CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

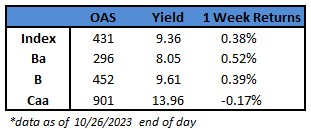

- US junk bond yields rose for the second day in a row and spreads widened 11 basis points to an almost four-month high of 431, driving modest losses for the second consecutive session. Losses were tempered as 10-year Treasury yields slid from near 5% last week to 4.85% on Thursday, driving modest gains for week ended Friday.

- Sliding Treasury yields in the aftermath of stronger-than-expected growth led to modest gains for the week across the high-yield market. Yields have dropped eight basis points week-to-date, while returns sit at 0.38% for the same period.

- CCC yields, the riskiest part of the junk bond market, climbed 12 basis points on Thursday to close near 14%, a seven-month high.

- Steadily climbing yields and strong growth renewed concerns about rates staying higher for longer pushing nervous investors to pull cash out of US high yield funds.

- US high-yield funds reported outflows of $942m for week ended Oct. 25, the seventh straight week of cash exits.

- Rising yields and Treasury volatility this month kept borrowers on the sidelines.

- The month-to-date volume is a little more than $8b. The week-to-date volume is a modest $2.24b.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.