CAM Investment Grade Weekly Insights

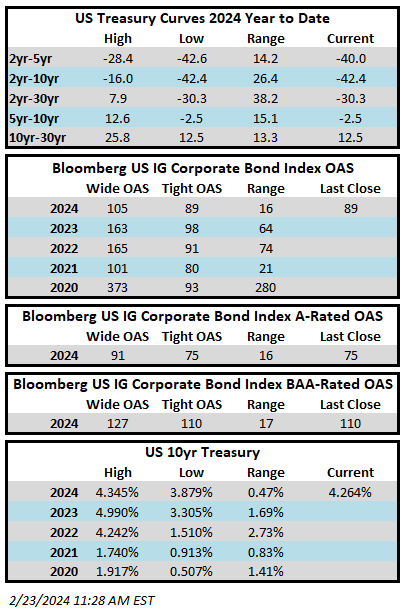

Another week is in the books and once again it is a year-to-date tight for credit spreads. The Bloomberg US Corporate Bond Index closed at 89 on Thursday February 22 after having closed the week prior at 92. The 10yr is trading at 4.26% this Friday morning after closing last week at 4.28%. Through Thursday, the Investment Grade Corporate Index YTD total return was -1.76%.

Economics

It was an extremely light week for economic data. Perhaps the highlight of the week was the release of the Fed minutes from the most recent meeting that highlighted consensus among policymakers about the risks of cutting rates too quickly. Next week brings some more action with many data releases including GDP, Core PCE and Personal Spending.

Issuance

It was a huge week for issuance even despite the fact that the market was closed on Monday. More than $53bln of new debt priced through Thursday and there is a rare large deal in the market on Friday that is likely to push the total past $60bln. Next week is expected to be reasonably busy with syndicate desks estimating about $30bln of new issuance.

Flows

According to LSEG Lipper, for the week ended February 21, investment-grade bond funds reported a net inflow of +$2.27bln. This was the tenth consecutive weekly inflow for IG funds.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.