CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

- US junk bonds extended their decline Thursday, logging their biggest one-day loss in the more than a week as slowed economic growth and a higher inflation rating curbed soft-landing hopes.

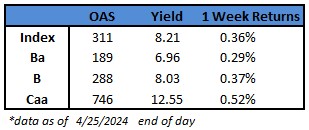

- Yields jumped 10 basis points to 8.21%, though they still remain lower for the week

- Ahead of today’s PCE reading, the inflation component in the 1Q GDP report fueled worries the Federal Reserve may further delay rate cuts to late this year

- BB yields climbed 8 basis points to 6.96% as such notes lost27%

- Single B yields jumped 12bps to 8.03%, with a loss of 0.3%

- CCCs also lost 0.3%, though yields rose just 3bps to 12.55%

- Tight spreads against the backdrop of a resilient economy continues to draw new bond sales

- This month’s supply is at $24b, up 28% from the full month of April 2023

(Bloomberg) US Economy Slows and Inflation Jumps, Damping Soft-Landing Hopes

- US economic growth slid to an almost two-year low last quarter while inflation jumped to uncomfortable levels, interrupting a run of strong demand and muted price pressures that had fueled optimism for a soft landing.

- Gross domestic product increased at a 1.6% annualized rate, below all economists’ forecasts, the government’s initial estimate showed. The economy’s main growth engine — personal spending — rose at a slower-than-forecast 2.5% pace. A wider trade deficit subtracted the most from growth since 2022.

- A closely watched measure of underlying inflation advanced at a greater-than-expected 3.7% clip, the first quarterly acceleration in a year, the Bureau of Economic Analysis report showed Thursday.

- The figures represent a notable loss of momentum at the start of 2024 after the economy wrapped up a surprisingly strong year. With the inflation pickup, Federal Reserve policymakers — who were already expected to hold interest rates at a two-decade high when they meet next week — may face renewed pressure to further delay any cuts and even to consider whether borrowing costs are high enough.

- “The hot inflation print is the real story in this report,” Olu Sonola, head of US economic research at Fitch Ratings, said in a note. “If growth continues to slowly decelerate, but inflation strongly takes off again in the wrong direction, the expectation of a Fed interest rate cut in 2024 is starting to look increasingly more out of reach.”

- The first-quarter pickup in inflation was driven by a 5.1% jump in service-sector inflation that excludes housing and energy, nearly double the prior quarter’s pace.

- Stripping out inventories, government spending and trade, inflation-adjusted final sales to private domestic purchasers — a key gauge of underlying demand — rose at a 3.1% rate.

- The GDP report showed outlays for services rose by the most since the third quarter of 2021, fueled by health care and financial services. Spending on goods decreased for the first time in more than a year, restrained by motor vehicles and gasoline.

- At next week’s Fed meeting, traders will parse Chair Jerome Powell’s comments for clues about the latest thinking around easing policy.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.