CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

- US junk bonds were broadly resilient as they shrugged off concerns about credit quality after Zions Bancorp disclosed a charge-off for a bad loan at a subsidiary tied to alleged fraud. Junk bond yields held steady and spreads moved in tandem with five-year US Treasury yields even as equities churned on worries about regional banks soon after the First Brands Group collapse.

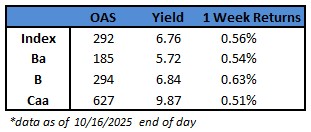

- While high yield spreads closed at 6.76%, just two basis points higher, leading to a modest loss of 0.3% on Thursday. The high yield market is set for weekly gains, with week-to-date returns at 0.56%, the most since the week ended June 27

- CCC yields were still far below 10%, closing at 9.87%, and spreads closed at 627 basis points

- BB yields barely moved and closed at 5.72%, while spreads closed at 185 basis points. BBs are also headed for a weekly gain, with week-to-date returns at 0.54%

- The markets, while struggling to assess the impact of the US-China trade war and broader credit quality in the wake of the regional bank scare, shifted their attention to widely expected interest-rate cuts after Chair Powell signaled that the Federal Reserve is set to deliver a quarter-point reduction at its meeting later this month. Speculation that the Fed will lower interest-rates twice this year fueled optimism about corporate earnings.

- The primary market is steady and investors are still hungry for new paper.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.