CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

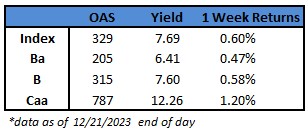

- The fourth quarter US junk bond rally spurred by the Federal Reserve drove yields further down to a new 16-month low of 7.69% and spreads to a another 20-month low of 329 basis points accelerating gains in CCCs, the riskiest tier of the junk bond market.

- CCC yields tumbled to a 10-month low of 12.26% and spreads closed at a 19-month low of 787 basis points.

- CCCs amassed gains of almost 19%, the best year since 2016. The fourth quarter returns so far stand at 5.95%, on track to be the biggest quarterly gains since December 2020.

- CCCs are the best asset class in the US fixed income market as they outperform single Bs, BBs and investment grade.

- Bloomberg Economics expects that the Fed will lead the way with 125 basis points of cuts over the course of 2024, Tom Orlik wrote on Tuesday.

- After the Fed’s own quarterly projections indicated that the central bank will lower interest rates by 75 basis points next year, yields and spreads dropped across all ratings in the US high yield market.

- BB yields dropped to a new 10-month low of 6.41%. Yields have fallen 158 basis points since the November Fed meeting and 59 basis points so far this month. Spreads were at 205 basis points, down 90 basis points year-to-date after falling 120 basis points so far this quarter.

- The rally drew both borrowers and investors into the market, spurring new bond sales.

- The primary market is expected to be largely quiet ahead of the holidays.

- Forecasts for junk-bond supply in 2024 generally range from around $200 billion to $230 billion.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.