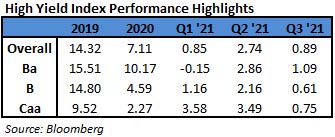

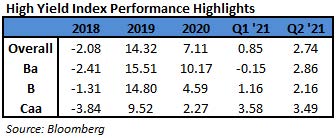

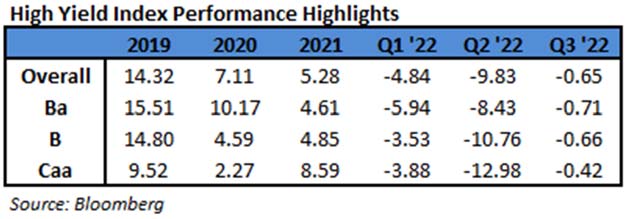

In the third quarter of 2022, the Bloomberg US Corporate High Yield Index (“Index”) return was ‐0.65% bringing the year to date (“YTD”) return to ‐14.74%. The S&P 500 stock index return was ‐4.89% (including dividends reinvested) for Q3, and the YTD return stands at ‐23.88%.

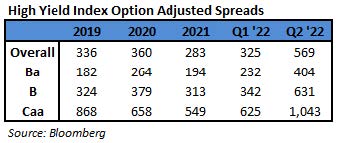

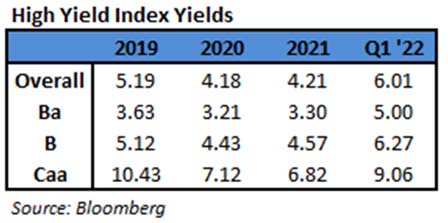

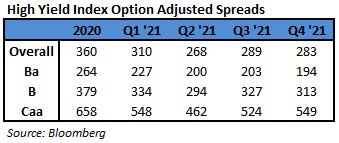

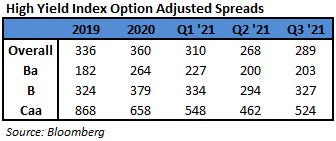

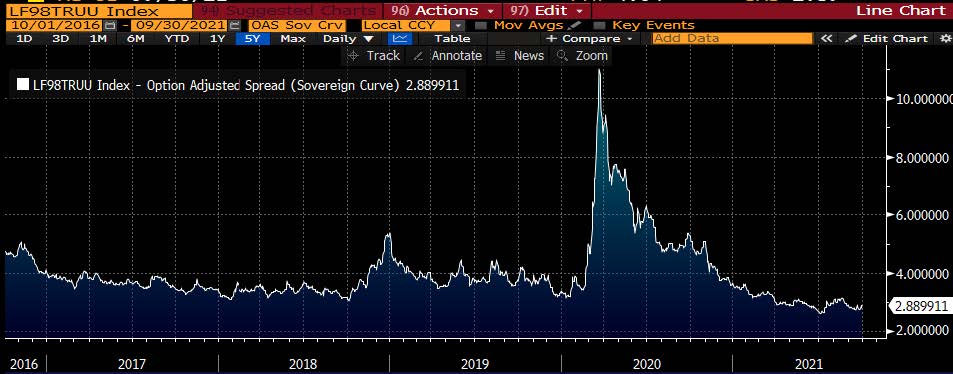

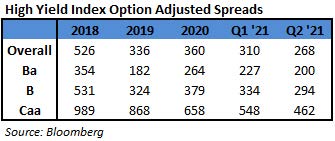

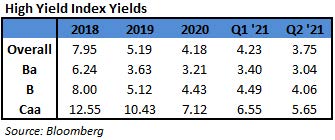

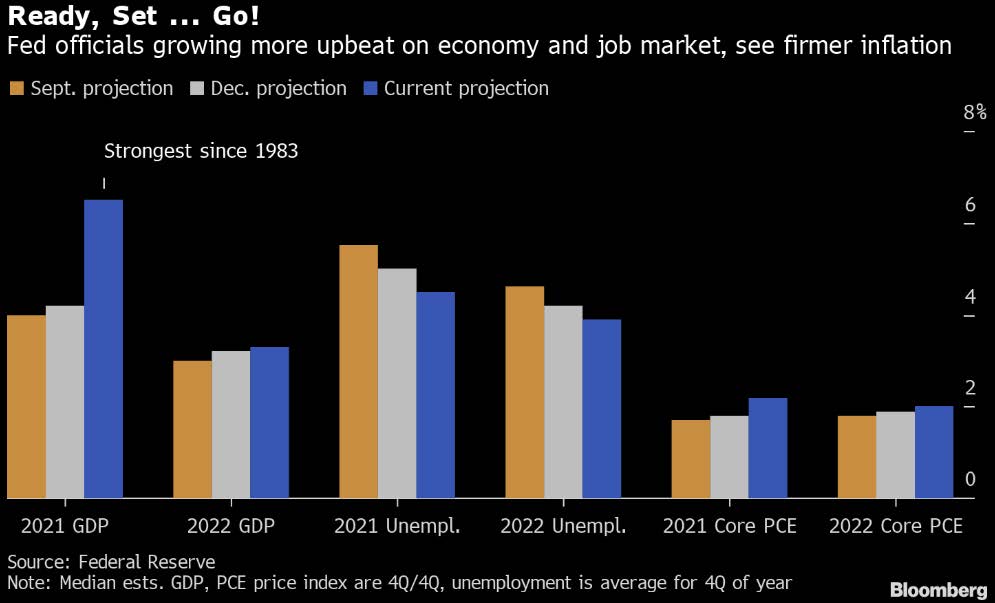

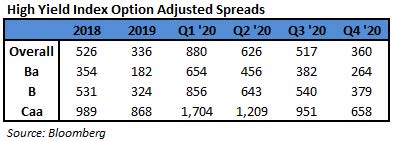

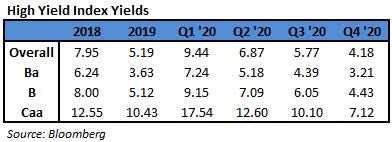

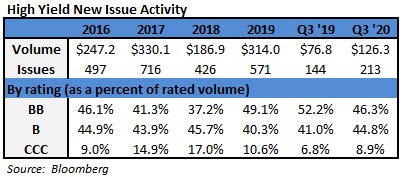

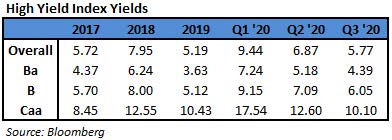

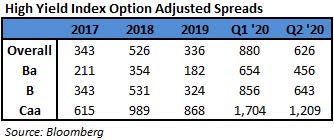

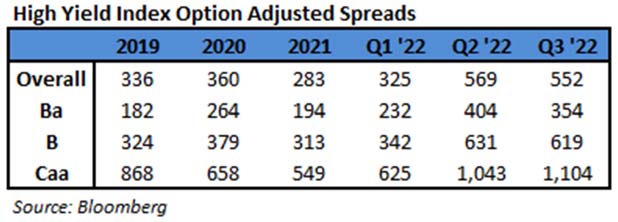

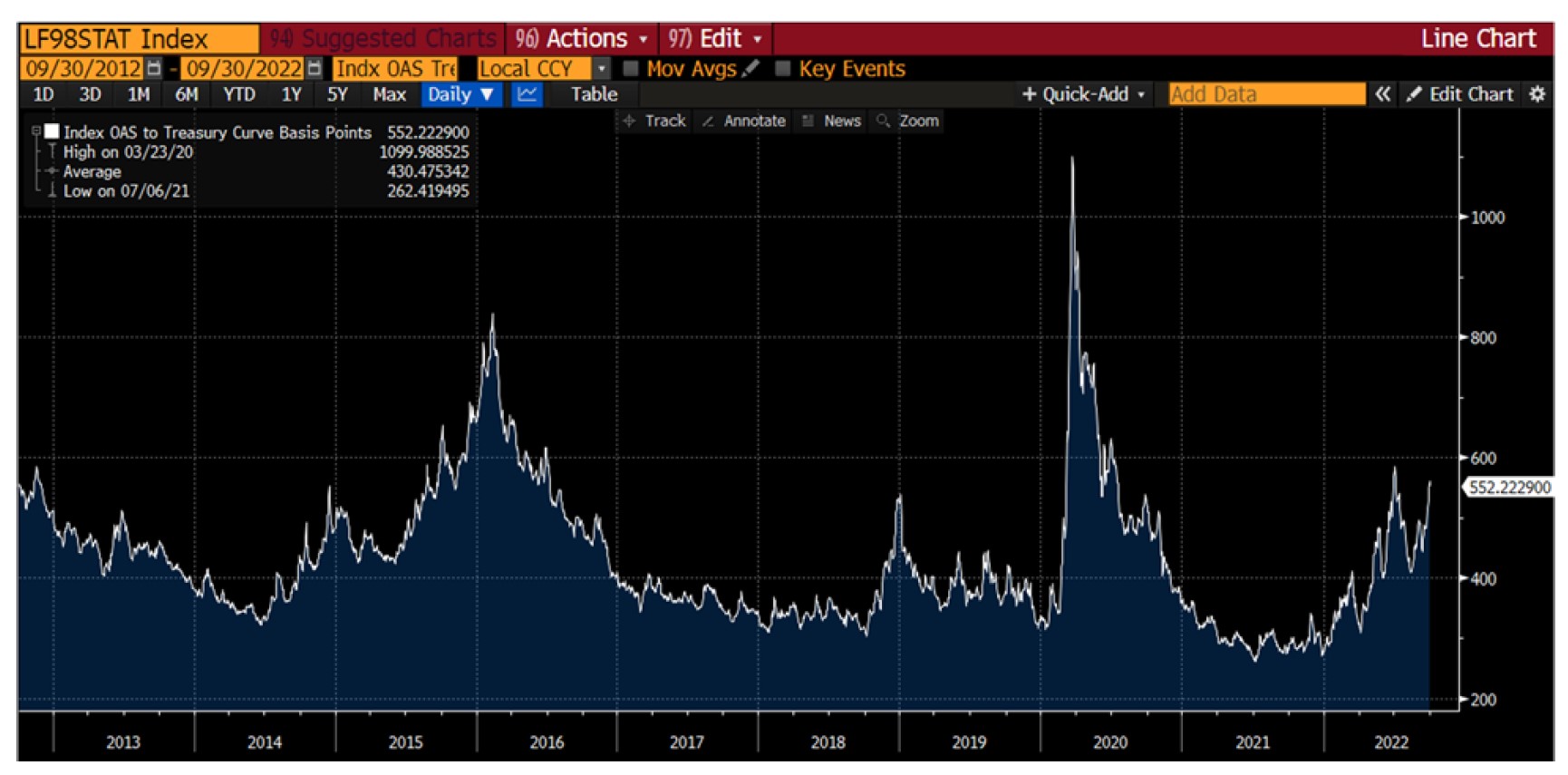

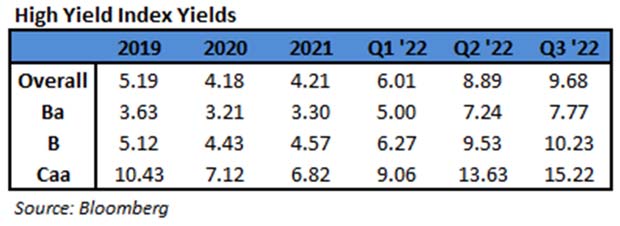

The 10 year US Treasury rate (“10 year”) generally marched higher after a small dip in July as the rate finished at 3.83%, up 0.82% from the beginning of the quarter. Over the period, the Index option adjusted spread (“OAS”) tightened 17 basis points moving from 569 basis points to 552 basis points. The higher quality segments of the High Yield Market participated in the spread tightening as BB rated securities tightened 50 basis points, and B rated securities tightened 12 basis points. Meanwhile, CCC rated securities widened 61 basis points. The chart below from Bloomberg displays the spread moves in the Index over the past ten years with an average level of 430 basis points.

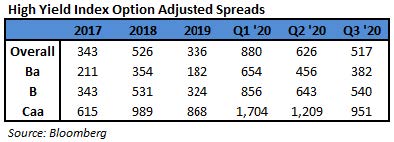

The Energy, Transportation, and Other Industrial sectors were the best performers during the quarter, posting returns of 1.28%, 1.20%, and 0.54%, respectively. On the other hand, Banking, Consumer Non‐Cyclical, and Brokerage were the worst performing sectors, posting returns of ‐3.91%, ‐2.82%, and ‐2.06%, respectively. At the industry level, aerospace and defense, refining, and gaming all posted the best returns. The aerospace and defense industry posted the highest return 3.49%. The lowest performing industries during the quarter were pharma, healthcare REIT, and retailers. The pharma industry posted the lowest return ‐9.57%. Crude oil has continued trending lower as can be seen on the chart at the left. OPEC+ members just met and agreed to cut oil production by two million barrels per day in a bid to help support the price of oil in the face of a weakening global economy. However, it is noted that the impact to supply is likely to be smaller than the headline number. “OPEC and its partners have been meeting online on a monthly basis and weren’t expected to arrange an inperson gathering until at least the end of this year. The slump in prices may have been what prompted the change of tack, requiring the first face‐to‐face talks since 2020.”i

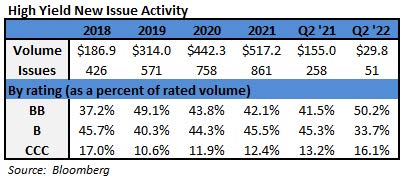

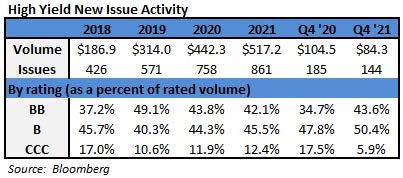

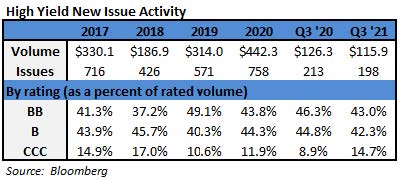

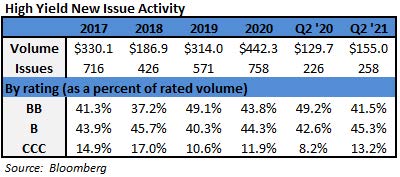

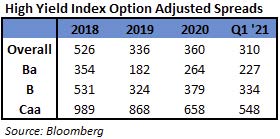

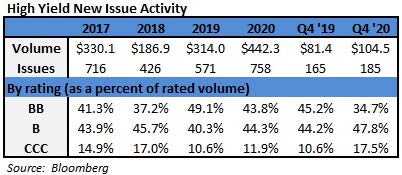

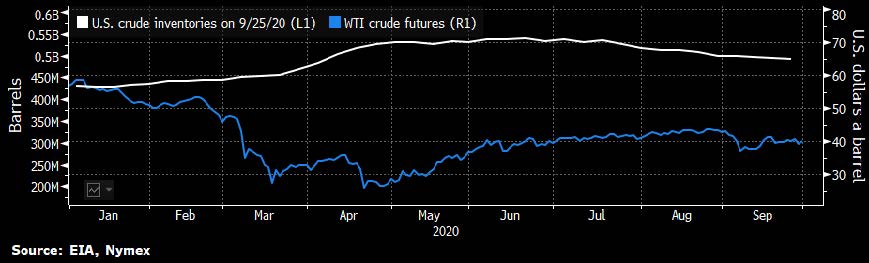

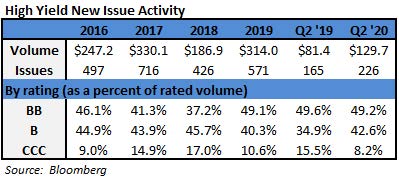

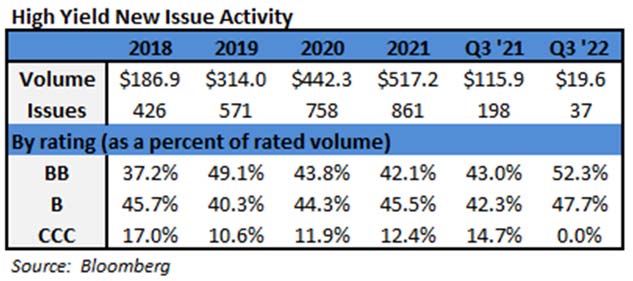

The primary market remained very subdued during the third quarter. The weak market led to year‐to‐date issuance of $95.2 billion and $19.6 billion in the quarter. That is the lowest quarter of issuance in four years. Discretionary took 37% of the market share followed by Technology at a 28% share. Currently, there isn’t much concern for lack of capital access due to issuers being so proactive with refinancing in the past few years. In fact, only about $50 billion in high yield bonds are due to mature from now through the end of 2023.

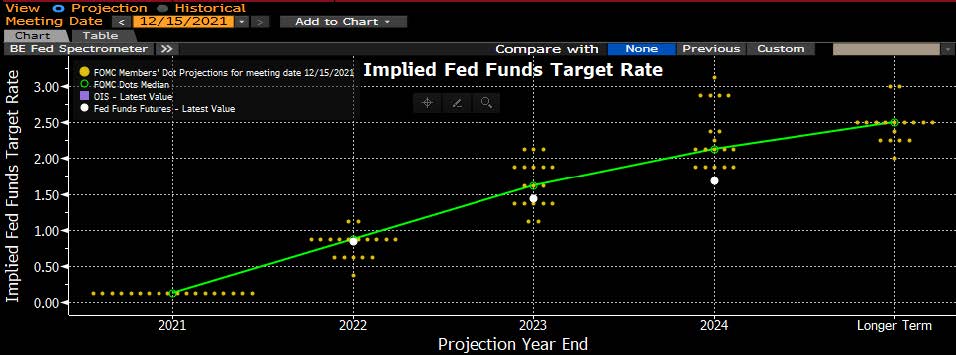

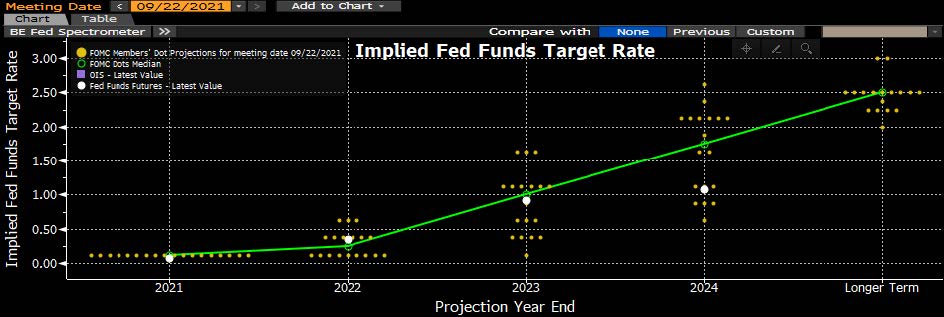

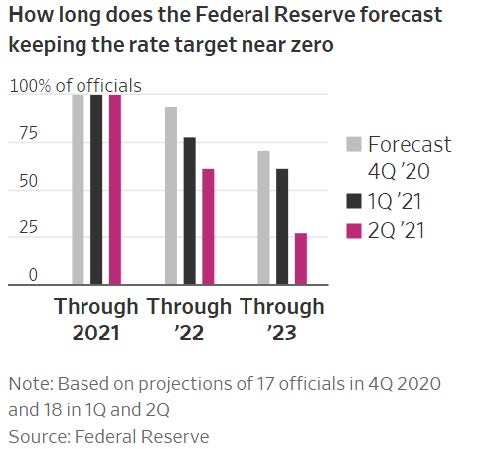

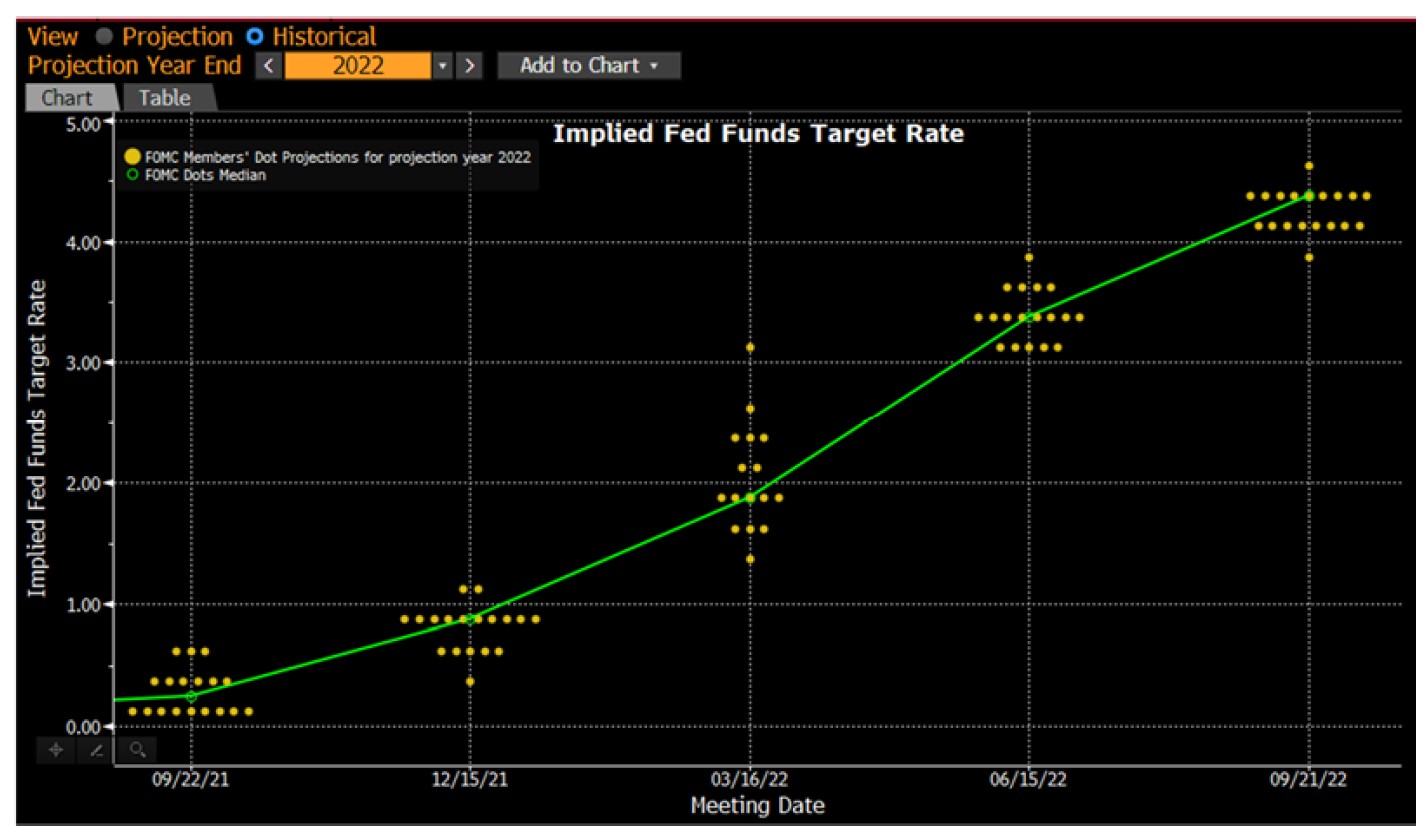

After the Federal Reserve lifted the Target Rate by 0.75% at their June meeting, Fed Chair Jerome Powell acknowledged that the hike was “an unusually large one.” It may have been a large one, but apparently it was not enough as the Fed raised an additional 0.75% at both the July and September meetings. For those keeping score, that brings the Fed to 300 basis points of raises this year.

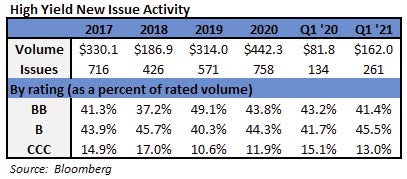

The dot plot chart shows how the Fed projections of the 2022 year‐end Target Rate have evolved over the past year. The Fed was clearly behind the curve and now believes stuffing the market with three consecutive “unusually large” hikes in a singular bid to break inflation is the appropriate move, notwithstanding all the other consequences. “We have always understood that restoring price stability while achieving a relatively modest increase in unemployment and a soft landing would be very challenging,” Powell said. “We have got to get

inflation behind us. I wish there were a painless way to do that. There isn’t.”ii Based on the Fed’s Summary of Economic Projections, they accept that the continuing rate hikes are going to lower growth and push up unemployment.

Intermediate Treasuries increased 82 basis points over the quarter, as the 10‐year Treasury yield was at 3.01% on June 30th, and 3.83% at the end of the third quarter. The 5‐year Treasury increased 105 basis points over the quarter, moving from 3.04% on June 30th, to 4.09% at the end of the third quarter. Intermediate term yields more often reflect GDP and expectations for future economic growth and inflation rather than actions taken by the FOMC to adjust the Target Rate. The revised second quarter GDP print was ‐0.6% (quarter over quarter annualized rate). Looking forward, the current consensus view of economists suggests a GDP for 2022 around 1.6% with inflation expectations around 8.0%.iii

Being a more conservative asset manager, Cincinnati Asset Management Inc. does not buy CCC and lower rated securities. Additionally, our interest rate agnostic philosophy keeps us generally positioned in the five to ten year maturity timeframe. Due to the continued rate moves, this positioning was a detractor of performance in the quarter as short‐end maturities outperformed. Further, our credit selections within communications and energy were a drag on performance. Benefiting our performance was our lack of exposure to pharma and our credit selections within healthcare. All totaled, the CAM High Yield Composite Q3 net of fees total return of ‐1.38% underperformed the Index. The Composite YTD net of fees total return of ‐17.06% also underperformed the Index.

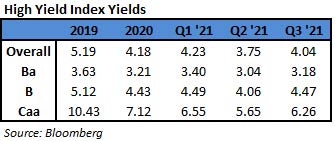

The Bloomberg US Corporate High Yield Index ended the third quarter with a yield of 9.68%. Equity volatility, as measured by the Chicago Board Options Exchange Volatility Index (“VIX”), had an average of 25 over the quarter moving from a low of 20 in mid‐August to a high of 32 atthe end of September. For context, the average was 15 over the course of 2019, 29 for 2020, and 19 for 2021. The third quarter had two bond issuers default on their debt. The trailing twelve month default rate stands at 0.83%.iv The current default rate is relative to the 0.92%, 0.27%, 0.23%, 0.86% default rates from the previous four quarter end data points listed oldest to most recent. The fundamentals of high yield companies still look good considering the economic backdrop. From a technical view, fund flows were positive in July but negative in August and September. The 2022 year-to‐date outflow stands at $61.5 billion.v Without question there has been a fair amount of damage in bond markets so far this year. It is important to remember that bonds are a contractual agreement with a defined maturity date. Thus, despite price volatility, without default, par will be paid at the stated maturity date. Currently, defaults are quite low and fundamentals are still providing a cushion. No doubt there are risks, but

we are of the belief that for clients that have an investment horizon over a complete market cycle, high yield deserves to be considered as part of the portfolio allocation.

As we move into the last quarter of 2022, fixed income markets remain pressured as the Fed continues raising the Target Rate. The US dollar has been moving higher all year. Over 80% of central banks around the world are now hiking, the highest percentage on record.vi Japan has taken to currency intervention. The Bank of England is hiking while the British government is pushing through their largest tax cut package since 1972. Citi’s London team commented that euro credit markets are disorderly. Subsequently, the Bank of England started buying gilts while some of the tax cut package was walked back. Back in the US with the message from the Fed steadfast, caution is warranted as uncertainty remains around the cycle’s terminal rate and the resulting depth of an intentional economic slowdown. Markets have been roughed up this year, but brighter days will eventually appear. As this cycle plays out, current uncertainty and volatility can create opportunities that lead back to positive returns. Our exercise of discipline and selectivity in credit selections is important as we continue to evaluate that the given compensation for the perceived level of risk remains appropriate. As always, we will continue our search for value and adjust positions as we uncover compelling situations. Finally, we are very grateful for the trust placed in our team to manage your capital.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results. Gross of advisory fee performance does not reflect the deduction of investment advisory fees. Our advisory fees are disclosed in Form ADV Part 2A. Accounts managed through brokerage firm programs usually will include additional fees. Returns are calculated monthly in U.S. dollars and include reinvestment of dividends and interest. The index is unmanaged and does not take into account fees, expenses, and transaction costs. It is shown for comparative purposes and is based on information generally available to the public from sources believed to be reliable. No representation is made to its accuracy or completeness.

The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed do not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable, or that the investment decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

i Bloomberg October 4, 2022: OPEC+ Considers Output Limit Cut

ii Bloomberg September 22, 2022: Powell Signals Recession May Be the Price for Crushing Inflation

iii Bloomberg October 3, 2022: Economic Forecasts (ECFC)

iv JP Morgan October 3, 2022: “Default Monitor”

v Wells Fargo September 29, 2022: “Credit Flows”

vi Goldman Global Markets Insights September 23, 2022: Markets/Macro