CAM Investment Grade Weekly Insights

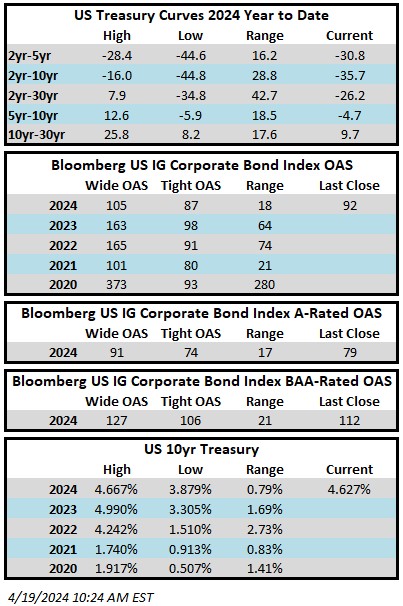

Spreads finally took a breather this week as the market moved modestly wider throughout the period. The Bloomberg US Corporate Bond Index closed at 92 on Thursday April 18 after closing the week prior at 89. The 10yr Treasury yield is higher again this week and is trading at 4.63% this Friday morning after closing last week at 4.52%. Higher Treasury yields have been a headwind for IG returns so far this year –through Thursday, the index YTD total return was -3.07% while the yield-to-maturity for the benchmark was 5.73% relative to its 5-year average of 3.65%.

Economics

Things got off to a hot start right away on Monday morning as March retail sales data beat expectations in a big way. Some economists have argued that an early Easter may have pulled some spending forward from April into March but there is no denying that it was a very solid number and yet another data point showing a resilient economy. Federal Reserve chairman Jerome Powell may finally be coming around to the realization that the Fed will have difficulty justifying near term rate cuts. At an economic forum on Tuesday, Powell commented on rate cuts: “The recent data have clearly not given us greater confidence and indicate that it is likely to take longer than expected to achieve that confidence.” Not all the data was rosy this week as Thursday’s existing home sales release showed a 4.3% decline from February, the biggest monthly drop in over a year. Additionally, higher Treasury yields caused the average rate on the standard 30-year fixed rate mortgage to surge to 7.1%. Next week we get plenty of data with the grand finale on Friday morning when Core PCE will hit the tape.

Issuance

Issuance was on the screws relative to estimates on the week as volume came in at just over $31bln, although there was not much diversity with the financial sector accounting for 90% of that number. Syndicate desks are looking for $20-$25bln of new bonds next week. Year-to-date issuance stands at $605.2bln, up +42% relative to 2023. It “feels” like new issue concessions showed some improvement on the week but the reality is that it has not yet shown up in the numbers. Even still, data did show that 66% of deals priced this week rallied in the secondary market.

Flows

According to LSEG Lipper, for the week ended April 17, investment-grade bond funds reported a net inflow of +$170mm. This was the 18th consecutive weekly inflow for IG funds. YTD flows into IG stand at +$33.5bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.