Author: CAM Bond Funds

High Yield Weekly Insight 12/15/2017

Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were -$1.4 billion and year to date flows stand at -$18.5 billion. New issuance for the week was $6.0 billion and year to date HY is at $273 billion, which is up 23% over the same period last year.

(Bloomberg) Corporate Credit Impacts of Proposed Tax Legistlation

- As Republicans target the passage of tax policy by year-end, high yield issuers may be net losers, while the benefits of accelerated depreciation are irregularly distributed. The potential for a cap on the deductibility of net interest expense will be felt more broadly.

- Capital-intensive industries, including materials and energy, and the highly levered communications sector potentially have the most to lose from tax-reform proposals limiting interest deductibility. Strong cash flow and lower average debt loads vs. revenues leave technology and consumer staples with limited exposure. Carry-forward provisions would benefit more cyclical sectors, allowing companies to apply interest expense not deducted in a low-earnings year to earnings over some future period.

- Issuers such as Sprint and Charter among communications issuers, and Halliburton and Chesapeake within energy, are among those that would lose some interest deductibility under the Senate proposal.

- The percentage of issuers with interest expenses exceeding 30% of operating income, however defined, climbs steadily as ratings fall. While a negligible number of issuers rated between AA and BBB would be unable to deduct the full amount of interest expenses, assuming the use of Ebitda, almost all triple-C issuers would be affected.

- Methodology differences between the House and Senate bills regarding interest deductibility could have wide-ranging effects for issuers. Both Congressional bodies entertain adjusted results, though the House plan to use a measure closer to Ebitda would mean about 25% of all companies would see some effect vs. about 40% under the Senate plan.

(New York Times) Fed Raises Interest Rates as Focus Turns to 2018

- The Federal Reserve, in a widely expected decision, raised its benchmark rate by a quarter of a percentage point, to a range of 1.25 percent to 1.5 percent.

- The Fed also predicted stronger economic growth over the next three years. It forecast 2.5 percent growth in 2018, well above its previous forecast of 2.1 percent growth in 2018, published in September. Janet L. Yellen, the Fed chairwoman, said the faster growth forecasts reflected an assessment of the $1.5 trillion tax cut moving through Congress.

- Officials did not deviate from their 2018 outlook for interest rates or inflation and continued to signal three interest rate increases next year.

(Business Wire) T-Mobile announces the acquisition of TV tech pioneer, Layer3 TV, Inc.

- T-Mobile US, Inc. president and CEO John Legere unveiled the next phase in the Un-carrier’s mobile video strategy, announcing plans to launch a disruptive new TV service in 2018. To fuel that, Legere also announced the Un-carrier has signed a definitive agreement to acquire TV technology innovator Layer3 TV, Inc. and will work with Layer3 TV’s leading technology and talent to create T-Mobile’s new TV service.

- “People love their TV, but they hate their TV providers. And worse, they have no real choice but to simply take it – the crappy customer service, clunky technology and outrageous bills loaded with fees! That’s where we come in. We’re gonna fix the pain points and bring real choice to consumers across the country,” said John Legere, president and CEO of T-Mobile. “It only makes sense for the Un-carrier to do to TV what we’re doing to wireless: change it for good! Personally, I can’t wait to start fighting for consumers here!”

- The Un-carrier will build TV for people who love TV but are tired of the multi-year service contracts, confusing sky-high bills, exploding bundles, clunky technologies, outdated UIs, closed systems and lousy customer service of today’s traditional TV providers. And people are tired of all the bull that comes bundled with Big Cable and Satellite TV – America’s #1 most-hated industry. In fact, 8 of the 10 brands with the lowest customer satisfaction scores in America are cable and TV providers1.

- “We’re in the midst of the Golden Age of TV, and yet people have never been more frustrated by the status quo created by Big Cable and Satellite TV,” said Mike Sievert, Chief Operating Officer of T-Mobile. “That’s because the world is changing – with mobile video, streaming services, cord cutting, original content and more — and yet, the old guard simply can’t – or won’t – evolve. It’s time for a disruptor to shake things up and give people real choice like only the Un-carrier can.”

(Bloomberg) Freeport Returns to Copper Focus, Grasberg Next Hitch

- Resolving its Contract of Work dispute covering its Grasberg mine with the Indonesian government is the key to current operations and Freeport-McMoRan’s future prospects. Grasberg accounted for a third of Ebitda in 2016 and Grasberg Block Cave will be the world’s largest underground mine when developed. Freeport, rated B1/BB-, is on positive outlook from Moody’s, with its bonds trading in-line with Ba2 metals and mining peers.

- Fighting off low commodity prices, Freeport-McMoRan has restructured to return its focus to its leading copper business. Freeport reached its $10 billion net-debt target in 3Q through execution of its operating plans, aided by recovering copper prices. A contract dispute and production shortfalls at its Indonesian Grasberg mine have hampered Freeport’s progress and may affect long-term prospects. Once Grasberg is resolved, the company will evaluate capital allocation among growth projects and dividends.

- Freeport-McMoRan reported 3Q adjusted Ebitda of $1.6 billion as the price of copper increased by 35% vs. 3Q16. This was the company’s best quarter since 4Q14 and put Freeport on pace for its best year since 2014.

- Freeport-McMoRan’s 3Q cash from operations exceeded capital spending and shareholder rewards for the sixth straight quarter as outlays have been significantly reduced. Freeport devoted $314 million to capital expenditures in 3Q and plans to spend $1.5 billion in 2017, down vs. $1.8 billion at the start of the year. This would be the lowest on an annual basis since 2010. Assuming normal operations at Grasberg, Freeport expects 2017 cash from operations of $4.3 billion, based on a copper price of $3 a pound for 4Q.

CAM High Yield Weekly Insights

Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were -$1.0 billion and year to date flows stand at -$17.0 billion. New issuance for the week was $11.4 billion and year to date HY is at $267 billion, which is up 26% over the same period last year.

(Bloomberg) High Yield Corporates Stalled as Monthly Returns Again Flat

- High yield corporate bonds, much like their high grade counterparts, continue to move sideways in 4Q to a U.S. Congress undertaking tax reform for stimulus clues. Communications sector spreads moved wider for the year, while miners and other basic industries remain the best performers for 2017.

- High yield corporates continue to lack direction with the Bloomberg Barclays U.S. High Yield Index total returns almost flat for November and 4Q, much like the investment grade counterpart. Corporate bond gains stalled as interest rates rose under the Federal Reserve’s less accommodative bias, while credit spreads near their tightest in three years exhausted momentum to narrow further, awaiting cues from a Congress debating tax reform.

- High yield gained a solid 7.2% year-to-date in line with the five year average. CCC rated debt has led gains, with 10% in total returns as stronger commodity prices and refinancing-friendly interest rates have benefited distressed issuers.

- Corporate junk spreads retraced early November trends to end just 6 bps wider for the month as gauged by the Bloomberg Barclays U.S. High Yield index OAS to Treasuries. Communications, the most indebted sector at 20% of the index struggled again, averaging spreads that were 41 bps wider for the month. It’s now the only sector trading at wider spreads than at the start of 2017. At the other end, metals and mining issuers led basic industries sector spreads to 150 bps tighter for the year on rising commodity prices.

- Bonds of Frontier Communications, among the largest issuers in the sector, averaged almost 8% total return losses in November as the company continues to struggle with high debt loads following the acquisition of Verizon assets early last year. Frontier returns have fallen 13% year-to-date.

(Wall Street Journal) Cineworld to Buy Regal in $3.6 Billion Movie Theater Deal

- British movie theater operator Cineworld Group PLC has agreed to buy American counterpart Regal Entertainment Group for $3.6 billion, creating the world’s second-largest cinema operator.

- Cineworld said the deal would give it a meaningful footprint in the U.S.—the biggest box office market—and create a company with more than 9,000 screens.

- It added that the combined group’s scale will help it mitigate any volatility in particular markets and match the global nature of rivals, including industry leader AMC Entertainment Holdings Inc.

(Business Wire) DAVITA SELLS DAVITA MEDICAL GROUP TO OPTUM FOR ABOUT $4.9B CASH

- Optum, a leading health services company, and DaVita Medical Group, one of the nation’s leading independent medical groups and a subsidiary of DaVita Inc. are combining. The agreement, entered into on December 5, 2017, calls for Optum to acquire DaVita Medical Group for approximately $4.9 billion in cash. The transaction is expected to close in 2018 and is subject to regulatory approval and other customary closing conditions.

- DaVita Medical Group will join with Optum’s physician-led primary, specialty, in-home, urgent- and surgery-care delivery services business. The combination will improve care quality, cost and patient satisfaction through integrated ambulatory care delivery systems enabled by information technology and supportive clinical services. Optum’s data, analytics, technologies and clinical expertise will help DaVita Medical Group physicians deliver even higher quality care more effectively to the patients they serve. With medical groups in California, Colorado, Florida, Nevada, New Mexico and Washington, DaVita Medical Group will expand the market reach of Optum’s strategic care delivery portfolio, including Surgical Care Affiliates, MedExpress and HouseCalls. Patients will further benefit from the sharing of best practices across both organizations.

- “I am so proud of the DaVita Medical Group accomplishments, including our excellent clinical outcomes as reflected in our star ratings performance, our strong emphasis on growing physician leaders, our teammate engagement and advancing the care model,” said Kent Thiry, chairman and CEO of DaVita Inc.

- “Combining DaVita Medical Group and Optum advances our shared goal of supporting physicians in delivering exceptional patient care in innovative and efficient ways while working with more than 300 health care payers across Optum in ways that better meet the needs of their members,” said Larry C. Renfro, CEO of Optum.

(Reuters) Toshiba, Western Digital aiming to settle chip dispute next week

- Toshiba Corp and Western Digital Corp have agreed in principle to settle a dispute over the Japanese firm’s plans to sell its $18 billion chip unit and aim to have a final agreement in place next week, sources familiar with the matter said.

- The board of the embattled Japanese conglomerate approved a framework for a settlement on Wednesday, one of the sources said.

- The potential for Western Digital – Toshiba’s partner in its main semiconductor plant and jilted suitor in the auction – to block a deal has been seen as the main obstacle to the planned sale of the unit to a Bain Capital-led consortium.

- The settlement under discussion calls for Western Digital to drop arbitration claims seeking to stop the sale in exchange for Toshiba allowing it to invest in a new production line for advanced flash memory chips that is slated to start next year, two sources said.

CAM Investment Grade Weekly Insights

Fund Flows & Issuance: According to Wells Fargo, IG fund flows on the week were $3.598bln. This brings the YTD total to +$286.112bln in total inflows into the investment grade markets. According to Bloomberg, investment grade corporate issuance for the week was $47.265bln, and YTD total corporate bond issuance was $1.239t. Investment grade corporate bond issuance thus far in 2017 is down 1% y/y when compared to 2016.

(Bloomberg) Investment-Grade Borrowers Power Through Thick Market

- High-grade issuers continue to shrug off broader market weakness and forge ahead with funding plans. More than 30 investment-grade issuers have tapped the USD market this week, powering through soft market conditions and high supply.

- Each session this week has kicked off with a multi-tranche corporate deal; Apple Inc. (AAPL) $7b 6-part Monday, Oracle Corp. (ORCL) $10b 5-part Tuesday and Johnson & Johnson (JNJ) $4.5b 5-part on Wednesday

- Utilities are having an active week, which was forecast with the completion of this year’s EEI conference.

- Weekly volume is set to top $40b in total volume, a feat not accomplished since early September

(Bloomberg) CenturyLink Dividend Doubts Send Shares, Bonds Plummeting

- CenturyLink Inc.’s shares and bonds plummeted after the telecommunications and Internet provider reduced its full-year forecast, boosting fears among investors that a dividend cut will follow.

- The company said 2017 results would fall short of guidance it provided in February because of lower-than-expected revenue growth as more people gave up on landlines. The shares plunged to their lowest value in seven years and the bonds were the biggest decliners in high-yield debt.

- Analysts peppered company officials with questions on an earnings conference call Wednesday night over the level of the dividend. They asked whether the current payout — 54 cents a quarter — can be maintained even as the company repays debt for its $34 billion acquisition of Level 3 Communications Inc. Regulators last month approved the deal, which CenturyLink hopes will stabilize its business among growing competition from cable companies.

- “CenturyLink’s near-term liquidity is OK,” said Stephen Flynn, a Bloomberg Intelligence analyst. “That said, CenturyLink does have a very large debt load and debt obligations step up significantly starting in 2020.”

- CenturyLink executives said on the conference call that they expect cost savings and accelerated growth from the Level 3 acquisition to support the current shareholder payout.

- “We are confident we can continue to pay the dividend while investing in growth and in our network,” Chief Executive Officer Glen Post said on the call.

(Bloomberg) Ebitda Mocked in Sign of How Frothy Debt Markets Have Become

- In an anything-goes world for debt, there’s a new definition for Ebitda: Eventually Busted, Interesting Theory, Deeply Aspirational.

- That’s the tongue-in-cheek assessment of a Moody’s analyst who’s been tracking earnings projections used by companies lately when asking investors for loans. Ebitda really means earnings before interest, taxes, depreciation and amortization, but borrowers have been stretching the limits of what’s acceptable when they tweak their accounting to boost the figure.

- The adjustments — known as “add-backs” in Wall Street lingo — make companies look more creditworthy by increasing revenue and earnings forecasts. They’re legitimate when companies use them to factor out foreseeable or one-time events that might unfairly reduce the number. But in this frothy market, the size and vagueness of some add-backs seen in offering documents are raising eyebrows:

- Eating Recovery Center, which helps people with diet disorders, almost doubled Ebitda through add-backs for a debt sale last month to help finance CCMP Capital’s purchase of a controlling stake in the company. Almost half of the add-backs were calculated on the basis that the company will “capture the true earnings potential” of its expanded treatment centers.

- When whitening-agent firm Kronos Worldwide Inc. asked lenders for 400 million euros last month ($470 million), its earnings formula allowed wiggle room for half a dozen specific future actions, such as mergers, “and any operational changes.” Kronos didn’t say what that means.

- Avantor Inc.’s $7.5 billion financing, also last month, pitched an adjusted earnings figure amounting to a 91 percent hike. The industrial supplierclaimed allowances such as shares awarded to employees as compensation, and operational benefits from a merger.

- GoDaddy Inc.’s offering back in February included 21 ways the web-hosting registration service could adjust Ebitda upward, including repeatable savings and synergies from anything it does, or expects to do, in “good faith” for a two-year period.

- Derek Gluckman, senior covenant officer at Moody’s Investors Service who floated the cheeky definition for Ebitda, said frustrated investors have little choice but to buy because of the overheated market. “We are seeing the prolonged effects of the persistent supply-demand imbalance for loans, which favors the borrowers enormously,” Gluckman said.

- Traditional add-backs let borrowers include future savings from cost-cutting or increases in revenue in their Ebitda. There’s nothing illegal or underhanded about the practice, and the offerings clearly lay out exceptions to potential creditors.

- But in a market that’s already in danger of boiling over, aggressive attempts to make companies appear more creditworthy could be masking the true amount of leverage in the system — and the pain for investors if the loans go sour. On top of that, the Trump administration is seeking to dial backregulations aimed at curtailing leverage, and a move is afoot in Congress to review and perhaps kill the current guidance from government agencies.

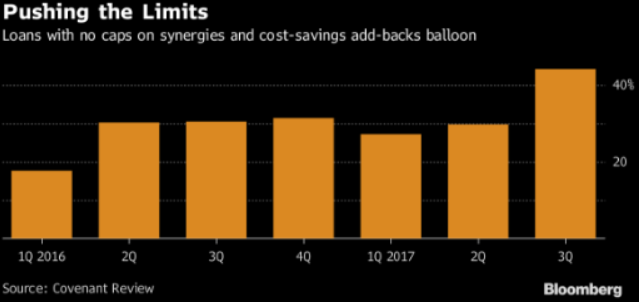

- Add-backs without caps or restrictions for synergies and cost savings spread to 44 percent of new loan deals in the third quarter, from 27.1 percent in the first, according to research firm Covenant Review. In 2017, and each of the two preceding years, 91 percent to 94 percent of North American bonds had at least one Ebitda add-back considered aggressive by Moody’s.

- More aggressive add-backs are one part of a trend toward weakening protections. The quality of covenants, or protections afforded to lenders, in junk bonds is hovering above a record low, according to Moody’s. Leverage levels are also near historical highs at 5.3 times in September, S&P Global Ratings said this week.

(Fierce Wireless) Sprint’s Claure: Tower companies ‘going to be very happy’ with our capex

- The nation’s fourth-largest wireless network operator has lowered its capex guidance several times over the last two years, raising the eyebrows of analysts who have questioned its ability to keep pace with the network upgrades of its rivals. But Son said on Monday that SoftBank not only will increase its stake in Sprint from 83% to 85%, but it will also roughly triple Sprint’s capex to a range of $5 billion to $6 billion beginning in a few quarters.

- Sprint has also been criticized for trying to cut costs by focusing on small cells to densify its network, minimizing its spending on traditional towers. But that strategy hasn’t always been as effective as the carrier hoped, and Claure said Sprint will make macrocells a higher priority as capex ramps up.

- “The last year and a half, two years have been a great learning experience. We’ve tried to disrupt the way networks get built. We’ve been successful in certain areas and, to be fair, we haven’t been successful in others,” he conceded. “So we’re going to go toward a more traditional network build-out. Our friends at the tower companies I think are going to be very happy.”

- Claure added that fewer than half of its towers currently access the carrier’s valuable 2.5 GHz spectrum. Sprint expects all its macrosites to support triband spectrum.

- Sprint still faces a mountain of debt, of course: It’s $38 billion in debt, about half of which will come due over the next four years. But Claure said the carrier’s ongoing cost-cutting efforts continue to prove successful, and its innovative financial mechanisms such as its handset-leasing program and its ever-improving cash position will help finance the network investments.

(Bloomberg) Teva’s Schultz Faces Dwindling Choices as Rating Cut to Junk

- Teva Pharmaceutical Industries Ltd. Chief Executive OfficerKare Schultz is finding himself in the hot seat in his first week on the job with rapidly shrinking options to halt the slide in the Israeli company’s securities after its debt was cut to junk overnight.

- Fitch Ratings cited the “significant operational stress” that the world’s biggest maker of copycat drugs faces at a time when it needs to pay down debt, and pared its rating by two levels to non-investment grade late on Monday. Teva’s debt obligations are almost three times its market value following an ill-timed $40 billion acquisition last year of Allergan Plc’s generics business.

- “We find it troubling that management, which presumably met with Fitch before the downgrade, was not able to convince the rating agency that it would take more dramatic deleveraging actions in order to preserve investment grade ratings,” Carol Levenson, an analyst at bond research firm Gimme Credit, said in a report.

- Kare Schultz

- The company will have to either sell assets or find external sources of financing to meet its obligations, Fitch said. Sales of Teva’s biggest drug, Copaxone, are under siege after a cheaper copycat version of the multiple sclerosis medicine entered the U.S. market last month. Schultz, who took the helm at the start of this month, has pledged to increase profits and cash flow.

- While Teva has enough free cash flow and proceeds from asset sales to pay down short-term debt, tackling longer-term leverage could be much more difficult. With the stock down 70 percent this year, issuing straight equity is an increasingly less attractive financing option. That may leave hybrid securities like mandatory convertibles the best source of new capital, Levenson said.

- Fitch downgraded the company’s debt rating to BB from BBB-. Standard & Poor’s and Moody’s Investors Service have both assigned it the lowest investment-grade rating, and all three have warned another downgrade is possible.

- Teva Bonds Already Trading at High-Yield Levels

- Teva’s most liquid 10-year equivalent bonds are the Baa3/BBB- rated 3.15% unsecured notes due in October 2026, which have fallen 10 points from recent highs to the mid-80s, implying a yield of 5.2%, +290 bps. Using Bloomberg Barclays HY Index, BB bond spreads are less than 10 bps wide of 10-year lows of +192 bps on Oct. 24 and single B spreads of about +330 bps. Teva 2.2% unsecured notes due July 2021 are trading at a spread of +250 bps. In yield terms, Teva 2.2% unsecured notes due July 2021 are approaching 4.5%. (11/08/17)

- Teva Bonds Already Trading at High-Yield Levels

(Bloomberg) Fixed 5G was tested by the cable industry, and it came up a bit short

- One of the hottest topics in the wireless industry right now is whether fixed 5G will be able to replace wired connections like DSL, DOCSIS or fiber. The motivation behind this question is obvious: 5G operators might be able to beam high-speed wireless services into wired rivals’ homes (literally going over the top) to steal broadband internet customers away from providers like Charter and Comcast.

- A wide range of tests and reports by wireless carriers and vendors have found plenty to get excited about in 5G—there’s lots of slideware featuring blazing fast speeds and limitless potential. But a new report from two leading players in the cable industry offers a decidedly more pragmatic picture of the fixed 5G space.

- Although the millimeter wave spectrum bands (generally those above 28 GHz) were initially targeted for 5G deployments, T-Mobile, Sprint and others are now pushing to deploy 5G in bands 6 GHz and below. Indeed, T-Mobile has said its 5G deployment, kicking off in 2019, will go all the way down to 600 MHz.

- However, lower spectrum bands generally transmit less data across farther geographic distances, while higher spectrum bands transmit more data across shorter geographic distances.

- For cable players specifically, the 3.5 GHz CBRS band has generated a significant amount of attention, with Charter detailing its wide range of fixed wireless tests in the band. In their report, Arris and CableLabs noted that the 3.5 GHz band can provide “100s of Mbps of broadband capability” in NLOS conditions at distances up to 800 meters—and those speeds could be raised to up to 10 Gbps through channel aggregation of the full 70 MHz available in a licensed scenario.

- Despite the burgeoning possibilities in the 3.5 GHz band, the report concludes that lower spectrum bands like 3.5 GHz simply won’t be able to keep pace with consumers’ growing demands for data, and will likely be used for backup connections. “For Fixed Wireless Access to be able to compete with Wired Solution, it has to be able to provide Gbps peak rates on both the Downlink and the Uplink. To achieve these peak data rates in a Wireless Access network the only wireless bandwidth available with sufficient contiguous spectrum to meet 3+ Gbps SG [service group] downstream service—if the spectral efficiencies remain under 10 bps/Hz—lies well into LOS-delivered (and near millimeter wave) frequencies (28 GHz, 37 GHz, 39 GHz, 60 GHz and 64-71 GHz). These frequencies offer huge amounts of bandwidth (the unlicensed bands alone in the 60 GHz range can deliver 128 Gbps),” the report states.

- “But these frequencies present some clear technical, operational, and aesthetic challenges,” the authors add.

- Although they have been long neglected, millimeter-wave bands have gained substantial notoriety in recent years. Indeed, Verizon and AT&T have spent several billion dollars this year acquiring millimeter-wave spectrum licenses.

- And for good reason: As the report points out, speeds in millimeter wave transmissions can seem almost magical. “Link capacities of approximately 750 Mbps were achievable in LOS conditions, which were degraded to just under 490 Mbps in adverse weather conditions,” the report states, citing CableLabs tests of transmissions in the 37 GHz band. “Also of particular interest was the maximum link length that can be achieved to deliver service where a LOS link extending approximately 2600 feet while delivering nearly 190 Mbps was demonstrated.”

- However, the report outlines the significant challenges players face in deploying millimeter-wave systems. In its 37 GHz tests, CableLabs found that speeds decreased to around 200 Mbps at 150 feet if signals have to travel through foliage – and those figures slow to below 100 Mbps at 150 feet in dense foliage.

- Rain, snow, wind, window tinting, moving vans and other commonplace objects can all conspire to dramatically reduce the effectiveness of millimeter wave transmissions. “The impact of deciduous and conifer trees (under gusty wind conditions) suggest that the leaf density from the conifer more frequently produces heavy link losses and these, more so at higher carrier frequencies,” the report thoughtfully notes.

- Thus, as is explained in the report, it’s still early days in 5G. Fixed applications in millimeter wave bands are some of the first applications of the technology, but that’s certainly not the only application. And advances in MIMO, beamforming, edge computing and other, related technologies may well push 5G calculations into more appealing territory.

- Nonetheless, it’s definitely worth looking at 5G with a clear pair of eyes.

CAM Investment Grade Weekly Insights

Fund Flows & Issuance: According to Wells Fargo, IG fund flows for the week were $3.5bln. This brings the YTD total to +$239.6bln in total inflows. According to Bloomberg, investment grade corporate issuance for the week was $15.845bln, and YTD total corporate bond issuance was $1.04t. Investment grade corporate bond issuance thus far in 2017 is down 4% y/y when compared to 2016.

(Bloomberg) China’s Credit Rating Cut as S&P Cites Risk From Debt Growth

- S&P Global Ratings cut China’s sovereign credit rating for the first time since 1999, citing the risks from soaring debt, and revised its outlook to stable from negative.

- The sovereign rating was cut by one step, to A+ from AA-, the company said in a statement late Thursday. The analysts also lowered their rating on three foreign banks that primarily operate in China, saying HSBC China, Hang Seng China and DBS Bank China Ltd. would be unlikely to avoid default should the nation default on its sovereign debt.

- “China’s prolonged period of strong credit growth has increased its economic and financial risks,” S&P said. “Although this credit growth had contributed to strong real gross domestic product growth and higher asset prices, we believe it has also diminished financial stability to some extent.”

(Bloomberg) Teva Pharmaceutical Downgraded to ‘BBB-‘ From ‘BBB’ By S&P

- Teva announced that it had obtained amendments to restrictive financial covenants under its credit facilities, S&P Global Ratings says.

- Although the amendments enable the company to more easily satisfy its leverage covenant requirement, it also leads S&P to reexamine its previous view that Teva will be able to reduce leverage to below 4x by 2018

- In light of the revised covenants, S&P revised its forecast for 2017 and 2018

- “While we continue to recognize the company’s commitment to reducing leverage, we believe it will take longer than previously expected due to ongoing pricing pressures in the generics industry that we project will continue well into 2018. We now expect 2018 leverage of about 4.6x, in contrast to our prior expectation that it would decline below 4x next year”

- S&P cut all of its ratings on the company, including corporate credit rating to ’BBB-’ from ’BBB’. The outlook is stable.

- The stable outlook reflects S&P’s expectation the company will reduce leverage more slowly than previously anticipated, with adjusted leverage of well over 4x over the next two years given continued generic pricing pressure and the introduction of generic competition to Copaxone in 2018.

(Reuters) Teva sells rest of women’s health business for $1.4 billion

- Teva Pharmaceuticals said on Monday it would sell the remaining assets in its specialty women’s health business for $1.38 billion in two separate transactions.

- The company, Israel’s biggest and the world’s largest maker of generic drugs, said it would use proceeds from the sales, along with those from its recently announced sale of contraceptive brand Paragard, to repay debt.

- Monday’s announcement, coupled with Teva’s announcement last week that it would sell Paragard to a unit of Cooper Companies for $1.1 billion, demonstrates the company’s commitment to delivering on its promise to generate net proceeds of at least $2 billion from the divestitures, Teva acting CEO Yitzhak Peterburg said. “With these initial divestitures we have exceeded expectations,” he added.

- Teva last week poached Lundbeck’s Kare Schultz as its new CEO, handing the industry veteran the urgent task of convincing investors of the struggling Israeli firm’s future.

- Teva has said it plans to pay down $5 billion of debt by year-end and is selling off businesses such as its women’s health business and European oncology and pain unit.

(Bloomberg) Clicks Likely Derail Bricks That Fail to Evolve

- Retailers focusing on a fast flow of goods and unpredictable inventory finds at lower prices are taking share from traditional stores.

- The rise of online shopping, information sharing and social media have created transparency in the retail marketplace. This has consumers opting for treasure hunts and values, in-store and online, and forgoing browsing stores.

- TJX, Ross, Burlington Stores, Costco, Wayfair, Overstock.com, Hayneedle and Zulily are sellers that use treasure hunts and value in their business model.

CAM High Yield Weekly Insights

Fund Flows & Issuance: According to a Wells Fargo report, flows week to date were -$1.8 billion and year to date flows stand at -$9.2 billion. New issuance for the week was $1.0 billion and year to date HY is at $172 billion.

(Business Wire) Zayo Group Holdings, Inc. Reports Financial Results for the Fourth Fiscal Quarter Ended June 30, 2017

- $638.0 million of consolidated revenue, including $509.1 million from the Communications Infrastructure segments and $128.9 million from the Allstream segment

- Bookings of $7.5 million, gross installs of $7.3 million, churn of 1.2% and net installs of $1.4 million, all on a monthly recurring revenue (MRR) and monthly amortized revenue (MAR) basis, excluding the Allstream segment

- Adjusted unlevered free cash flow of $117.2 million

- The Company completed the acquisition of Castle Access, Inc.’s San Diego data centers. The two data centers, located at 12270 World Trade Drive and 9606 Aero Drive, total more than 100,000 square feet of space and 2 megawatts of critical, IT power, with additional power available. The acquisition was funded with cash on hand and was considered a stock purchase for tax purpose.

(NJB Magazine) B&G Foods to Acquire Back to Nature Foods Company

- B&G Foods, Inc. announced that it has entered into a definitive agreement to acquire Back to Nature Foods Company, LLC, from Brynwood Partners VI L.P., Mondelēz International and certain other entities and individuals for approximately $162.5 million in cash, subject to customary closing and post-closing working capital adjustments. B&G Foods expects the acquisition to close during the third quarter of 2017, subject to customary closing conditions, including the receipt of regulatory approvals.

- “We are very pleased to add Back to Nature® to the B&G Foods family of brands. Consistent with our acquisition strategy and our recent Green Giant®, spices & seasonings and Victoria® acquisitions, we are continuing to diversify our portfolio of brands and invest in brands and products that we believe are most relevant to today’s consumer,” stated Robert C. Cantwell, President and Chief Executive Officer of B&G Foods.

- B&G Foods expects the acquisition to be immediately accretive to its earnings per share and free cash flow and projects that following the completion of a six-month integration period, the acquired business will generate on an annualized basis net sales of approximately $80 million and adjusted EBITDA of approximately $17 million. Based upon the foregoing adjusted EBITDA guidance, the acquisition represents a purchase price multiple of approximately 9.6 times adjusted EBITDA (or 8.4 times adjusted EBITDA net of the present value of expected tax benefits).

(Reuters) United Rentals to buy equipment rental chain Neff for about $1.3 billion

- United Rentals Inc, the world’s largest construction equipment rental company, will buy Neff Corp for about $1.3 billion, the companies said, topping H&E Equipment Services Inc’s about $1.2 billion offer last month.

- “United Rentals is an industry leader in equipment rentals, and as a result of this transaction, our employees and customers will benefit from the combined company’s expanded geographic footprint and diversified offering,” Neff’s Chief Executive Graham Hood said.

- Neff is expected to generate $419 million of total revenue for the full year, the companies said.

(Reuters) Western Digital group to offer $17.4 billion for Toshiba chip unit

- A consortium that includes Western Digital is offering 1.9 trillion yen ($17.4 billion) for Toshiba Corp’s memory chip business, which the Japanese conglomerate is trying to sell to cover losses from its U.S. nuclear business, sources said on Thursday.

- Western Digital is set to offer 150 billion yen through convertible bonds and will not seek voting rights in the business, the sources who were familiar with the deal said.

- The consortium also includes U.S. private equity firm KKR & Co as well as the state-backed Innovation Network Corp of Japan and Development Bank of Japan, all of which will offer 300 billion yen each for the chip business, the sources said.

- Under the proposal, Toshiba’s lenders including Sumitomo Mitsui Banking Corp and Mizuho Bank would also extend around 700 billion yen in loans, they said.

- Other Japanese companies will also invest around 50 billion yen to ensure domestic firms hold a combined 60 percent stake, the sources said, adding that Toshiba itself would keep a 100 billion yen stake in the business.

- Sources have said that Toshiba wants to reach a deal by the end of the month and close the sale by the end of the fiscal year in March to ensure it does not report negative net worth, or liabilities exceeding assets, for a second year running. This could result in a delisting from the Tokyo Stock Exchange.

- Given regulatory approvals could take more than six months, the company has been hoping to reach a deal by the end of the month to ensure it can close the sale in time.

CAM Investment Grade Weekly Insights

Fund Flows & Issuance: According to Lipper, for the week ended August 9, investment grade funds posted a net inflow of $2.464bn. This marks 34 straight weeks of inflows and inflows in 70 of the last 75 weeks. Per Lipper data, the year-to-date net inflow into investment grade funds was $81.490bn. According to Bloomberg, investment grade corporate issuance for the week was $43.55bn, as 26 issuers tapped the market across 48 tranches. Through the week, YTD total corporate bond issuance was $899.475bn. Investment grade issuance thus far in 2017 is down 4.5% y/y when compared to 2016.

(Bloomberg) IG NIC ANALYSIS: Softer Backdrop Prompts New Issue Concessions

- High-grade bond issuers shrugged off a soft broader market tone for the second day running, pricing $4.25b Thursday.

- Given the geopolitical tensions between the U.S. and North Korea, the recent deluge of primary supply, and wider credit spreads, many investment-grade bond deals are requiring new issue concessions. Thursday’s three corporate bond sellers, all rated BBB, provided no exceptions.

- Deals priced with low-mid single digit concessions as issuers look to navigate the more uncertain primary market terrain.

- Thermo Fisher Scientific Inc. (TMO) Baa2/BBB/BBB Mkt Cap $69.1b Healthcare/Medical Equipment

- New Issue Concession: 10y: 8bps, 30y: 10bps

- The Priceline Group Inc. (PCLN) Baa1/BBB+ Mkt Cap $91.1b Communications/Media

- New Issue Concession: 5bps

- O’Reilly Automotive Inc (ORLY) Baa1/BBB+ Mkt Cap $17.6b Consumer/Auto Retailer

- New Issue Concession: 5bps

- Thermo Fisher Scientific Inc. (TMO) Baa2/BBB/BBB Mkt Cap $69.1b Healthcare/Medical Equipment

(Bloomberg) Cimarex Reports Second Quarter 2017 Results

- Second Quarter Production up 9% sequentially; Oil Production up 11% sequentially

- Successful Wolfcamp Downspacing test in the Delaware Basin

- 16 wells per section in Reeves County Upper Wolfcamp

- E&D Capital unchanged for 2017; Production guidance raised slightly

- Cimarex invested $296 million in exploration and development during the second quarter, 53 percent in the Permian Basin and 45 percent in the Mid-Continent. Cimarex completed 51 gross (18 net) wells during the quarter. At June 30, 2017, 98 gross (29 net) wells were waiting on completion. Cimarex is currently operating 14 drilling rigs.

- Of note, Cimarex completed a successful four-well downspacing project testing 16 wells per section in the Upper Wolfcamp. Located in Reeves County, the Pagoda State project was brought on production in late April. The four 10,000-foot lateral wells had an average peak 30-day initial production of 1,922 BOE per day of which 956 barrels per day (50 percent) is oil. Please see our latest presentation (posted at www.cimarex.com) for more detail.

(Bloomberg) American Water Capital $1.35b Debt Offering in Two Parts

- American Water Works Co., Inc. provides drinking water, wastewater, and other water-related services in multiple states and Ontario, Canada. The Company’s primary business involves the ownership of regulated water and wastewater utilities that provide water and wastewater services to residential, commercial, and industrial customers.

- Tranches

- $600m 10Y (09/01/2027) at +73

- $750m 30Y (09/01/2047) at +93

- UOP: To lend funds to American Water and its regulated operating subsidiaries and to (1) repay $524m principal of the issuer’s 6.085% notes due 2017 upon maturity on Oct. 15, 2017, (2) redeem up to $327m aggregate principal amount of the issuer’s outstanding long-term debt securities due 2018 and 2021 and which have a weighted-average interest rate of 5.71% and (3) repay commercial paper obligations

CAM High Yield Weekly Insights

Fund Flows & Issuance: According to Wells Fargo, flows week to date were $0.4 billion and year to date flows stand at -$5.6 billion. New issuance for the week was $6.8 billion and year to date HY is at $157 billion.

(MarketWatch) AMC hits record low as unrelentingly poor box office continues to take a toll

- AMC said on Tuesday that not only would the company swing to a loss in the quarter, but that it would be wider than analysts surveyed by FactSet were expecting.

- Analysts have, for the most part, stayed positive on the film exhibitor group, as box office revenues have suffered so far this year. While investors clearly don’t like the news, analysts believe that this too will pass.

- So far in the year, box office revenue is down 2% compared with the same point last year.

- “[Our] fundamental view is unchanged, but the stock is likely in the penalty box,” RBC analyst Leo Kulp wrote in a note to investors. “The news does not change our fundamental view given our already low expectations around the second quarter. With higher costs and a weaker third-quarter box office outlook now baked in as well as a positive outlook on the 2018 box office, we believe we could be near a bottoming out.”

(DSL Reports) Frontier Communications Loses Another 101,000 Frustrated DSL Users

- Frontier continues to lose DSL customers frustrated by the company’s high prices and slow broadband speeds. Frontier’s latest earnings report indicates that the company lost another 101,000 DSL customers last quarter, thanks in large part to users fleeing to cable or wireless services that offer dramatically faster connectivity. Customers in Florida, Texas and California are also still fleeing the ISP due to its bungled acquisition of Verizon’s unwanted DSL and FiOS customers in those states.

- Frontier CEO Dan McCarthy tried to put a positive spin on the company’s problems with the acquisition, its outdated speeds, and the ongoing defections.

- “We’re back in the market with new offers, slightly higher speeds, and we feel pretty good about that,” McCarthy said. “Those offers launch really this week, and we’re expecting to see continued voluntarily churn reduction, as well as an uptick in gross adds, and the combination of the two is where we see improvements in net as we get into this quarter.”

- But that statement tries to obfuscate that many Frontier customers are leaving because the company still refuses to upgrade older DSL lines at any real scale, leaving many users on 3-6 Mbps DSL that falls well below the base definition of 25 Mbps. Cable providers have been having a field day in these markets as DOCSIS 3.1 now allows them to offer gigabit speeds for relatively little investment.

(24/7 Wall St.) More Upside Seen for Cell Tower Giants Ahead of 5G Deployments

- If there is one part of the communications industry that many consumers tend to overlook, it is the cell and communications tower operators. At least until they lose their signal. SBA Communications Corp. reported mixed earnings that looked a bit softer than expected, but analysts by and large call for more upside in SBA and from its two top rivals.

- Jeffrey Stoops, president and CEO of SBA Communications, talked up the spending climate ahead of spectrum and 5G deployments in the quarters and years ahead.

“With substantial spectrum and 5G deployments on the horizon in both the U.S. and internationally, we expect customer demand to remain solid for years to come. Against that demand, we intend to continue to execute well and we expect to continue to favor allocating capital to portfolio growth and stock repurchases. We continue to remain on track to achieve our long term goal of $10 or more of AFFO per share in 2020.”

(CNBC) Sprint swings to a profit, helped by cost cuts

- Sprint on Tuesday swung to a quarterly profit for the first time in three years and its chief executive said an announcement on merger talks should come in the “near future.”

- Sprint is in the middle of a turnaround plan and has sought to strengthen its balance sheet to compete in a saturated market for wireless service.

- While Sprint has cut costs, analysts say the company is highly leveraged. And although its customer base has expanded under Chief Executive Marcelo Claure, growth has been driven by heavy discounting.

- On the company’s post-earnings conference call, Claure said that while Sprint could sustain itself on its own, the synergies that could come with a transaction were significantly better than remaining a standalone entity.

- “We have plenty of options, and we’ve had discussions with a lot of different parties,” he said.

- He said he was surprised Charter said it was not interested in acquiring Sprint given Sprint was never offered for Charter to buy. Rather, he said, it was part of the “bigger play that has been reported.”

- “Everybody has shown a high level of interest in evaluating Sprint as a potential merger partner. We’re very encouraged by the results of our conversations,” Claure later told reporters.

CAM High Yield Weekly Insights

Fund Flows & Issuance: According to Wells Fargo, flows week to date were -$0.3 billion and year to date flows stand at -$6.0 billion. New issuance for the week was $2.0 billion and year to date HY is at $151 billion.

(Bloomberg) Lean Inventory Fueling Home-Price Gains in 20 U.S. Cities

- Steady price gains in 20 U.S. cities in May indicate that a tight supply of properties paired with increased demand is boosting home values, according to figures from S&P CoreLogic Case-Shiller on Tuesday.

- A shortage of listings is still behind the rapid appreciation of home prices, particularly in high-demand areas such as Portland, Oregon, and Seattle, where values have surpassed pre-recession peaks. Housing demand is supported by a solid labor market, steadily rising wages and low mortgage rates. While lofty asking prices are making it difficult for some Americans to become homeowners for the first time, they’re encouraging owners of more expensive properties to put their houses up for sale, as trade-up demand remains solid.

- “Home prices continue to climb and outpace both inflation and wages,” David Blitzer, chairman of the S&P index committee, said in a statement. “The small supply of homes for sale, at only about four months’ worth, is one cause of rising prices. New home construction, higher than during the recession but still low, is another factor in rising prices.”

(Reuters) Saudi vows to cap crude exports next month

- Saudi Energy Minister Khalid al-Falih said his country would limit crude oil exports at 6.6 million barrels per day in August, almost 1 million bpd below levels a year ago.

- Russian Energy Minister Alexander Novak also told reporters that an additional 200,000 bpd could be removed from the market if compliance with a global deal to cut output was 100 percent.

- The Saudi and Russian energy ministers were in St. Petersburg for a gathering of the Organization of the Petroleum Exporting Countries and other producers. Ministers discussed their previous agreement to cut production 1.8 million bpd from January 2017 through March 2018.

- Falih said OPEC and non-OPEC partners were committed to cut output longer if necessary but would demand that non-compliant nations stick to the agreement.

- OPEC members Nigeria and Libya have been exempt from the output cuts, and market watchers remain concerned that production from the two countries is offsetting the impact of the global reduction.

- In the United States, rig counts were up to 764 in the latest week, from 371 rigs a year ago.

- The executive chairman of energy services company Halliburton said he expected a U.S. rig count above 1,000 by year end, but that about 800 to 900 rigs was more sustainable in the medium term.

(MarketWatch) HCA’s weak quarter speaks to a long-term trend: People are going to the doctor less

- Hospital operator HCA Healthcare Inc. reported a dismal quarter early Tuesday, complete with profit and revenue misses and a cut to its earnings-per-share outlook for the year.

- Hospital operators haven’t been having a particularly good time in recent months, especially given congressional Republicans’ effort to repeal the Affordable Care Act. The ACA, also called Obamacare, greatly benefited hospitals because more people became insured, especially through the law’s Medicaid expansion.

- But there’s another possible reason at play, too: fewer people going to the doctor, said Veda Partners analysts Spencer Perlman and Sumesh Sood.

- Health plans increasingly shift more costs to consumers through such things as high deductibles and cost-sharing, which has in turn changed how patients behave, they said.

- HCA earnings show that “we remain in a much lower healthcare utilization environment post-2008 and this is the new normal,” they said.

- Perlman and Sood also pointed to data published by the Healthcare Cost and Utilization Project in June, which “clearly indicates a continued decline in inpatient stays, surgical volumes and deteriorating payer mix.”

S&P awards Regal Entertainment unsecured debt an upgrade to B+

- Regal unsecured debt was upgraded one notch to B+ on the expectation of continued investment in the theater network and stable leverage over the next 12-18 months

(Fierce Cable) Charter’s 90K lost video subscribers in Q2 far better than forecasts

- Charter Communications delivered far better pay-TV customer metrics in the second quarter than predicted by investment analysts, with the No. 2 U.S. cable company dropping only 90,000 customers in the three-month period that is typically the weakest for pay-TV operators.

- Video subscriber losses at legacy Charter (down 10,000 vs. -7,000 in the second quarter of 2016) and Bright House Networks (down only 12,000 vs. -72,000 in Q2 2016) were offset by 68,000 lost former Time Warner Cable customers during the period.

- Most of the decline came from the loss of “limited basic relationships” at TWC, Charter CFO Christopher Winfrey told investment analysts.

- Revenue grew 3.9% to $10.4 billion on a pro forma basis, while second quarter EBITDA was up 8.6% to $3.8 billion.

- “Results were a nice surprise, with EBITDA ahead of estimates and subscriber trends well ahead,” said New Street Research analyst Jonathan Chaplin. “Video losses in the TWC markets were half what we and consensus expected. This bears out management’s comment that they had turned the corner on TWC integration and churn. This quarter should have been the low-water mark, and the results were good.”

CAM Investment Grade Weekly Insights

Fund Flows & Issuance: According to Lipper, for the week ended July 26, investment grade funds posted a net inflow of $2.319m. This marks 32 straight weeks of inflows and inflows in 68 of the last 73 weeks. Per Lipper data, the year-to-date net inflow into investment grade funds was $77.541bn. According to Bloomberg, investment grade corporate issuance for the week was $36.35bn. Through the week, YTD total corporate bond issuance was $830.435bn, which is down 1% when compared to 2016.

(Moody’s) Moody’s upgrades PG&E Corporation and Pacific Gas & Electric; outlook revised to stable

- Moody’s Investors Service, (“Moody’s”) today upgraded PG&E Corporation’s (PCG) senior unsecured rating to A3 from Baa1.The senior unsecured rating at Pacific Gas & Electric Company (PG&E), PCG’s principal utility operating subsidiary, was upgraded to A2 from A3. PG&E’s commercial paper rating was also upgraded to Prime-1 (P-1) from Prime-2 (P-2). The outlook on both companies was revised to stable from positive.

(Bloomberg) AT&T Sells Year’s Biggest Bond Deal and Market Wanted Even More

- AT&T Inc. sold $22.5 billion of bonds in a multi-part offering on Thursday, drawing almost three times as many orders as there were securities for sale, according to a person with knowledge of the matter. It’s not only the largest investment-grade deal of the year, but the third-biggest in history behind offerings from Verizon Communications Inc. and Anheuser-Busch InBev SA. The sale is likely the last funding AT&T needs for its $85.4 billion takeover of Time Warner Inc.

- The longest portion of the sale, which came in seven parts, is a 41-year bond that yields about 2.4 percentage points above Treasuries, down from initial talk of 2.55 percentage points, another person said. With the U.S. offering higher yields than Europe and Japan, it has become a destination for foreign investors to park their money, a trend that AT&T benefited from.

(FBN) Illinois Tool Works Sees Margin Expansion and Earnings Growth

- Multi-industrial company Illinois Tool Works (NYSE: ITW) delivered another good quarter of earnings and raised full-year guidance across the board. It was a positive quarter for the company, driven by its automotive segment and recovery in some of its more cyclical segments (specifically welding, test and measurement, and electronics). That said, management served notice of a relative slowdown in the third quarter.

(Bloomberg) Caterpillar Outlook Bright as Sales, Margins Rebound

- A global recovery in Caterpillar’s key markets is picking up steam — earlier than expected — after four years of plummeting sales as global growth accelerates. Aftermarket demand is leading the charge, yet construction equipment is strong and 2Q mining orders doubled. Almost $2 billion in cost cuts, with more to come, is generating much higher-than-historical operating leverage as volume rises. Market-share gains achieved in the downturn are another potential driver as mining and construction markets rebound.

- As the leader in construction and mining machinery, Caterpillar is a major beneficiary of a global recovery. The company may face a one-time charge of $2 billion related to alleged tax violations at a Swiss-based subsidiary and a higher tax rate.