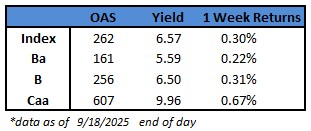

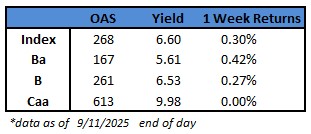

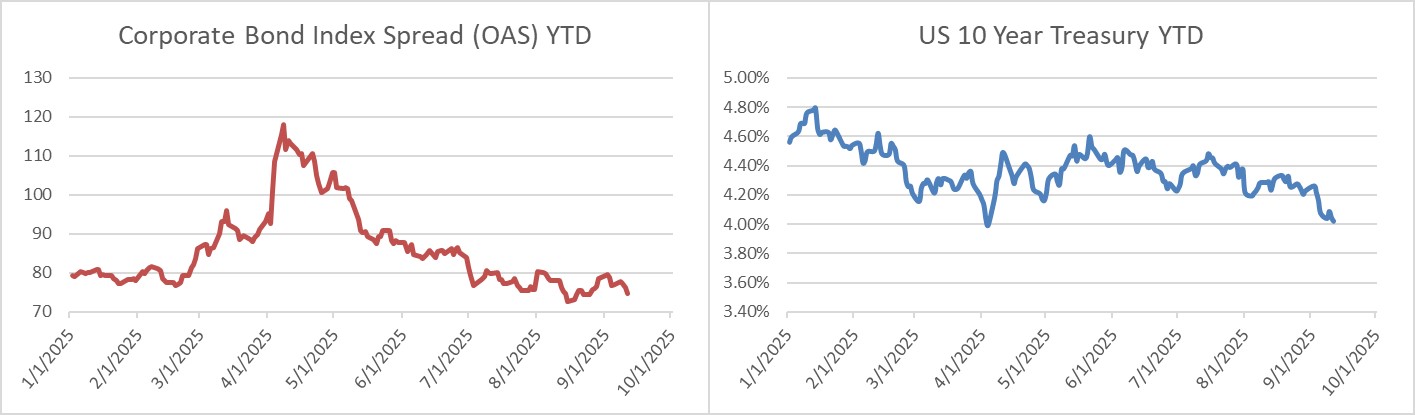

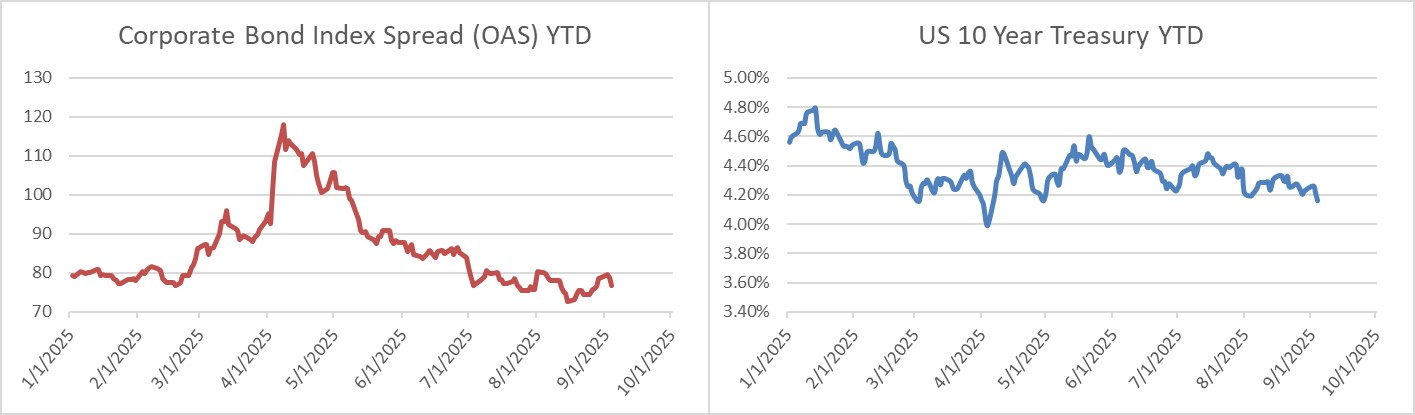

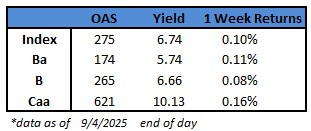

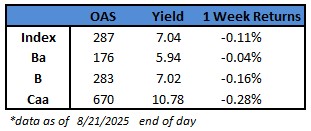

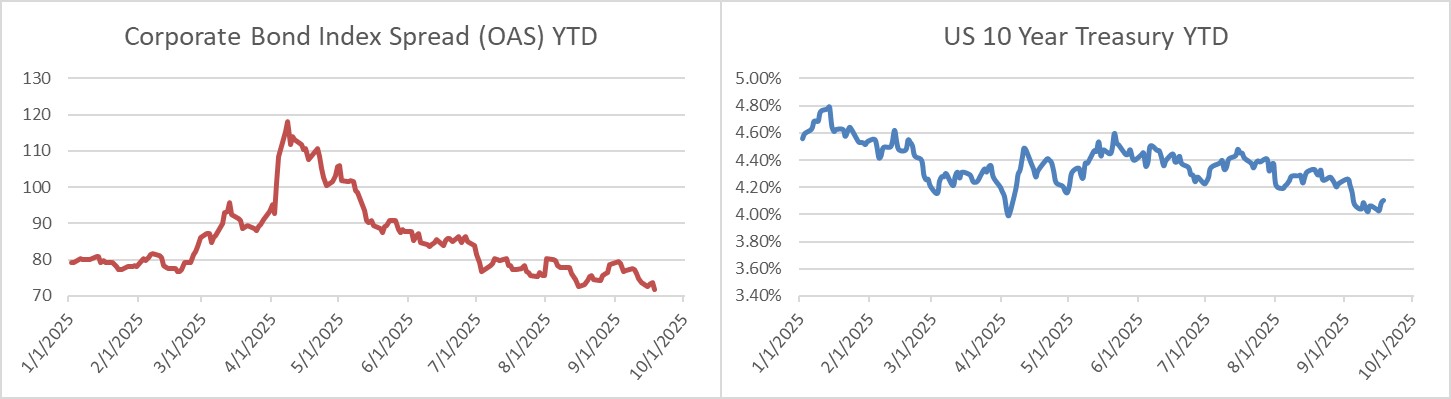

Credit spreads look as though they will finish the week slightly tighter again. These have not been big moves tighter the last few weeks but more of an incremental grind lower. The OAS on the Corporate Index closed at 72 on Thursday September 18th after closing the week prior at 74. Treasury yields drifted higher throughout the week and are now off their lows across the curve. The 10yr Treasury yield closed last week at 4.06% and was 4.12% as we went to print mid-morning on Friday. Through Thursday, the Corporate Bond Index year-to-date total return was +7.03% while the yield to maturity for the index was 4.76%.

News & Economics

The highlight of the week was the FOMC release and 25bp rate cut, which was essentially baked-in leading up to the meeting. The updated SEP (dot plot) indicated 50bps of additional easing over the two remaining meetings of the year (no November meeting). During his press conference, Chairman Powell was neither hawkish nor dovish, in our view, and retained a neutral stance. He chose his words carefully during the presser, and in our opinion made it clear that the FOMC would not be too aggressive with easier monetary policy with inflation still stubbornly elevated above the Fed’s target and with too many unknowns that have yet to filter their way through the economy with regard to trade policy.

Primary Market

It was a solid week for the primary market as companies priced $34bln of new debt, besting dealer estimates of $30bln. Next week dealers are looking for another $30bln as the market backdrop remains accommodative for both borrowers and investors.

Flows

According to LSEG Lipper, for the week ended September 17, investment-grade bond funds reported a net inflow of +$2.18bln. This marked the 19th straight week of inflows and is the largest such streak since 2021. Total year-to-date flows into investment grade were +$47.4bln.

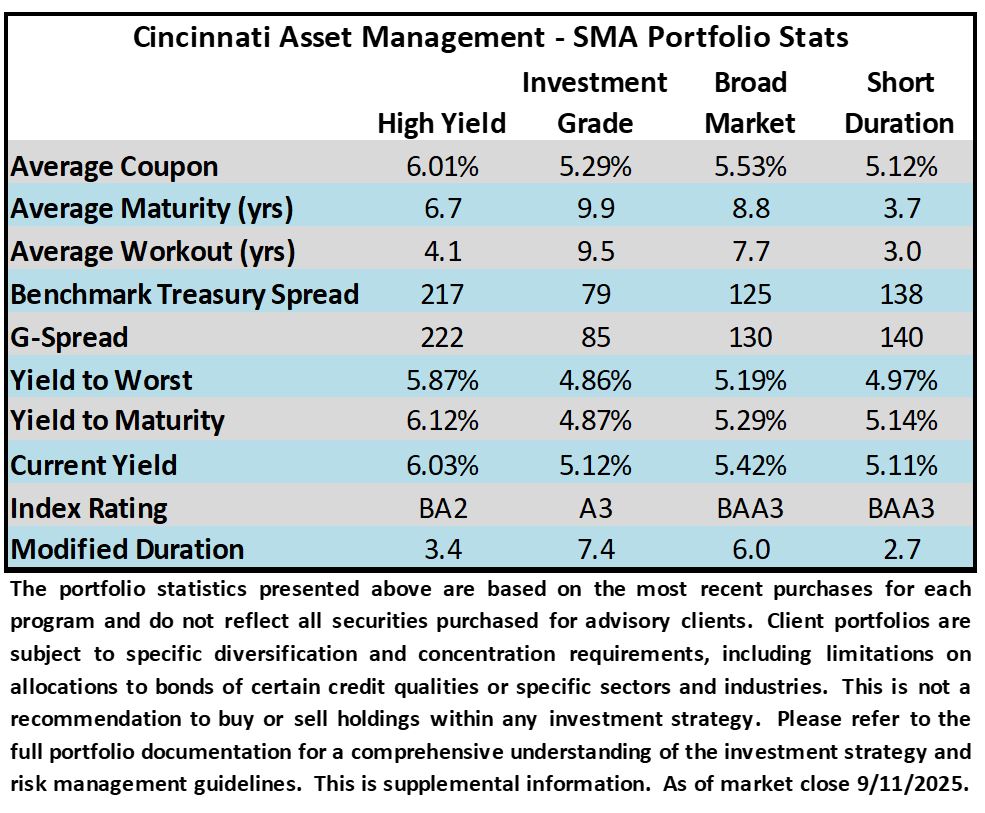

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.