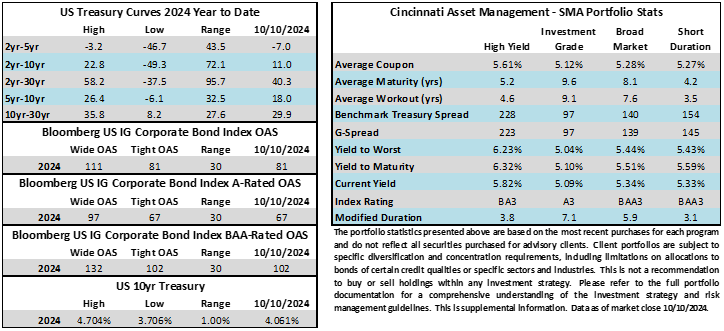

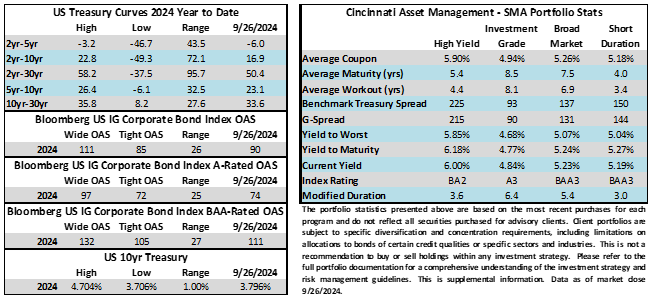

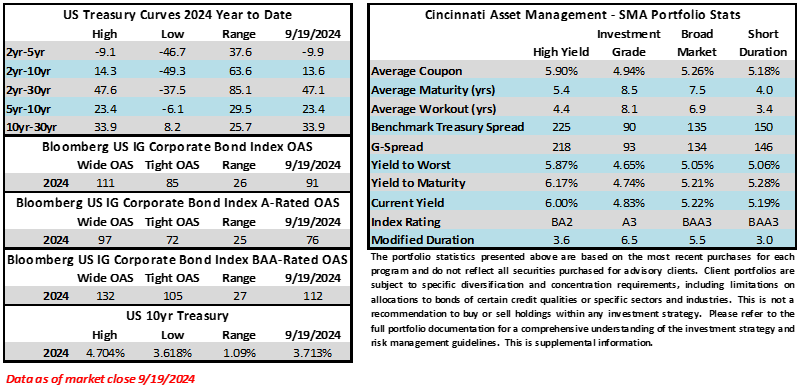

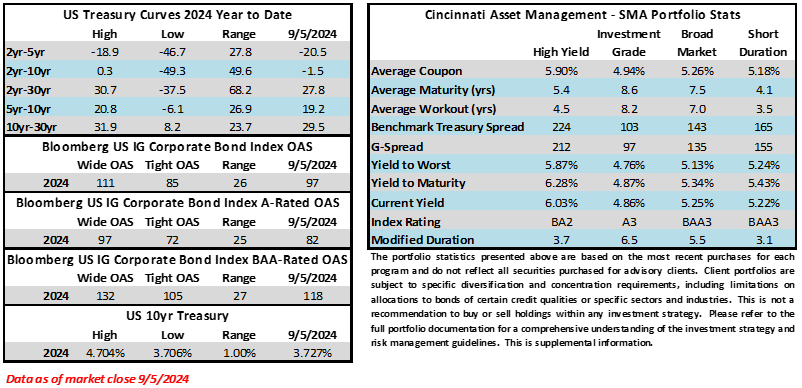

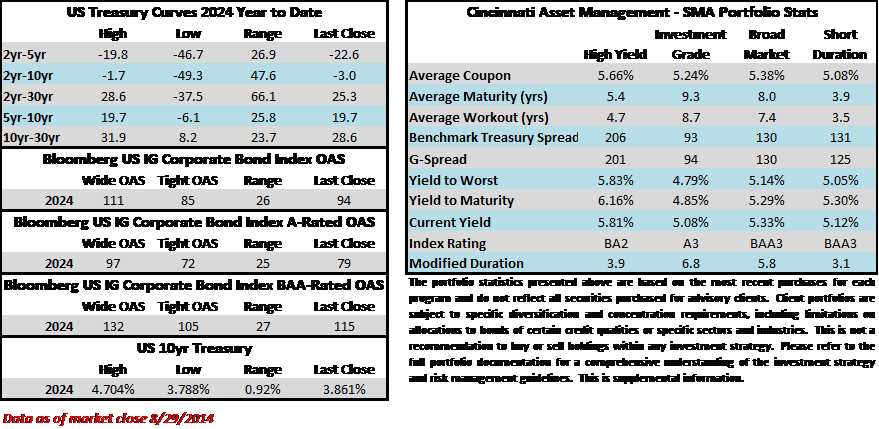

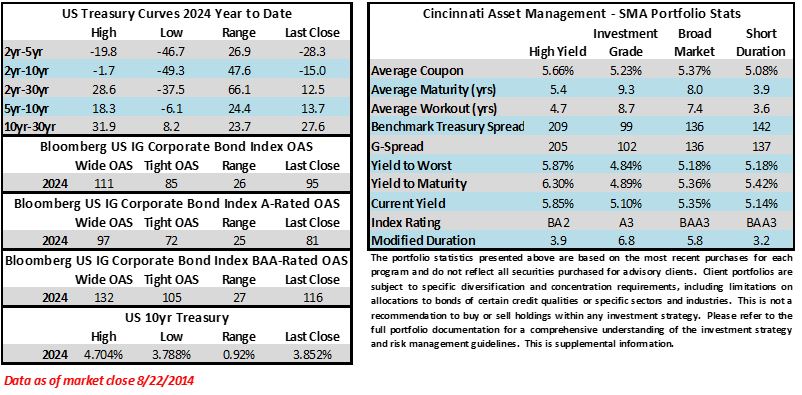

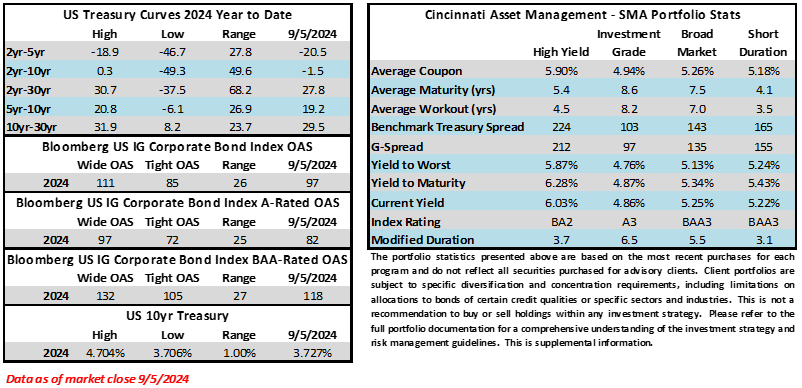

Credit spreads did not change much this week though the index may finish the period a basis point tighter if the current trend holds through the end of the day on Friday. The Bloomberg US Corporate Bond Index closed at 92 on Thursday September 5 after closing the week prior at 93. The 10yr Treasury yield traded lower throughout the week, down 17 basis points from last week through Thursday’s close. The 2/10 Treasury curve closed with a positive slope on Wednesday evening for the first time since July 1 2022, snapping the longest streak on record for a 2/10s curve inversion. Through Thursday, the corporate bond index year-to-date total return was +4.71%.

Economics

The biggest data release during this holiday shortened week was Friday’s job report which came up slightly short of expectations keeping the FOMC on schedule to deliver the first policy rate cut on September 18. There are some meaningful prints next week with CPI, PPI and consumer sentiment data, but today’s employment report was the last large hurdle to clear to ensure a rate cut, in our view. Now it just comes down to a matter of whether the Fed will deliver 25 or 50 basis points with its first ease of the cycle. As we go to print Friday morning traders are split on the magnitude of a cut with Fed Funds Futures pricing a 100% chance of at least a 25bp cut and a 40% chance of a 50bp cut.

Issuance

Issuance was the big story of the week as US investment grade bond sales topped $80bln capping the fifth busiest week on record according to Bloomberg. The wild week that was featured a record breaking 29 borrowers tapping the market on Tuesday for a total of $43.3bln. Volume-wise Monday was the third busiest day on record. With $80bln of issuance in the first four trading days of the month it seems that we are well on our way to hitting the $125bln September estimate that dealers were looking for at the end of August. Next week syndicate desks are projecting $30-$35bln of issuance though we would not be surprised if one or two larger deals could push that total higher. Year-to-date issuance now stands $1.174 trillion which is +29% ahead of last year at this point in time, and 2023 was not a light year by any means.

Some readers may be wondering why issuance has been so robust this year even as we are on the precipice of a Fed easing cycle. There are a few reasons why the environment for IG issuance has been so strong. First, fund flows into the IG asset class have been solid thus far in 2024 which means a variety of investors have money to put to work. However, a large portion of IG investors (~70%) are institutional in nature and are not necessarily reliant on these flows. These are life insurance companies, property casualty insurance companies, pensions, banks and foreign institutional investors. These investors often have long term liabilities that they need to match against an income stream (asset liability matching) and high-quality investment grade bonds are a very good vehicle to help them accomplish these goals. There are also scores of investors in the IG market with long time horizons such as pensions and endowments. These investors always have funds to invest and this has been magnified by rebalancing. Due to the strong performance of equities the past few years these accounts have been allocating even more funds to IG credit as some of those equity gains find their way into corporate bonds. With real and nominal yields at elevated levels relative to the recent past institutional investors of all types have been very active buyers of IG credit and this is a trend that has been in place for the past 18 months. In recent months we have started to see increased interest from retail investors in the form of SMA/mutual fund/etf which is more reflected in fund flows and creates some additional demand for IG issuance. We believe this interest will only continue to increase as the Fed cuts its policy rate which will in turn lower the interest rate for money market accounts, high yield savings and other cash alternatives.

From the perspective of companies, a popular misconception is that they should wait for the Fed to cut before they borrow. This may be true at the very front end of the Treasury curve but when the Fed cuts its policy rate it typically has little effect on the 10yr or 30yr Treasury. The trading levels of these longer maturities are more reflective of investor expectations for inflation and economic growth. Many companies, especially large investment grade rated companies, are doing quite well operationally. Margins are at or near their peak for some companies and many companies are still increasing profit margins. Companies are no longer getting the free lunch they were getting back when they were borrowing in the low-rate era but their business models can easily support long term funding in the 4-6% range so they are not letting that level of interest expense interfere with their long-term plans for growth, expansion or M&A. This has made for an environment where investors are happy to lend at what they view as attractive interest rates and borrowers are happy to lock in funding at levels where the math still works for their business plans. The current environment for investment grade is about as close as you can get to a win-win for both investors and borrowers.

Flows

According to LSEG Lipper, for the week ended September 4, investment-grade bond funds reported a net inflow of +$3.3bln. Short and intermediate investment-grade bond funds have seen positive flows 30 of the past 36 weeks. The total year-to-date flows into investment grade funds are +$50.1bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.