CAM Investment Grade Weekly Insights

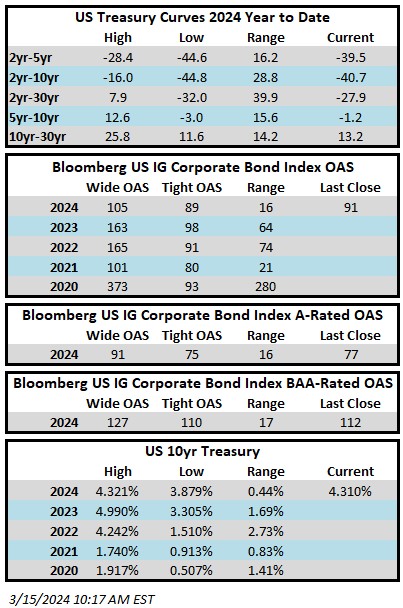

Spreads moved tighter throughout the week. The Bloomberg US Corporate Bond Index closed at 91 on Thursday March 15 after having closed the week prior at 95. The 10yr is trading at 4.31% this Friday morning after closing last week at 4.07%. Through Thursday, the Investment Grade Corporate Index YTD total return was -1.40%. Although spreads are near the tight end of their historical range, yields remain significantly higher than they have been in the recent past and meaningfully higher than they have been for most of the past two decades. The yield to maturity for the Bloomberg US Corporate Bond index as of Thursday evening was 5.4%, relative to its 10 and 20-year averages of 3.49% and 4.15%, respectively.

Economics

It was a mixed week for economic data but, overall, the economy remains resilient and the job market hasn’t yet lost its luster. On Tuesday, the core CPI gauge exceeded expectations for the second straight month. Headline CPI was up +3.2% year over year in February, slightly ahead of the +3.1% recorded for January. On Thursday, the data had something for both Hawks and Doves. PPI came in hot with pries paid during the month of February exceeding estimates while an employment report showed that fewer people were applying for jobless benefits. On the other side of the coin, tepid February retail sales data showed that consumer spending slowed relative to estimates. Market expectations have continued to shift –last week at this time interest rate futures were showing that investors were looking for 3 or 4 rate cuts in 2024 while this week the consensus has shifted more toward only 3 cuts. Next week is extremely light on the data front with the exception of the main event on Wednesday as all eyes will be on the FOMC rate decision. The Fed will also release its first update to the vaunted dot plot since December of 2023.

Issuance

In was another solid week of issuance as companies priced over $37bln of new debt, in line with sell side estimates. 2024 continues to be the busiest year in the history of the investment grade primary market with supply running at ~$476bln YTD, which is +36% higher than 2023’s pace. Next week is expected to see supply slow slightly with dealers estimating $25-$30bln of new supply.

Flows

According to LSEG Lipper, for the week ended March 13, investment-grade bond funds reported a net inflow of +$1.61bln. This was the thirteenth consecutive weekly inflow for IG funds. YTD flows into IG stand at +$22.5bln relative to +$13.1bln for the same period last year. Demand for IG credit has been strong as investors look to lock-in yields ahead of potential Fed rate-cuts.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.