CAM Investment Grade Weekly Insights

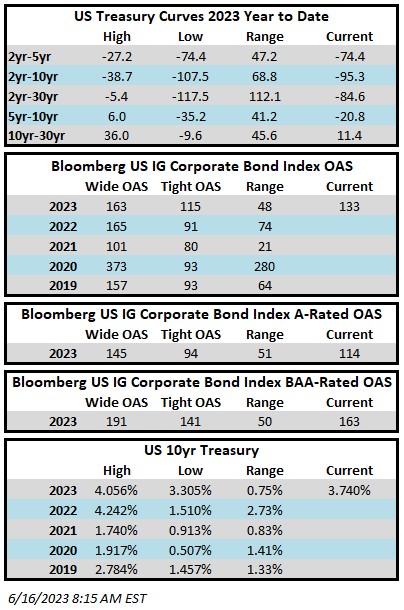

Investment grade credit spreads experienced a steady grind tighter this week. The Bloomberg US Corporate Bond Index closed at 133 on Thursday June 15 after having closed the week prior at 138. The investment grade credit market is feeling good vibes again as we go to print this Friday morning. Equity futures too are in the green after a strong risk rally on Thursday. Treasuries may finish the week unchanged. The 10yr Treasury is currently 3.74%, which is exactly where it closed trading last week. There were times this week where it looked like the 10yr would break through 3.85% but mixed economic data sparked a bit of a rate rally on Thursday morning. Through Thursday June 15 the Corporate Index had a YTD total return of +3.03%.

The economic data this week was mixed for the most part which is the continuation of a larger theme we have experienced in recent months. The data is and has been varied enough that bears, bulls and prognosticators of all stripes can pick and choose, arriving at a variety of views and outlooks. The biggest news during the week of course was Wednesday’s Fed meeting, although the result was so well telegraphed in advance that it was largely a non-event for markets. The Fed paused for the first time in 15 months but may look to resume hikes as soon as July and the Fed’s own projections are calling for two additional hikes in 2023. Speaking of Fed projections, we would point out that, one year ago at its June 2022 meeting, the median Fed dot plot implied a June 2023 target rate of 3.75% while the actual current Fed Funds rate is 5.25%. This miscalculation does not mean that the Fed is bad at its job or that it is not credible. The Fed has a very difficult task against an evolving backdrop and its predictions are not prophecy. We believe that economic data and especially the labor market will continue to guide the Fed in its decision making.

Issuance was very light this week with just $10.4bln in new debt relative to consensus estimates of $15-$20bln. This isn’t too shocking to us as issuance is usually light during weeks when the Fed meets and the calendar is getting more into the summer vacation season. The market is also closed next Monday for the Juneteenth holiday. With nine business days left in the month, June has seen $61bln in issuance. Next week the street is looking for $15bln in new debt.

According to Refinitiv Lipper, for the week ended June 14, investment-grade bond funds collected more than $4bln of cash inflows. IG inflows have been consistently positive in recent weeks and this was one of the strongest weeks of the year so far.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.