CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

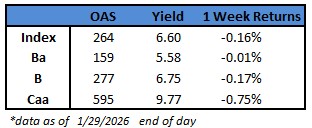

- US junk bonds stalled for a third straight session as yields climbed after data showed consumer confidence collapsed to its lowest level in more than a decade. A measure of consumer sentiment on present conditions slid to a five-year low, reinforcing concerns about a potential economic slowdown. The market racked up the biggest one-day loss in eight sessions.

- The declines gained momentum after Chair Jerome Powell signaled that the Federal Reserve is prepared to keep rates on hold for an extended period. The markets do not expect any rate cuts before June. However, Bloomberg economist Anna Wong suggests that data developments will cut short any pause and the Fed will reduce rates by 100 basis points this year.

- While the market rally lost its momentum this week, pushing yields modestly higher and spreads wider, the primary market rushed to take advantage of still-low risk premiums, attractive yields and strong demand

- The overall economic picture is constructive, though the sentiment is weak, Barclays strategists Brad Rogoff and Dominique Toublan wrote on Friday

- Three new deals priced a total of $2.5b on Thursday, driving the month’s volume to nearly $28b. At close of business today, the issuance volume will close the month at $30b to make it the second busiest January since 2021. It will be the busiest month for supply since September

- The primary calendar is still pretty crowded

(Bloomberg) Fed Holds Rates as Window for Another Powell Cut Begins to Close

- Jerome Powell has two more opportunities to adjust interest rates before his term as Federal Reserve chair ends — and he may not need them.

- After the Fed kept borrowing costs on hold Wednesday, Powell talked up a “clear improvement” in the US outlook and said the job market shows signs of steadying. It signals a cautious optimism: Fed officials delivered three cuts last fall, and see nothing in the latest data to suggest more are needed to prop up the economy. Futures markets expect no shift in rates before June.

- By then, Powell’s term as chair will have ended and a new one should be in place — likely opening another phase of President Donald Trump’s campaign for lower rates, which has upended the Fed over the past year. In a potential sign of what’s coming, the only two officials who voted for another cut this week were Governor Stephen Miran — on leave at the Fed from his post as a top Trump aide — and Governor Christopher Waller, one of four names on Trump’s shortlist of potential Powell successors.

- “The window for a cut under a Powell-led Fed is essentially closed,” said Stephanie Roth, chief economist at Wolfe Research. “He is more optimistic about the labor market and economy overall than he was.”

- The Federal Open Market Committee voted 10-2 Wednesday to hold the benchmark federal funds rate in a range of 3.5%-3.75%. Waller and Miran dissented in favor of a quarter-point reduction. Officials dropped language pointing to increased downside risks to employment that had appeared in the three previous statements.

- Numbers published since the Fed’s December meeting point to accelerating growth, cooling inflation and steadying employment.

- “The outlook for economic activity has improved, clearly improved since the last meeting, and that should matter for labor demand and for employment over time,” Powell told reporters Wednesday.

- That upgraded assessment of the labor market is likely to hold expectations for a near-term rate cut at bay, despite escalating pressure from the Trump administration. Still, Powell was at pains not to overstate the improvement in the labor market. While it’s shown signs of stabilizing, “I wouldn’t go too far with that,” he said.

- Fed watchers said the mixed messaging suggests policymakers want to keep their options open.

- “You could get whiplash from the various descriptions,” said Tim Mahedy, a former senior adviser at the Federal Reserve Bank of San Francisco.

- On inflation, Powell said the overall story was “modestly positive,” despite his estimate that the Fed’s favored gauge ended 2025 at 3%, a full percentage point above target.

- “Most of the overshoot was in goods prices, which we think is related to tariffs,” he said. “We think those will not result in inflation, as opposed to a one-time price increase.”

(Bloomberg) Trump Picks a Reinvented Warsh to Lead the Federal Reserve

- News out Friday morning…

- President Donald Trump said he intends to nominate Kevin Warsh to be the next chair of the Federal Reserve.

- Warsh, who served on the US central bank’s Board of Governors from 2006 to 2011 and has previously advised Trump on economic policy, would succeed Jerome Powell when his term at the helm ends in May, if confirmed by the Senate.

- Warsh is currently an adviser at Stanley Druckenmiller’s Duquesne Family Office, a fellow at the conservative Hoover Institution think tank and a lecturer at Stanford Business School.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.