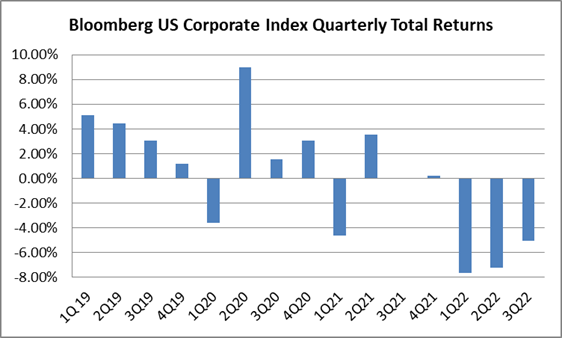

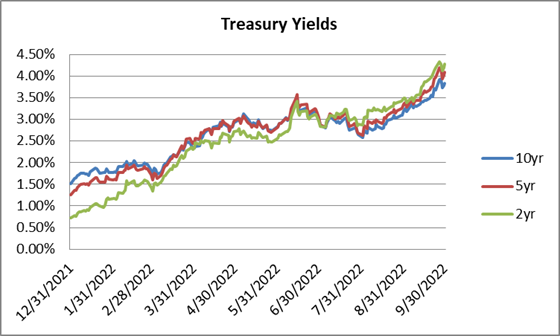

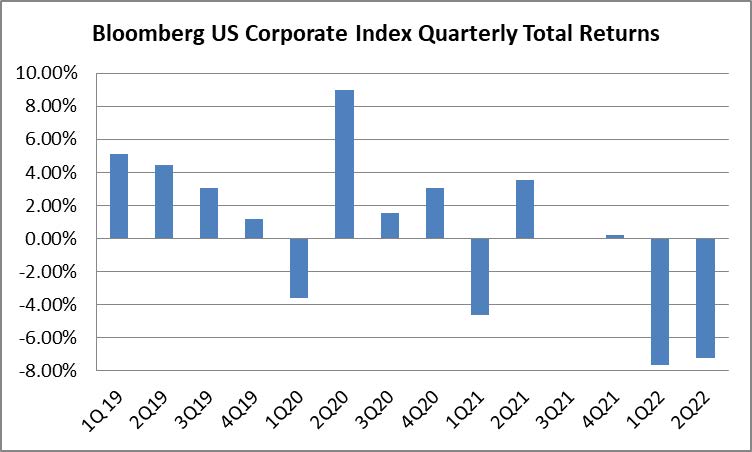

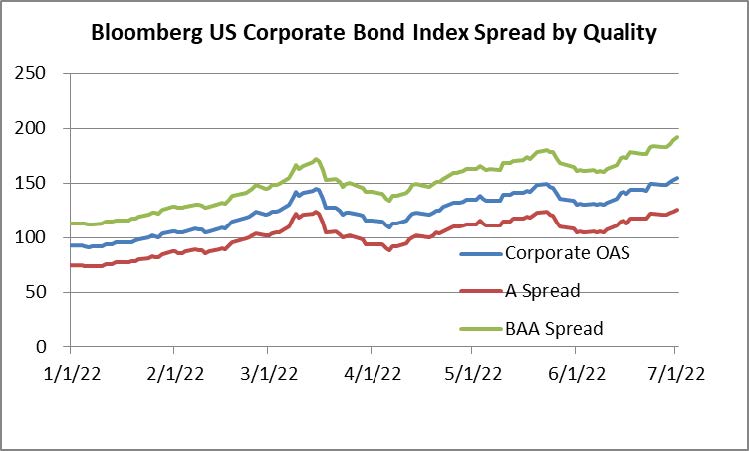

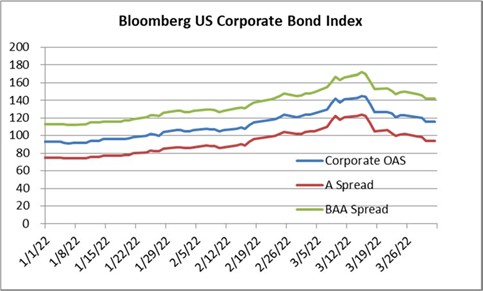

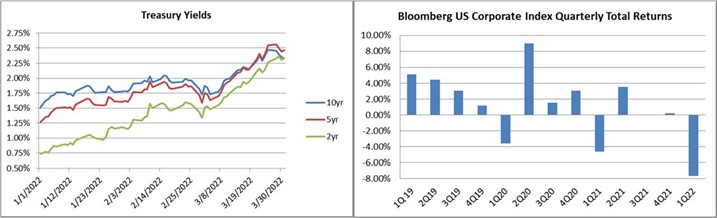

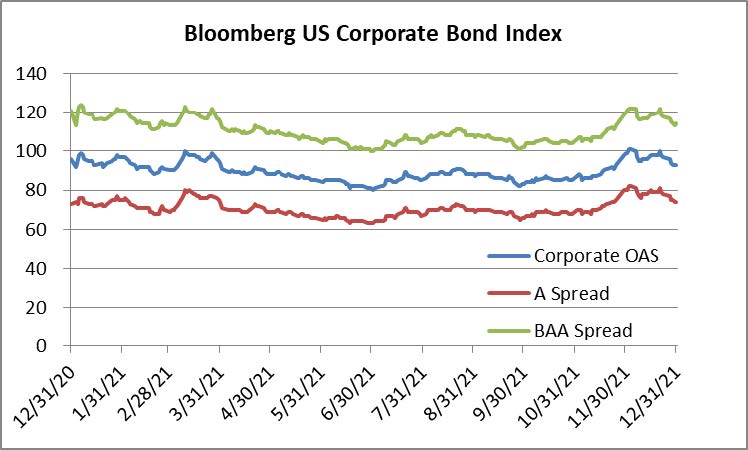

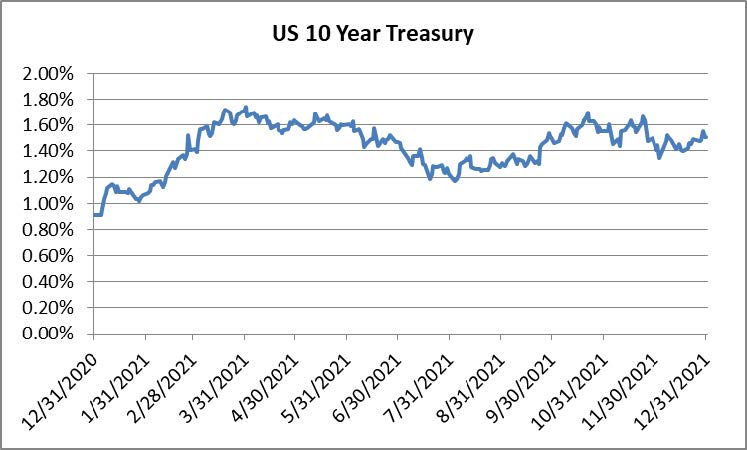

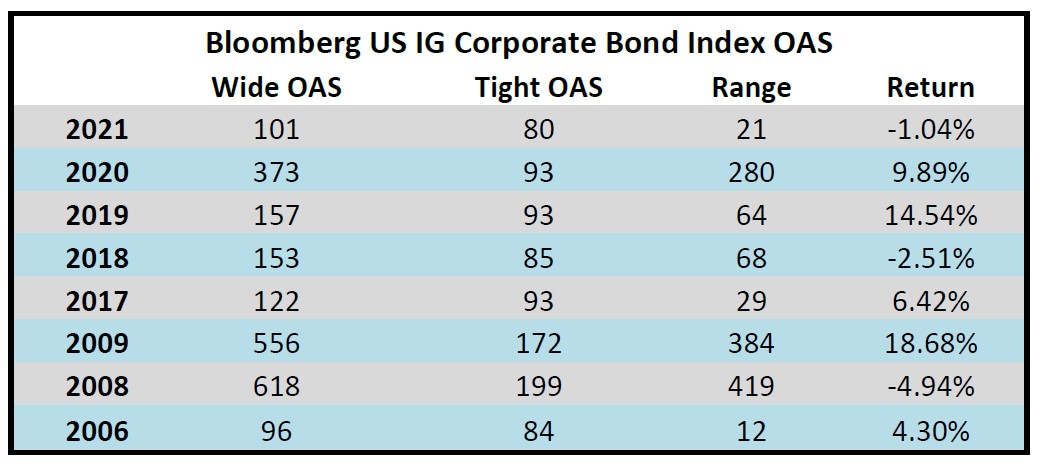

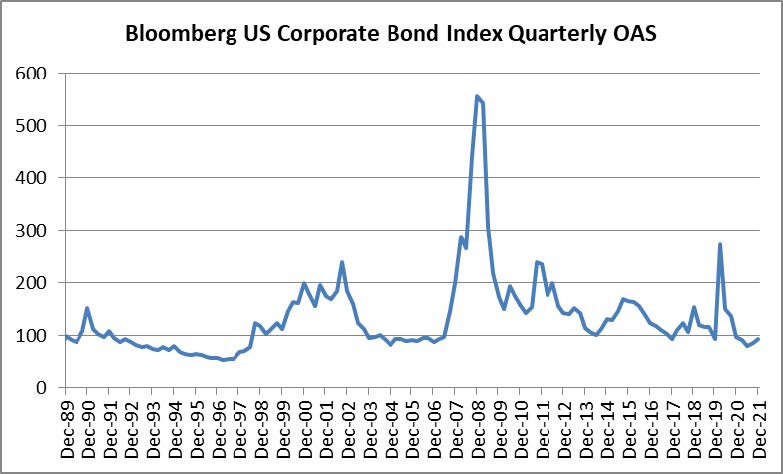

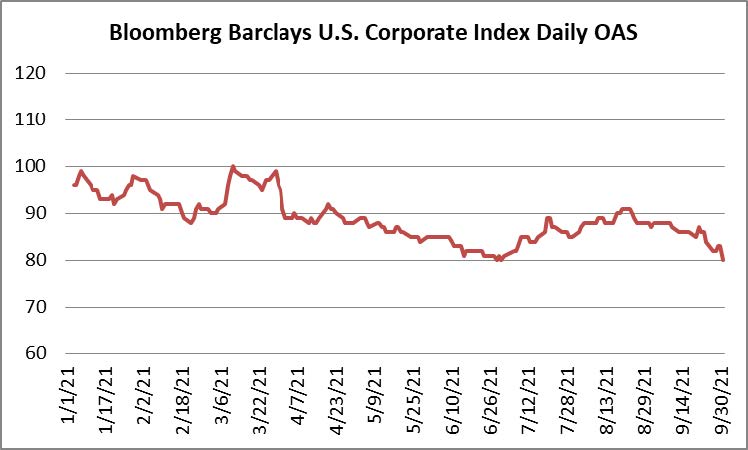

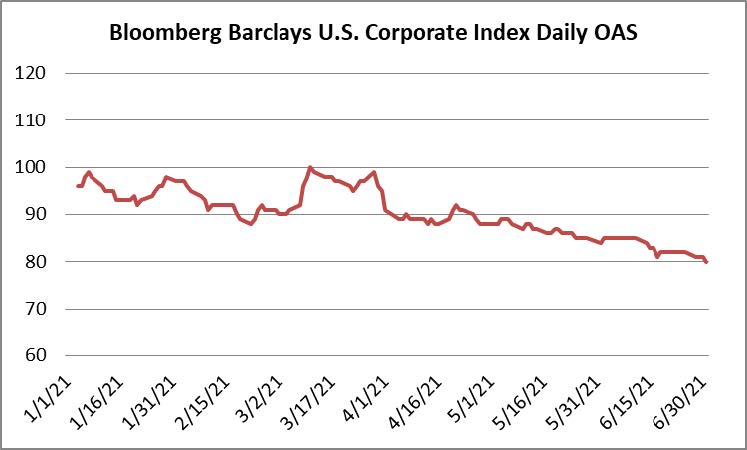

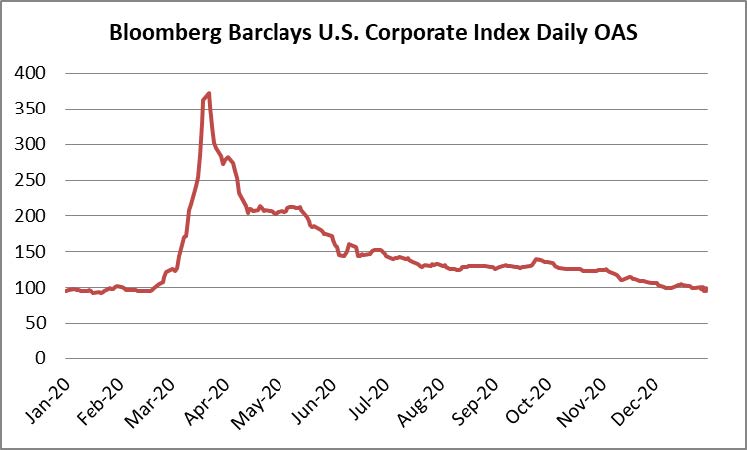

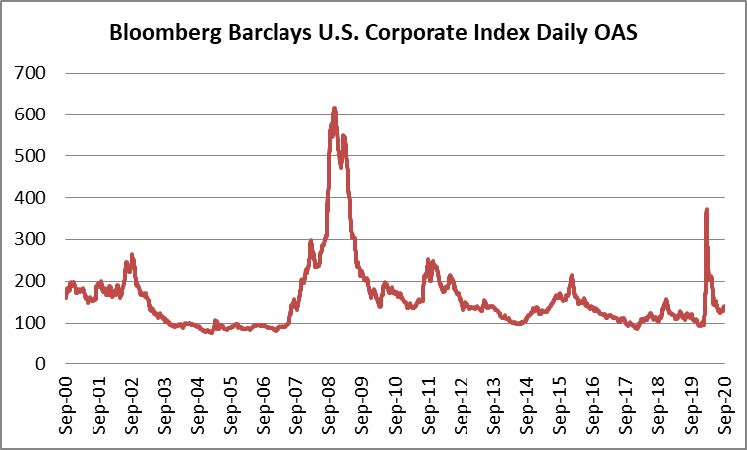

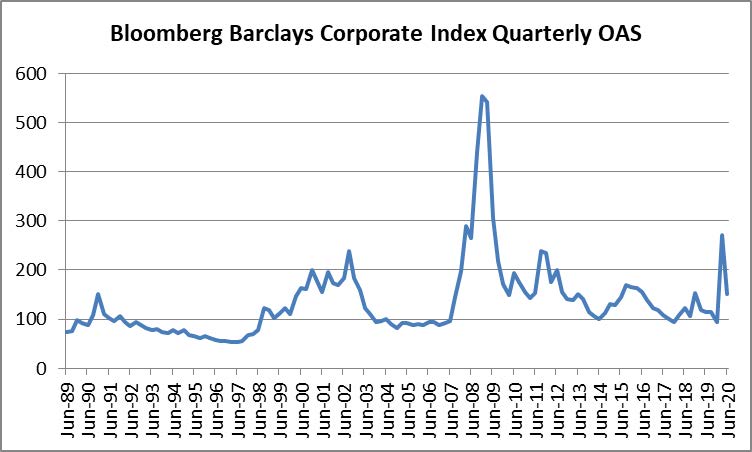

Negative performance continued to plague the investment grade credit market during the third quarter and 2022 built on its record as the most difficult year of performance that the market has ever experienced. It was a hopeful start to the quarter, as investment grade bonds posted sharply positive returns for the month of July, but August and September were ugly, as Treasury yields climbed higher, creating a major headwind for performance. Credit spreads finished the quarter modestly wider but behaved reasonably well for most of the period and the spread performance of IG‐credit was relatively strong compared to other risk assets, but the magnitude of the sell‐off in Treasuries during the quarter and during the first 9 months of 2022 has led to historically poor performance across fixed income. The option adjusted spread (OAS) on the Bloomberg US Corporate Bond Index widened by 4 basis points during the quarter to 159 after having opened the quarter at an OAS of 155. The 10yr Treasury opened the quarter at 3.01% and finished 82 basis points higher, at 3.83%. The 5yr Treasury opened the quarter at 3.04% and finished 105 basis points higher, at 4.09%. The 2yr Treasury opened the quarter at 2.95% and finished 133 basis points higher, at 4.28%. The very front end of the yield curve has experienced the most dramatic movement year‐to‐date and the 2yr has now climbed 355 basis points during 2022 through the end of the third quarter.

The Corporate Index posted a third quarter total return of –5.06%. CAM’s Investment Grade portfolio net of fees total return for the third quarter was –4.12%.

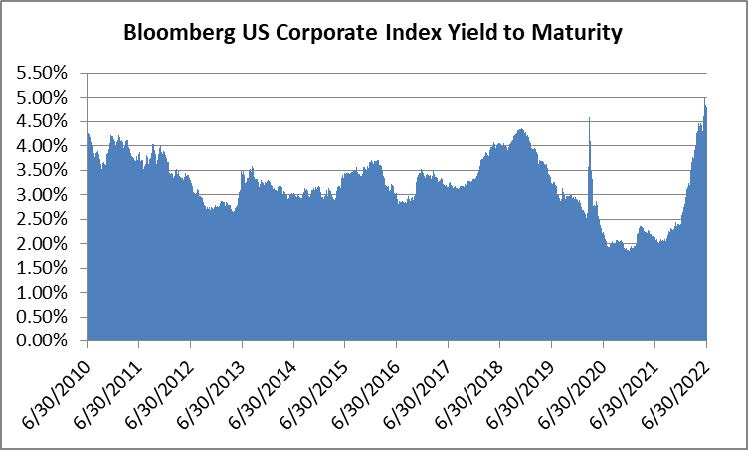

The drawdown in credit has continued. We cannot predict when the tide will turn but we are confident that it will do so eventually, and it is only a matter of time. An increasing amount of hawkishness has been priced into the Treasury markets as the year has worn on. Eventually, the economic data on inflation will break, whether it is this year, in 2023, or even beyond that. The valuations and compensation afforded from high quality investment grade credit are as high as they have been in a very long time. The process of getting to these yields has been painful to endure but the market is now trading at levels that set up well for investors with longer time horizons. The market could cheapen further but higher Treasury rates and wider credit spreads have given investors a larger margin of safety and increased the likelihood of positive returns in the future.

Cash Alternatives Are Back, Finally

We are a bond manager and are not in the business of giving investment advice, but this is a topic that has started to come up frequently in our conversations so we thought it would be helpful to discuss. The rise in short term Treasury rates has given investors the option to generate higher levels of income without taking much duration risk for the first time in a long time. For example, the 2-year Treasury has not offered yields this high since 2007. This is a great cash alternative for many investors in our opinion. Some may prefer to park their short term funds while for others it may make sense to allocate a larger portion of their portfolio.

We have received questions asking why we have not changed our intermediate investment grade strategy, putting all of our investments into short duration assets or even short term Treasuries. What investors need to understand is that a portfolio that is entirely reliant on short duration securities introduces a risk for those that have medium or longer term time horizons: reinvestment risk. When the time comes to sell or, for example, when the 2-year Treasury matures, the landscape could look totally different. Credit spreads could have raced tighter or intermediate Treasury yields could have decreased – or both of these things could have occurred, meaning the investor missed out on larger returns and now they find themselves in a position where they need to redeploy capital into a market with richer valuations. So we would caution investors from making wholesale tactical changes to their fixed income portfolios. A Strategic approach may yield better results, because like all risk assets, fixed income benefits an overall portfolio by being diverse in its exposure. Having different maturities, credit exposures and asset classes within fixed income is in our opinion the best way to build a portfolio with a longer term view. We do offer a variety of short duration strategies at CAM, but for most investors with longer time horizons a combination of short and intermediate duration strategies will typically be the best fit.

What Now for Low Dollar Bonds?

We have officially exited the longstanding regime of ultralow interest rates. As rates have rapidly increased, some of our holdings have incurred significant price declines. This is particularly the case with bonds that we purchased in 2020-2021 that were newly issued at the time. This was a time period when interest rates were much lower and credit spreads were tighter than they are today. As a result, many of these bonds have coupons that are lower than Treasuries are today, thus they have seen significant price declines, with dollar prices in the high 70s or low 80s (price declines of more than 15-20% since issuance). In almost all of these cases, our ongoing analysis has shown that the company that issued the bonds is operating well from the standpoint of creditworthiness. In other words, the price declines have not stemmed from concerns over credit risk but rather the declines have been all about duration and higher interest rates. We have received questions from investors about our expectation for price recoveries in these bonds.

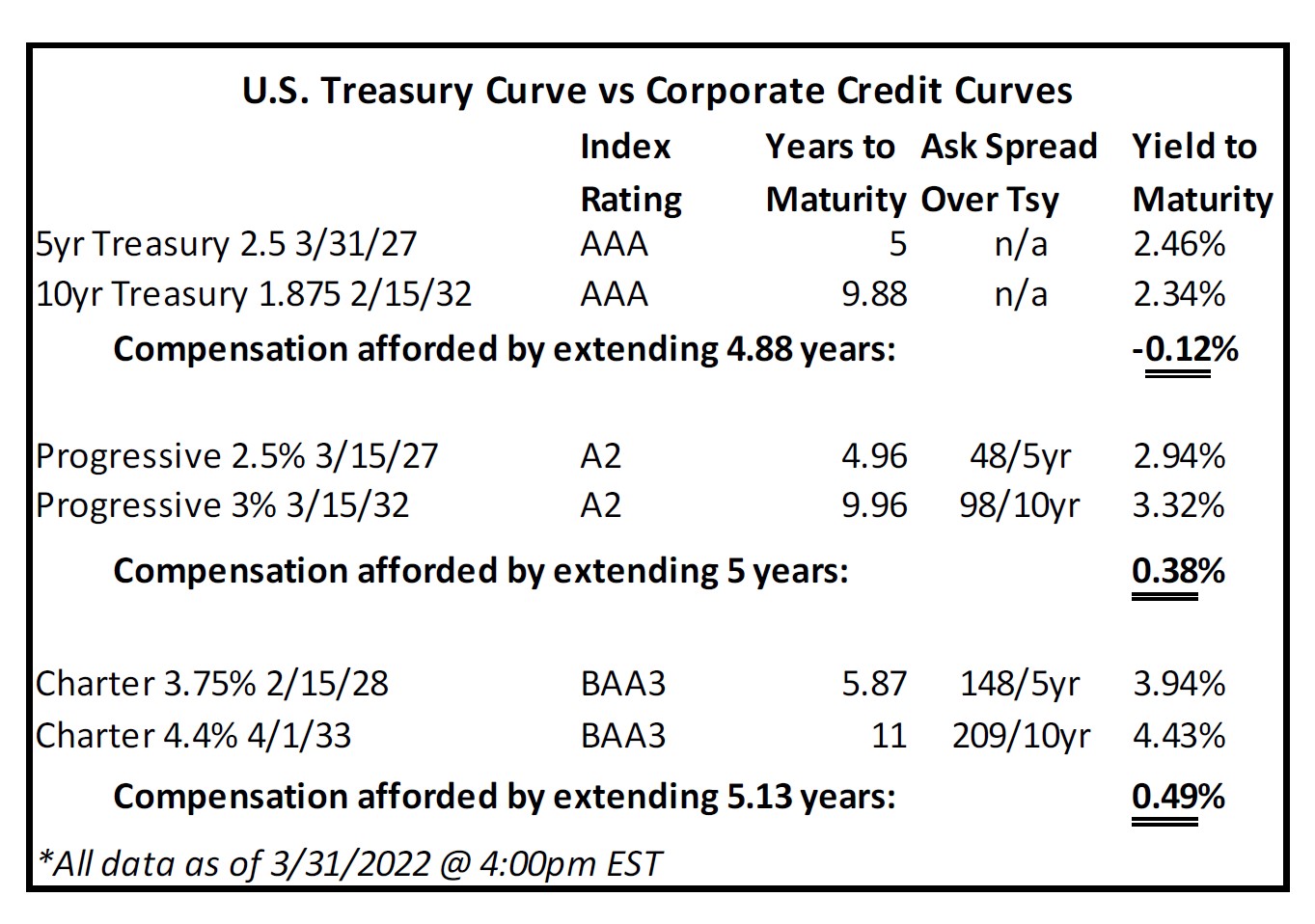

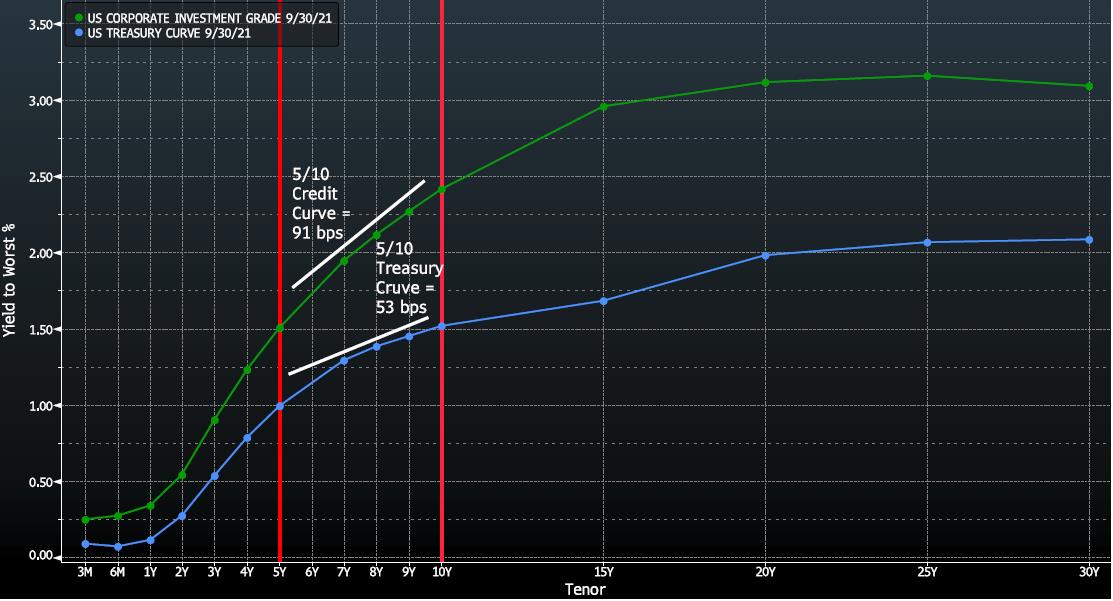

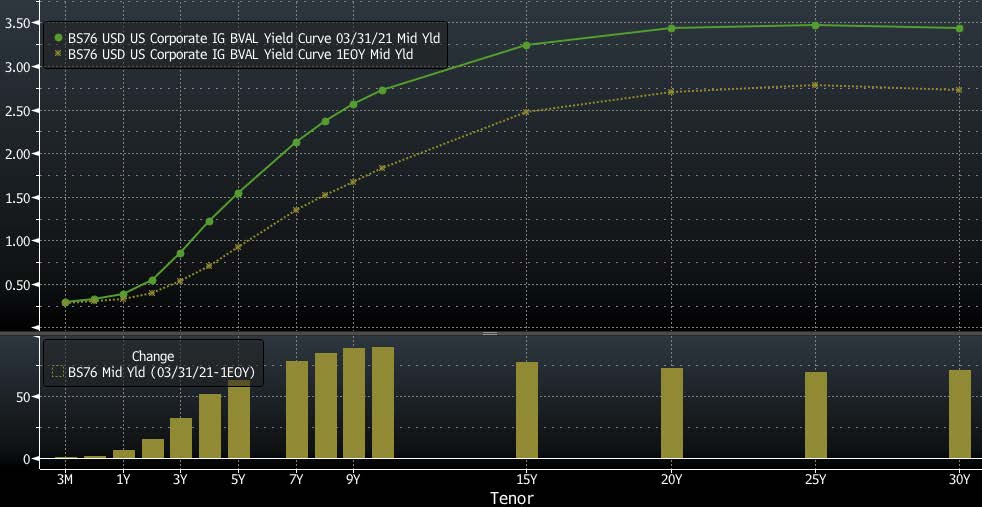

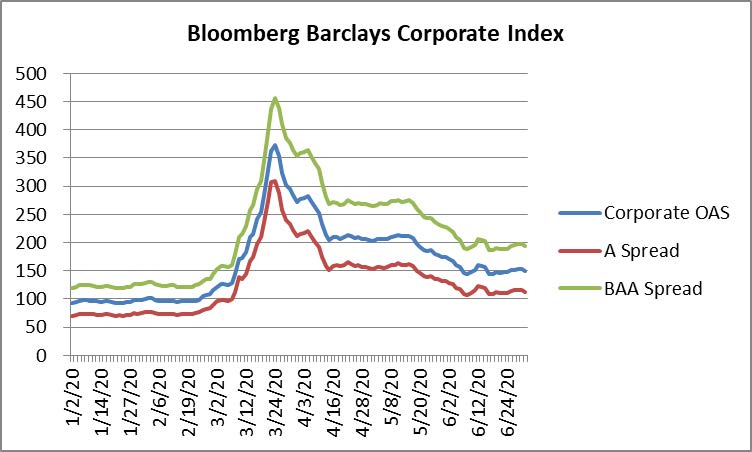

Ultimately, the prices of these bonds stand to benefit the most from the passage of time and a reversal of the currently inverted yield curve. There are two curves that we deal with as a bond manager: the corporate credit curve and the Treasury curve. The corporate credit curve represents the extra spread that an investor receives for purchasing a corporate bond instead of a Treasury –it is the spread on top of the underlying Treasury. The corporate credit curve remains steep at the moment, as it almost always is. For A-rated credit at the end of the third quarter it was not uncommon for us to observe a 5/10 curve of 50 basis points for many A-rated credits. That is, you could sell a 5yr bond of a company at a spread of 50 basis points over the 5yr Treasury and then use those proceeds to buy the 10 year bond of the same company at a spread of 100 basis points over the 10yr Treasury. The corporate credit curve is even steeper for BAA-rated credits because riskier credits require steeper curves as investors demand more compensation to own the bonds of a lower quality credit. The problem with doing an extension trade at the moment is that at the end of the quarter the 5/10 Treasury curve was inverted to the tune of -26 basis points, which takes a big bite out of the compensation afforded by an extension trade because we are selling off of a higher 5-year Treasury (4.09%) and purchasing a bond that trades off a lower 10-year Treasury (3.83%). We would still be increasing yield by doing this trade, because of the steepness of the corporate credit curve, it is just much less of a yield increase than we would get in a typical environment where we have an upward sloping Treasury curve and an upward sloping credit curve. Thus, in order for these deeply discounted bonds to recover value it requires Treasury yield curve normalization. Historically, yield curve inversions have been brief in nature. The longest period of inversion was 21 months, beginning August 1978 until April 1980 . We don’t know when the yield curve will normalize but we expect that it will over time.

The best prospect for value recovery in a deeply discounted bond that still has good credit metrics is to trust the bond math and to embrace the passage of time as our friend. With each passing day, a bond gets shorter and closer to its maturity and the credit spread gets tighter, all else being equal. The passage of time will also allow the Treasury curve to normalize and give investors a chance to recover principal and to execute more favorable extension trades where both the value of selling and buying are maximized. Finally, as the bond is held, the investor receives coupon payments which serve to help offset the decline in price.

How Are We Responding?

We will always stay true to our mandate as a manager of intermediate maturities, but we will also adapt to market conditions and we have responded to 2022’s market volatility in a number of ways. The single biggest dislocation we have observed in our portion of the market is that bonds that mature in 7.5-8.5 years have consistently offered exceptional value relative to other portions of the yield curve. We are still buying 9-10 year maturities when it makes sense to do so but we have been able to consistently find value in shorter maturities which has allowed us to take less duration risk while increasing yield. For example, it has become commonplace for the ~8yr bond of a company to trade at a wider spread than the ~10yr bond of the same company, which is something that should not happen with a high degree of frequency. This type of dislocation is something that has always occasionally occurred in the market but it is typically idiosyncratic in nature and quickly arbitraged away by market participants. What we are observing in 2022 is that this has become widespread which has presented an opportunity for an investor like us because when we buy an 8-year maturity we have a 3 to 4 year time horizon before we are looking to sell. 10-year bonds are trading rich to 8-year bonds usually because of some type of market technical. We believe that it is most likely occurring because the 10-year bond is being bid-up by short term investors that are primarily concerned with short term liquidity. These investors believe that the 10-year bond is more liquid and could be easier to sell a week or a month from now if needed. We are longer term investors and we are not concerned about liquidity a week or a month from now, we care more about liquidity 3 or 4 years from now. When our 8-year bond rolls down the yield curve and becomes a 5-year bond we are highly confident that we will have plenty of liquidity when the time comes to sell our bonds. Thus we will happily take advantage of this dislocation for our client accounts.

Not only have we been able to buy shorter maturities, but we have also become more patient when evaluating the sale of existing holdings. Much of this patience is borne out of necessity as a result of the currently inverted yield curve but some of it is also related to fund flows and technical factors at play in the market. Traditionally, we would look to exit most securities right around the time that they have 5 years left to maturity. For extremely high quality A-rated paper you could see us sell with 5.5 years left to maturity while some lower quality BAA-rated paper may need to roll down to 4-4.5 years in order to maximize value. What we are seeing in the current environment is that there is simply too much “juice” left in many of our 5 year holdings so we are continuing to hold them beyond the typical 5-year time period. We are willing to wait; allowing that bond to roll down to 3 or 4 years to maturity–it is entirely about being opportunistic and maximizing value for our investors. As the Treasury yield curve normalizes, we would expect that the market will revert to an environment where it makes more sense to sell nearer the 5-year mark.

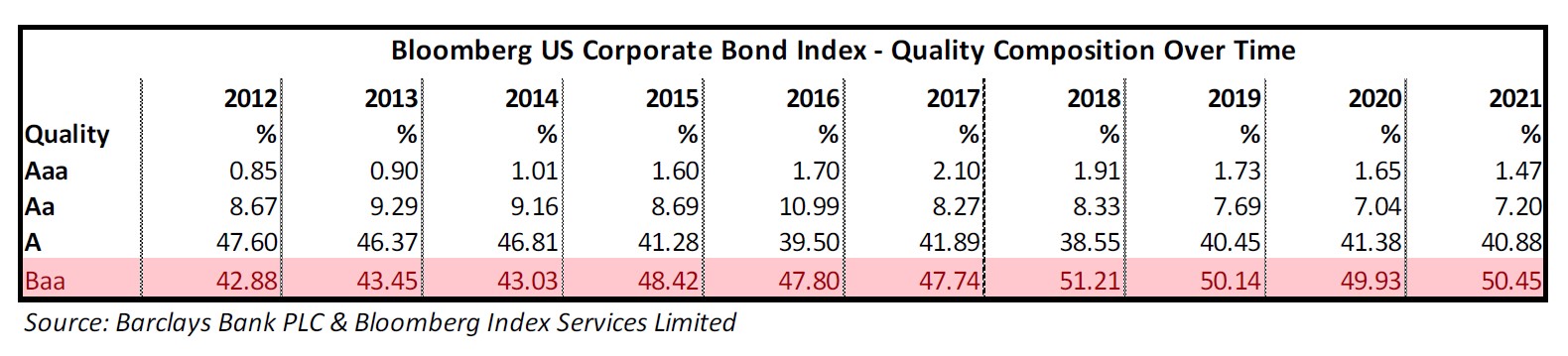

We have also been able to take even less credit risk than we typically would. To be clear, we already position our investment grade strategy as “up-in-quality” relative to its benchmark and that high quality bias comes from the fact that we cap our BAA-rated exposure at 30% while the Corporate Index was 48.93% BAA-rated at the end of the 3rd quarter. Even though we have a meaningful underweight in BAA-rated credit, we maintain a focus of adding value for our investors through credit research and identification of those BAA-rated credits that are mispriced or that are poised to improve their credit metrics. Traditionally, we have not necessarily shied away from risk taking in lower quality credit so long as it was for the right reasons and that the compensation was appropriate for the risk incurred. We always intend to stick to our cap of a 30% weighting for this portion of the market but we have always been willing to take credit risk based on thorough research. What we are finding in the current environment, however, is that we simply do not need to take much risk in order to find compelling value. There are plenty of very solid BAA-rated credits that offer spreads that are quite attractive in our view. We are positioning the portfolio for a recessionary period and shying away from those credits that are most exposed and we are in a position where we are able to dial-back risk without giving up yield.

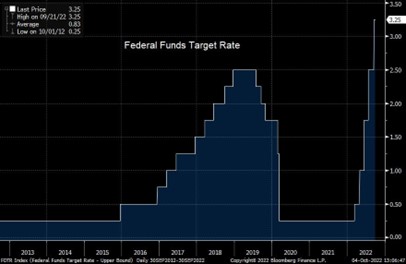

Fed Fait Accompli

The Federal Reserve has been active in 2022, to say the least. Six rate hikes in six months is unprecedented, and the market has never experienced so many hikes in such a short period of time. The Fed has been clear in its communication in recent weeks. It is fully committed and will not stop until inflation shows signs of slowing. Our only prediction about where the Fed goes from here is that we continue to expect tightening through further increases in Fed Funds until the data on inflation and labor shows signs of cooling. This data is entirely backward looking in nature. This could be problematic for the economy because rate hikes take time to work their way through the economy. With the Fed focused on backward looking data, it introduces a risk that financial conditions will tighten too much and the potential for overtightening diminishes the probability of a soft landing. At the very least, it appears likely that the economy will slow throughout 2023. Growth may even turn negative, thrusting the economy into recession. If there is any good news that investors can take from the Fed’s quick action to this point is that we are likely closer to the end of tightening conditions than we were just a short six months ago.

Slipping Into Darkness

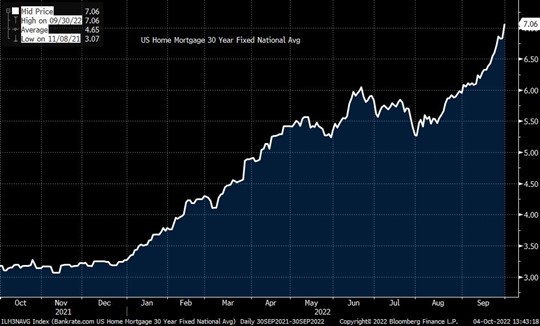

The economy is still reasonably strong by many measures but cracks are starting to form in the foundation, and housing could be leading the way. Housing is an important sector for the economy and it makes up 15-18% of GDP on average. Recently released data showed that during July housing prices experienced their first monthly decline since January 2019. It should come as no surprise that housing has shown signs of slowing as mortgage rates have climbed throughout 2022 and this his had a severe impact on home affordability. According to the US NAR Homebuyer Affordabilty Index, the monthly payment on a median priced single family home ($410,600) went from $1,011 in January of 2021 to $1,933 at the end of June 2022. Mortage rates were up another 1% from June through September so this payment will be even higher when the August and September data is released, with the montly payment on a median home having more than doubled in less than two years. Builders have started to report increasing cancellations and inventory has risen . It is only a matter of time until this data starts to filter through to lower home prices and ultimately to lower GDP.

We have also begun to see earnings revisions in other cyclically sensitive portions of the economy with companies in the chemical and semiconductor industries pointing to slowing demand, especially out of Europe. Retailers like Nike have reported bloated inventories and aggressive promotions. Large stalwart companies like Walmart and Amazon are slowing or altogether pausing hiring. It is too early to tell for sure but the negative data points are piling up, and we do not view these as the signs of a soft landing. We do not necessarily believe a severe recession is the base case but it is becoming more likely that the economy will slip into a recession at some point in 2023 or 2024.

What’s Ahead for Credit?

The good news is that the vast majority of the investment grade universe has balance sheets that will hold up reasonably well in a scenario where the economy experiences a modest recession. Investment grade companies were busy in 2020 and 2021, issuing debt at record low interest rates, decreasing their interest expense burdens and pushing out maturity walls. Most companies do not need to issue new debt to fund capital budgeting projects or to refinance existing debt balances. Cash balances have declined from their 2021 peak but remain elevated by historical standards. Interest coverage ratios are near a 13-year high. We are seeing some deterioration: revenue and earnings are slowing and for some companies profit margins are deteriorating, but these are coming off of very high levels. Many investment grade companies have multiple levers to pull in the face of a slowing economy and they have shown a willingness to make conservative choices with regard to capital budgeting and share buybacks. Credit fundamentals remain strong and point to our aforementioned narrative that the selloff in credit during 2022 has been much more about interest rates than it has been about creditworthiness.

As far as spreads are concerned, the OAS on the index recently hit a year-to-date wide of 164 on September 29. If there is a modest recession then spreads could trade out to 200 and they could temporarily trade even wider in a severe recession or in the event that we get an exogenous shock to the markets but investors are being reasonably well compensated from a yield perspective. The yield on the Corporate Bond Index finished the quarter at 5.69%, which provides some cushion against the potential for wider spreads.

Keep on Trucking

The volatility in the market has presented a real opportunity for investors. Yields have risen and investors do not need to be nearly as creative in their quest to generate income. Investment grade credit is a straightforward, easily understood, asset class. Due diligence and credit research are required to identify the companies that have the best creditworthiness and from there a manager can determine opportunities in the market based on their own measure of risk and reward. We are no longer in an environment of ultralow interest rates and tight credit spreads where investors may feel compelled to consider increasingly complex asset classes or products in order to generate income. Investment grade companies, by and large, will not have difficulty navigating a recessionary environment. Spreads could go wider and Treasury yields could even retest the high end of their range but the market has cheapened so much in such a short period of time that it is hard to ignore the level of compensation that is offered by the asset class. We think that investors that stay the course will be rewarded over a longer time horizon.

We thank you for your business and your continued interest. We look forward to hearing from you to discuss the credit markets and to help with any questions you may have.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results. Gross of advisory fee performance does not reflect the deduction of investment advisory fees. Our advisory fees are disclosed in Form ADV Part 2A. Accounts managed through brokerage firm programs usually will include additional fees. Returns are calculated monthly in U.S. dollars and include reinvestment of dividends and interest. The index is unmanaged and does not take into account fees, expenses, and transaction costs. It is shown for comparative purposes and is based on information generally available to the public from sources believed to be reliable. No representation is made to its accuracy or completeness.

The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed do not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of an account’s portfolio holdings. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable, or that the investment decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

i St. Louis Fed, 2022, “10‐Year Treasury Constant Maturity Minus 2‐Year Treasury Constant Maturity”

ii National Association of Homebuilders, 2022, “Housing’s Contribution to Gross Domestic Product” https://www.nahb.org/newsand‐

economics/housing‐economics/housings‐economic‐impact/housings‐contribution‐to‐gross‐domestic‐product

iii The Wall Street Journal, September 27 2022, “Home Pries Suffer First Monthly Decline in Years”

iv Bloomberg, August 9 2022, “Builders Are Stuck With Too Many Houses as US Buyers Pull Back”

v The Wall Street Journal, September 29 2022, “Micron Issues Another Muted Outlook After Missing Expected Sales Results”

vi Barron’s, September 16 2022, “Huntsman Falls Sharply After Cutting Profit Forecast”

vii Charged Retail Tech News, October 4 2022, “Nike is Aggressively Offloading Inventory Before the Holiday Season”

viii The Wall Street Journal, September 22 2022, “Walmart to Slow Holiday Hiring”

ix The New York Times, October 4 2022, “Amazon Freezes Corporate Hiring in Its Retail Business”

x J.P. Morgan North America Corporate Research , September 8, 2022, “HG Credit Fundamentals: 2Q 2022 Review”