CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

- US junk bonds are posted to close the month with modest gains, outperforming investment-grade bonds, on expectations the Fed may pause its rate-hike campaign after an anticipated 25bps increase at the next policy meeting. The struggles of First Republic Bank this week reinforced that market consensus. The gains spanned the risk spectrum, propelled by CCCs, the riskiest of junk bonds, with a month-to-date return of 2%, the most since January’s 6.06%. CCCs rebounded from a loss of 1.37% in March.

- The April rally was also partly fueled by cash inflows into US high-yield funds. US junk bond funds reported a cash haul of almost $8b in April as investors returned to the asset class after pulling nearly $7b in March amid turmoil in the banking industry.

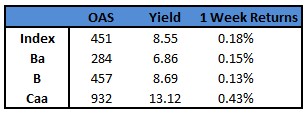

- CCCs were the best-performing assets in the US fixed- income market. Yields tumbled 32bps month-to-date to 13.12% while BB yields rose 6bps to 6.86%. The broader junk bond index yield rose 3bps for the month to 8.55%.

- The primary market was revived with a steady stream of borrowers ranging from bankers offloading debt sitting on their books to gaming and travel.

- The year-to-date supply is at $56.5b, up 4.4% year-over-year.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.