CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

- US junk bonds are heading for a modest weekly gain as investors debate whether the Federal Reserve will pause its tightening campaign or keep rates higher for longer following the example of the Bank of Canada.

- Signs of bullish sentiment can be seen as US high yield funds reported a cash haul of $2.5b for week ended June 7, according to Refinitiv Lipper, marking a U-turn after investors pulled $4.7b in four of the five weeks in May.

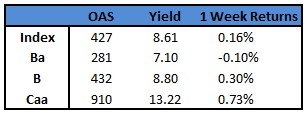

- The week-to-date gains are 0.16%.

- Yields rose seven basis points week-to-date to 8.61% and rose in two the last four sessions after dropping for two consecutive weeks.

- While the high yield market slowed down a tad this week, CCCs outperformed BBs and single Bs, with week-to-date returns of 0.73% compared to a loss of 0.1% and a gain of 0.3% in BBs and single Bs, respectively.

- CCC yields dropped 6 bps on Thursday to close at 13.22%. Yields fell in two of the last four sessions.

- CCCs have been some of the best performing assets in the US corporate debt market this year, with year-to-date returns of 7.62% compared with 2.59% in investment grade, and BBBs in particular, with 2.76%.

- Risk assets have rallied materially in the last couple of weeks on strong technical backdrop, Barclays’s strategists Brad Rogoff and Dominique Toublan wrote this morning. The rally has been helped by a combination of higher yields and lower tail risk expectations, they wrote.

- The primary market priced more than $4b this week as borrowers took advantage of the risk-on sentiment.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.