CAM Investment Grade Weekly Insights

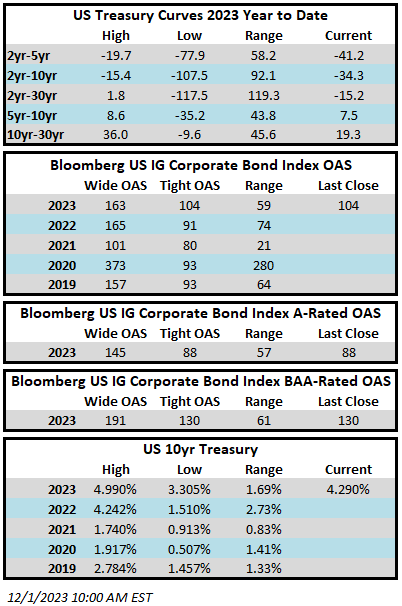

Credit spreads will finish the week tighter and are currently at their tightest levels of 2023. The Bloomberg US Corporate Bond Index closed at 104 on Thursday November 30 after having closed the week prior at 109. The 10yr is trading a 4.29% as we go to print Friday morning, 18 basis points lower than its close the week prior. Through Thursday, the Corporate Index YTD total return was +4.01%. The month of November was particularly strong for spreads as the index has moved 25 basis points tighter since the end of October. The performance of the rates market was also strong as Treasuries’ November gain was the largest since 2008.[i] Monthly yield changes for UST benchmarks were as follows:

- 2Y -41bp

- 5Y -59bp

- 10Y -60bp

- 30Y -60bp

Economics

The calendar for economic data was reasonably busy this week. The biggest print of the week is debatable but it was probably initial jobless claims on Thursday which came in exactly in line with expectations. Jobless claims have been top of mind ever since the October NFP report that missed expectations to the downside. There were other meaningful releases during the week, but none of the numbers were out of consensus enough to take the market by surprise: New Home Sales, Consumer Confidence, Core PCE, Personal Consumption, and Personal Income. Not to be lost in the shuffle was Thursday’s 3Q US GDP release that showed the economy grew at a 5.2% annual rate at the end of that quarter. While this is backward looking data, it is a long way from a recessionary GDP release. The first half of next week is pretty light but the action starts to pick up on Thursday with jobless claims and then the November NFP report on Friday morning.

Issuance

It was a solid week of issuance as borrowers printed $17.5bln of new debt which was the midpoint of the estimated range. Next week syndicate desks are looking for $15-$20bln of new issue volume. In all likelihood the first week of December will be the busiest week of the month before the primary market starts to slow as the calendar moves closer to the holidays and year-end.

Flows

According to Refinitiv Lipper, for the week ended November 29, investment-grade bond funds reported a net inflow of +$324.8mm. Flows for the full year are net positive +$12.357bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.

[i]Bloomberg, December 1 2023, “Treasuries’ November Gain Biggest Since 2008: Rates Monthly”