CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

- US junk bonds stalled after a two-day rally as jobless claims dropped to a three-year low, suggesting employers are largely holding onto workers. Still, the market is on track for its fourth straight week of gains amid growing expectations of a Fed rate cut next week.

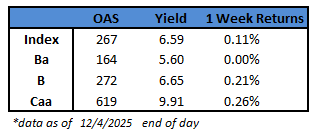

- Yields were unchanged on Thursday, and are now just two basis points above the multi-year low of 6.57%. Spreads closed at a five-week low of 267 basis points and just 11 basis points above the year-to-date low.

- Steadily falling yields and tighter spreads crowded the primary market, with 12 borrowers pricing more than $12b in four sessions this week, the busiest in more than two months.

- Two more borrowers entered the market on Thursday and priced $4b. Both were BB-rated bonds and priced at the tight end of talk. Nine of the 12 deals were BB rated

- The market wobbled across ratings in reaction to the jobless claims data, though CCCs shrugged off the weakness and notched gains for the third straight session. Yields dropped to a five-week low of 9.91% and are poised for a third week of declines

- BB yields jumped nine basis in the past four sessions to 5.60%. Returns are expected to stay flat for the week

(Bloomberg) Payrolls at US Companies Fall by Most Since 2023, ADP Says

- US companies shed payrolls in November by the most since early 2023, adding to concerns about a more pronounced weakening in the labor market.

- Private-sector payrolls decreased by 32,000, according to ADP Research data released Wednesday. Payrolls have now fallen four times in the last six months. The median estimate in a Bloomberg survey of economists called for a 10,000 gain.

- Wednesday’s weak ADP report risks heightening concerns of a more rapid deterioration in the labor market ahead of the Federal Reserve’s final policy meeting of the year next week. It could hold more sway than usual as one of the few up-to-date reports officials will have by then, as the shutdown delayed the government’s November jobs report.

- Policymakers have been torn as to whether they’ll cut interest rates for a third straight meeting as they attempt to balance the slowdown in the job market with still-elevated inflation. Investors, however, widely expect the Fed to lower borrowing costs next week.

- “I think it’s still probably going to be a pretty divided decision,” said Veronica Clark, an economist at Citigroup Inc. The expectation is there will be a rate cut, but the guidance will be more hawkish, she said, as the Fed will also provide fresh quarterly economic projections at the meeting.

- “Hiring has been choppy of late as employers weather cautious consumers and an uncertain macroeconomic environment,” Nela Richardson, chief economist at ADP and a contributor to Bloomberg Television, said in a statement.

- Professional and business services led the decline in payrolls, followed by information and manufacturing. Hiring in education and health services increased.

- Until recently, economists have largely said the labor market is in a state of low hiring and low firing. But a number of large companies like Apple Inc. and Verizon Communications Inc. have recently cut workers or announced plans to do so, which risks driving unemployment higher.

- The November jobs report from the Bureau of Labor Statistics, originally due Dec. 5, will now come out Dec. 16 as data collection was halted during the record-long shutdown. That report will also include nonfarm payrolls for October since BLS is skipping a full release for that month, as it couldn’t collect certain data retroactively.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.