CAM Investment Grade Weekly Insights

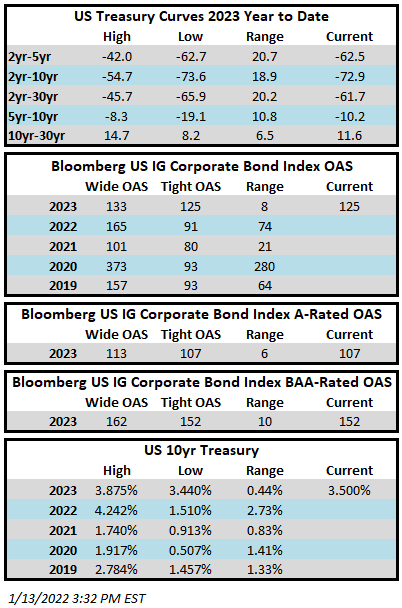

Investment grade credit spreads move tighter throughout the week. The Bloomberg US Corporate Bond Index closed at 125 on Thursday January 12 after having closed the week prior at 132. The 10yr Treasury closed the week prior at 3.56% and it is trading at 3.50% as we go to print on Friday afternoon. Through this Thursday the Corporate Index had a YTD total return of +3.7% while the YTD S&P500 Index return was +3.8% and the Nasdaq Composite Index return was +5.1%.

There was a treasure trove of economic data this week with the crown jewel being the CPI release on Thursday morning. Consumer prices rose 6.5% in the past 12 months through the end of December. The Fed’s preferred metric of core inflation was up 5.7% over the same period which was the smallest increase in over a year. The majority of market prognosticators believe that the CPI release increases the probability that the Fed will choose to raise its policy rate by 25 basis points on February 1 but 50 basis points remains a possibility. There was more positive news on the inflation front in the consumer sentiment numbers that were released on Friday morning. That data showed that respondents expect prices to increase just 4% over the next year. This was the lowest reading for price expectations since April 2021. There will be plenty of data to parse in the week ahead and the highlights include retail sales, producer price data and the NAHB housing market index.

The primary market had another strong week with more than $36bln in new supply pushing the total for January to $94.1bln. Next week is shaping up to strong too as money center banks are expected to tap the debt markets as they exit earnings blackout. The bond market is closed on Monday in observance of Martin Luther King Day but estimates are still calling for as much as $30-$40bln in new supply during the holiday shortened week.

Investment grade credit reported its largest weekly inflow in over two years. Per data compiled by Wells Fargo, inflows for the week of January 5–11 were +8.4bln which brings the year-to-date total to +$10.5bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.