CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

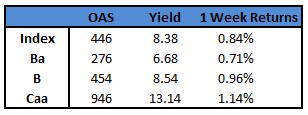

- US junk bonds staged the biggest one-day rally in two weeks, capping a six-session advance that marks the longest winning streak in more than three months. Yields tumbled to a two-month low of 8.38% and spreads dropped below +450 to close at +446, the tightest in five weeks. The rally gained momentum as the latest readings on jobless claims and producer price index fueled expectations that the Federal Reserve is nearing the end of its aggressive monetary policy tightening.

- Junk bonds are headed for fourth week of gains, with week-to- date returns at 0.84%, the longest winning streak since December.

- The gains spanned across all high-yield ratings drawing more investors to junk bonds. The HYG and JNK ETFs reported combined cash haul of almost $2b on Thursday. HYG saw an inflow of $955m, the biggest net inflow since Feb. 2, and JNK’s inflow of $960m was the biggest since November last.

- CCCs, the riskiest of junk bonds, were the best performing asset in the high-yield universe. Yields plunged to an almost two- month low of 13.14% and spreads were at a five-week low of +946.

- The minutes of the March 21-22 Fed meeting showed that a group of policy makers weighed pausing and called for flexibility on decisions in the upcoming meetings. The Fed staff projected a “mild recession” starting later in 2023, followed by a recovery in subsequent two years.

- Fed officials have also signaled that some pause may be warranted.

- The primary market sees a window of opportunity here as investors pile on new issues as they look for opportunities to put money to work.

- The market has priced $12b month-to-date driving the year-to-date tall to almost $51b.

(Bloomberg) Fed Leans Toward Another Hike, Defying Staff’s Recession Outlook

- Federal Reserve officials appear on track to extend their run of interest-rate hikes when they meet next month, shrugging off their advisers’ warning of recession with a bet that they need to do a little more to curb inflation.

- Minutes of last month’s policy meeting showed officials dialed back expectations of how high they’ll need to lift rates after a series of bank collapses roiled markets last month. Still, officials raised their benchmark lending rate a quarter point to a range of 4.75% to 5%, as they sought to balance the risk of a credit crunch with incoming data showing price pressures remained too high.

- They did so even after hearing from Fed staff advisers that they were forecasting a “mild recession” later this year.

- Officials agreed “some additional policy firming may be appropriate,” according to minutes of the Federal Open Market Committee gathering, a posture several Fed speakers have reiterated in recent days.

- Policymakers “commented that recent developments in the banking sector were likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring and inflation,” the minutes said, though they agreed the extent of the effects was uncertain. “Against this background, participants continued to be highly attentive to inflation risks.”

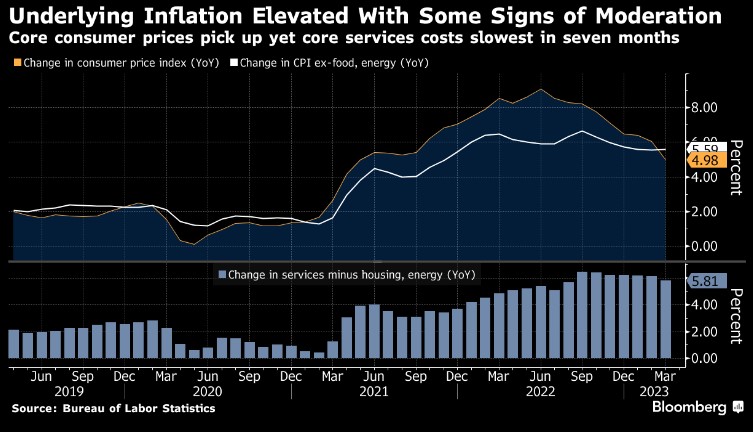

- Earlier Wednesday a key measure of US inflation showed hints of moderating in March, but likely not by enough to dissuade the Fed from a rate hike in May.

- Economists see the most likely outcome as a quarter-point increase at the next meeting, followed by an extended pause. But the language in the minutes, coupled with some officials’ comments and a still-uncertain outlook for the impact of credit tightening on the economy, point to a rate path that may not be fully settled.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.