CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

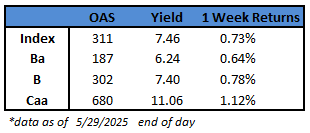

US junk bonds shrugged off a jump in jobless claims and recurring benefits to rally for a third straight session. Yields and spreads also dropped for the third day to close at 7.46% and 311 basis points, respectively.

US junk bonds shrugged off a jump in jobless claims and recurring benefits to rally for a third straight session. Yields and spreads also dropped for the third day to close at 7.46% and 311 basis points, respectively.- Attractive all-in yields and still tight spreads have revived the primary market this month after it slowed to a near halt in April. Two more borrowers — oil and gas company Civitas Resources and Goodyear Tire — sold more than $1.2b on Thursday, taking May’s tally to $31b, the busiest month for supply since September 2024.

- Strong risk appetite accompanied by huge demand is expected to bring more supply in the coming weeks.

- The broad gains extended across ratings as the markets looked past the Federal appeals court’s decision to allow US tariff policy to continue, temporarily blocking a ruling that threatened to throw out Donald Trump’s tariff agenda.

- CCC yields, the riskiest part of the junk bond market, tumbled 37 basis points in three sessions this week to close at 11.06%, a two-week low. Spreads dropped 34 basis points this week to 680. Falling yields and tightening spreads drove gains for three sessions in a row.

- BB yields fell 18 basis points in three sessions to 6.24% and spreads tightened 15bps to 187. BBs notched up gains for three successive sessions.

- As the week closes, US junk bonds may slow amid cautious sentiment, with equity futures struggling to advance given uncertainty over tariff policies and ahead of more macro data.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.