CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

- US junk bonds gained for the second session in a row, pushing yields down 10 basis points to a three-week low after Fed Chair Powell indicated on Wednesday that a hike in interest-rates was unlikely. However, he also suggested that higher-than-expected inflation readings have reduced the central bank’s confidence that price pressures are easing.

- The US high-yield market is headed toward a second week of positive returns, partly fueled by Chair Powell’s reiteration that the Fed is not mulling a hike in rates, while also expressing hopes that rate cuts could happen later in the year.

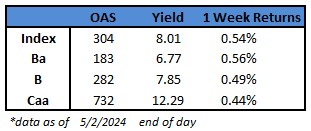

- The broader junk bond index yields dropped to 8.01% , falling 12 basis points week-to-date, the second straight week of decline

- BBs notched up gains of 0.37% on Thursday, the strongest one-day returns since December and on track for a second consecutive week of gains. The week-to-date advance is 0.56%, the most in six weeks

- BB yields dropped nine basis points on Thursday to 6.77%, and 11 basis points week-to-date

- Single B yields also slid 11 basis points week-to-date to 7.85%, driving gains of 0.49%

- CCC yields fell 19 basis points on Thursday to 12.29% and 13 basis points week-to-date. Tumbling yields drove gains of 0.44% in the first four days

- The primary market resumed normal business after the Fed meeting, pricing $1.3b on Thursday amid strong economic data, attractive all-in yields and tight spreads

(Bloomberg) US Jobs Post Smallest Gain in Six Months as Unemployment Rises

- US employers scaled back hiring in April and the unemployment rate unexpectedly rose, suggesting some cooling is underway in the labor market after a strong start to the year.

- Nonfarm payrolls advanced 175,000 last month, the smallest gain in six months, a Bureau of Labor Statistics report showed Friday. The unemployment rate ticked up to 3.9% and wage gains slowed.

- Friday’s report signaled further evidence that demand for workers is moderating, but the data likely don’t amount to “an unexpected weakening” that Federal Reserve Chair Jerome Powell said would warrant a policy response.

- After holding interest rates steady for a sixth straight meeting this week, Powell said he thinks policy is restrictive as seen by weaker demand for labor, though it still exceeds the supply of available workers. As inflation has largely receded from its 2022 peak, officials are now also focused on ensuring maximum employment, he said Wednesday.

- Treasury yields and the dollar fell, while stock futures rose after the report.

- Aggregate weekly payrolls, a broad measure of employment, hours and earnings, were unchanged from a month earlier. That snapped three straight years of monthly advances and, if sustained, raises the risk of a downshift in consumer demand.

- The very gradual cooling in hiring and wage growth is part of the reason why policymakers have indicated they’re in no rush to bring interest rates down from a two-decade high.

- The participation rate — the share of the population that is working or looking for work — held steady at 62.7%. The rate for workers aged 25-54 ticked up to 83.5%, matching the highest level in two decades. Increased participation will help to restrain wage growth.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.