CAM Investment Grade Weekly Insights

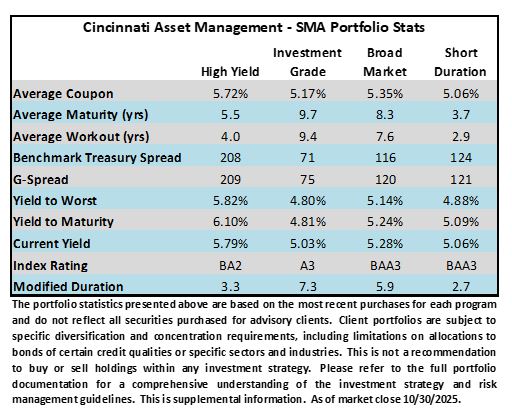

Credit spreads will finish wider this week. The OAS on the Corporate Index closed at 76 on Thursday October 30th after closing the week prior at 75. Although this was a very modest move wider the market “feels” a bit heavier as we go to print on Friday. Investors are busy processing earnings releases as well as a large amount of new issue supply so we would expect the spread on the index to finish the week 1-2 basis points wider than 76. Spreads are still very much rangebound over the past few months as the OAS on the index has not traded wide of 80 since early August. Treasury yields moved slightly higher throughout this week. The 10yr Treasury closed last week at 4.00% and the benchmark rate closed at 4.10% on Thursday evening. Through Thursday, the Corporate Bond Index year-to-date total return was +7.54% while the yield to maturity for the index was 4.80%.

News & Economics

It was another week of light economic data as US government data remains impacted by the shutdown. There were still a few private party releases that occurred this week particularly as it pertains to the housing market. Mortgage applications rose +7.1% last week indicating that perhaps some buyers/refinancers are starting to come off the sidelines as mortgage rates are closing in on three-year lows. However, later that morning data showed that pending sales of existing US homes stalled in September after a strong showing in the month of August.

The highlight of the week was Wednesday’s FOMC release. The Fed cut by 25bps, in line with expectations. The committee was largely in agreement with just two of the twelve voting members having differing views. One voting member wanted no cut and one wanted a 50bp cut. In our view the biggest takeaway from this meeting was Chairman Powell’s press conference as he sought to push back against the idea that a December cut is a forgone conclusion. Interest rate futures responded in kind as they were pricing a 92.3% chance of a cut on Tuesday evening with that number having been whittled down to a 68.9% chance by Wednesday’s close.

Next week will be another quiet one for government sponsored releases absent a reopening but there will be some datapoints from private providers including MNI Chicago PMI, S&P Manufacturing PMI and ISM data.

Primary Market

It was shock and awe this week in the primary market as it was the busiest week of 2025 and the sixth highest volume week of all time. It also capped off the busiest October on record. $78.9bln of new debt priced this week relative to dealer estimates of just $20bln. Meta Platforms led the way with a $30bln jumbo deal on Thursday. Other larger issuers of note were HSBC, Lloyds and Santander. Dealers are looking for $55bln next week to start the month of November.

Flows

According to LSEG Lipper, for the week ended October 29, investment-grade bond funds reported a net inflow of +$1.8bln. Total year-to-date flows into investment grade were +$61.4bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.