CAM Investment Grade Weekly Insights

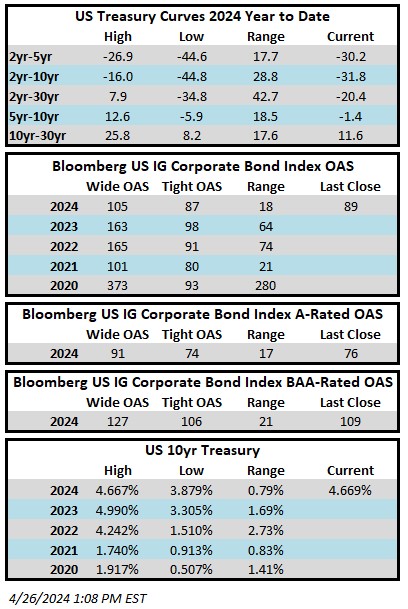

Credit spreads battled through some volatility this week before moving tighter near the end of the period. The Bloomberg US Corporate Bond Index closed at 89 on Thursday April 25 after closing the week prior at 92. The 10yr Treasury yield is up slightly on the week, trading at 4.67% this Friday afternoon after closing last week at 4.62%. Through Thursday, the corporate bond index YTD total return was -3.22% while the yield-to-maturity for the benchmark was 5.75% relative to its 5-year average of 3.66%.

Economics

Most of the big economic news of the week occurred in the second half of the period. Durable goods orders were released on Wednesday with a headline number for March that was in-line with consensus but accompanied by a significant revision downward in February’s number. GDP data on Thursday was very weak relative to expectations, coming in at +1.6% versus the survey of +2.5% which caused a sizeable selloff in equities and ironically sent Treasury yields higher as the inflationary component of GDP advanced higher relative to expectations. Friday saw the release of personal spending data as well as PCE data with both coming in hot versus economist estimates. Taking it all together, there was something for both hawks and doves but none of these numbers are likely to be a game changer for the Fed in its zeal to cut rates. The FOMC releases its May rate decision next Wednesday and interest rate futures are currently implying just a 2.6% probability of a cut as we go to print this Friday afternoon. The ride on the road to policy easing continues to be a long and complicated journey.

Issuance

It was the slowest week of the year for new issue with only four borrowers tapping the market for a total of $11.6bln. The consensus estimate of $20-$25bln was obviously too optimistic especially considering 32% of the S&P 500 reported earnings this week. Next week is another busy one for earnings and with a Fed meeting on Wednesday prognosticators are only looking for $15bln in new supply. Year-to-date issuance stands at $616.8bln, up >40% relative to 2023.

Flows

According to LSEG Lipper, for the week ended April 24, investment-grade bond funds reported a net outflow of -$607mm. This was the first outflow of 2024, breaking a streak of 18 consecutive weeks of inflow for IG funds. YTD flows into IG stand at +$32.9bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.