldn’t be good either, as interest-rate volatility and uncertainty matters more to IG investors than the interest rate level itself.”

- Investment-grade spreads widened last night following the market close Wednesday. Treasury yields have fallen from highs yesterday, with 10-year back below 3%

(Advisor Perspectives) Dan Fuss – Only Two Things Can Stop Rates from Rising

- As his 60-year tenure attests, Dan Fuss is one of the most respected bond investors. In my interview with Fuss last week, he explained why it would take either a geopolitical crisis or an economic collapse to drive rates lower. Fuss also said investors should exercise caution in bond ETF markets that are exposed to liquidity shocks.

- According to Fuss, existing deflationary forces in the global economy would not be enough to drive rates lower.

- This is not the first time Fuss has forecasted higher rates. In October 2017, Fuss advised investors to exercise caution by building reserves, and suggested that they position themselves for an environment of rising interest rates. He also did so in October 2015, March 2015, and October 2013, causing his fund to miss the full benefit of bond rally in 2014. In April 2012 he made a similar, but incorrect, prediction.

(WPO) What Comcast’s $31 Billion Offer for a U.K. TV Company Tells Us About the Cable Giant’s Ambitions

- Comcast said Wednesday that it’s offering $31 billion to buy the British TV provider Sky, officially starting a bidding war between the U.S. cable giant and 21st Century Fox, which has offered $16.5 billion for the company.

- But why is a U.K.-based television company such a sought-after piece of property, and what could a deal mean for Comcast’s customers?

- The answer can be found in Comcast chief executive Brian Roberts’s remarks to investors on an earnings call Wednesday morning.

- “It’s a unique asset,” Roberts said. “It fits well with the assets we’ve already got. … A benefit is, you’d get new geographies and additional scale that gives you optionality.”

- In other words, a deal would give Comcast access to a bigger overseas audience and — according to industry analysts — new TV programming.

- Media and entertainment companies are increasingly consolidating — Time Warner, for example, is seeking to merge with AT&T for $85 billion. And it looks as though Comcast also is seeking additional opportunities in this space

- But unlike AT&T-Time Warner, which AT&T casts as a make-or-break bet as the telco tries to compete with Google and Facebook with a data-driven ad business, Comcast is emphasizing the optional nature of its offer for Sky. It’s simply a good opportunity and the best use of Comcast’s money right now, Roberts told analysts on the call.