CAM Investment Grade Weekly Insights

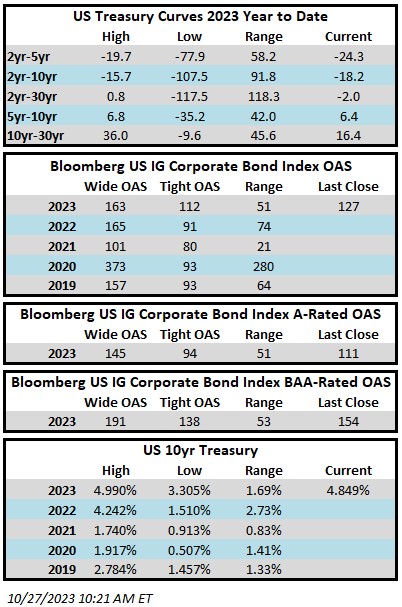

Credit spreads moved tighter this week on the back of mostly positive earnings reports and muted primary supply. The Bloomberg US Corporate Bond Index closed at 127 on Thursday October 26 after having closed the week prior at 130. The 10yr is trading a 4.85% as we go to print Friday morning, higher by 6 basis points on the week. Through Thursday, the Corporate Index YTD total return was -1.46%.

Economics

The data this week was largely positive and it painted a broad picture of a U.S. economy that remains resilient in the face of tightening financial conditions. Some of the positive highlights this week included a +12.3% advance in new home sales (the largest increase in over a year), a Q3 U.S. GDP print that came in at a +4.9% annualized pace (at one point last year some economists had this as a negative print!) and then finally on Friday, we got a real personal spending number for September that came in at +0.4%. It isn’t all peaches and cream though, for a few reasons. As it relates to housing, mortgage rates remain stubbornly high and that is unlikely to change in a “higher for longer” environment. This will continue to take its toll on existing home sales as fewer and fewer people will move residences, which casts a ripple effect through the economy. As far as consumer spending was concerned, we also got income numbers, and after adjusting for inflation, real income dipped for the fourth consecutive month in September. There may be some excess savings still sloshing around in some pockets of the consumer economy but spending is unlikely to continue to increase if this trend of declining real income continues. Last but not least, we still have the potential for increased conflict in the middle east which can have wide ranging effects on commodity markets and risk assets.

Putting it altogether, the market concensus is that the FOMC keeps the benchmark rate steady at its meeting next Wednesday. Interest rate futures are currently pricing in almost no chance of a hike/cut next week but pricing imples a +20.4% chance of a hike at the December meeting.

Issuance

It was a quiet week for issuance with just $5.8bln priced through Thursday with one deal pending on Friday morning which could to push the total closer to $7bln relative to expectations of about $20bln. Even though it was a sizeable miss relative to estimates it is not too surprising given that we are in the heart of earnings season –1 or 2 large potential issuers that are lurking on the sidelines could have easily pushed the total north of $20bln. Syndicate desks are calling for $15-$20bln of new supply next week. Year-to-date issuance is just north of $1 trillion, coming in at $1,035bln through Thursday.

Flows

According to Refinitiv Lipper, for the week ended October 25, investment-grade bond funds reported a net outflow of -$1.790bln. October has been a tough month for bond funds with $5.9bln in outflows so far. Flows for the full year are net positive +$16.426bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.