Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were -$5.3 billion and year to date flows stand at -$22.9 billion. New issuance for the week was zero and year to date issuance is at $71.5 billion.

(Bloomberg) High Yield Market Highlights

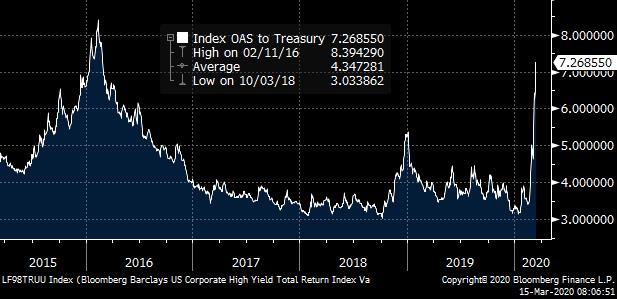

- U.S. junk bonds may pare losses Friday with stock futures higher and oil extending a recovery. But the asset class has lost the most in any month so far since 2008, and investors pulled billions of dollars of cash from funds.

- Yet the junk-bond index has posted losses for 11 straight sessions, with 2.63% on Thursday alone. The asset class has lost 17.6% year-to-date and 16.46% in March, the biggest monthly loss since 2008

- High-yield spreads widened 72bps Thursday to 976bps. Single-B spreads widened 78bps to 990bps. That’s very close to the 1,000bps that’s typically considered distressed

- In less than two weeks, the amount of distressed debt in the U.S. has doubled to a half-trillion dollars as the collapse of oil prices and the fallout from the coronavirus shutters entire industries.

- Junk-bond yields jumped 63bps to close at 10.75%, the highest since September 2009

- Energy-bond yields surged to a new 20-year high of 23.69%, with the index losing more than 37% this month

- High-yield bonds with more than $1.37b outstanding are trading above upcoming call prices, making it attractive for issuers to redeem the securities in the next three months. But that’s down 70% from the prior week, and the primary market hasn’t seen a deal price since March 4

(Bloomberg) Junk Debt Market Freeze Risks $35 Billion Banker Headache

- Banks that agreed to help private equity firms and highly leveraged companies fund recent acquisitions may have to come up with billions of dollars of their own cash

to finance the deals if the market for risky debt remains shut. - Underwriters across Wall Street have committed to providing more than $30 billion to junk-rated companies by mid-year, according to data compiled by Bloomberg and people with knowledge of the matter who asked not to be identified because not authorized to speak publicly.

- But with the markets for leveraged loans and high-yield bonds virtually shut since the Covid-19 pandemic triggered fears of a global recession, the banks now face the prospect that they might not be able to offload the risk before the takeovers are scheduled to close.

- The exposure is a small fraction of the commitments they held heading into the 2008 financial crisis. Still, it could force banks to take losses or tie up capital for months just as

dozens of companies are drawing credit lines or seeking fresh financing to cope with the coronavirus fallout. - The deals run the gamut of sectors and geographies, ranging from an $11 billion financing for the leveraged buyout of ThyssenKrupp’s elevator unit in Europe to a $500 million debt deal for Culligan’s acquisition of water-filtration company AquaVenture.

- Representatives for lead arrangers including Morgan Stanley, JPMorgan Chase & Co., Deutsche Bank AG, Bank of America Corp., Citigroup Inc. and Barclays Plc declined to comment.

- For the vast majority of deals, the acquisitions themselves are not in doubt. If the banks are unable to syndicate the loans to institutional investors before closing, they are typically required to come up with the cash, and may try to offload the debt at a later date.