CAM Investment Grade Weekly Insights

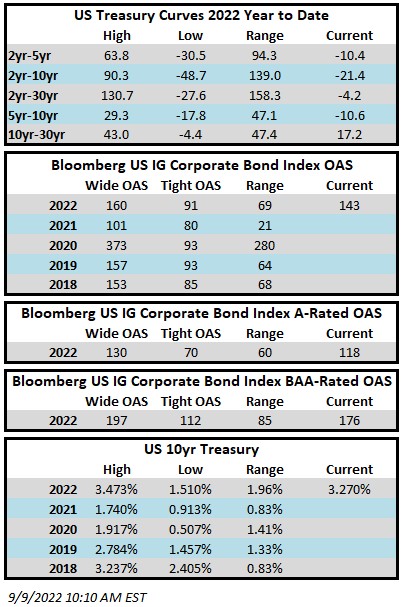

Investment grade credit spreads were pushed wider to start the week after a deluge of new issue supply on Tuesday. By mid-Wednesday morning spreads were trending tighter after investors had a chance to digest issuance and now this Friday morning it is clear that the market is set to finish the week better than last which sets up well for another bout of new issue on Monday. The Bloomberg US Corporate Bond Index closed at 143 on Thursday September 8 after having closed the week prior at 145. The 10yr Treasury closed last week at 3.19% and is trading at 3.27% as we go to print on Friday morning. Through Thursday the Corporate Index had a negative YTD total return of -15.02% while the YTD S&P500 Index return was -15.12% and the Nasdaq Composite Index return was -23.74%.

The FOMC does not meet until September 21 but next Tuesday will see the release of the latest CPI figure which is a big data point that will guide the Fed in its choice of a 50bp or 75bp hike 12 days from now. Other central banks joined the rate-hike party this week. On Wednesday, the Bank of Canada increased its target for the overnight rate by 75bps to 3.25%, a 14-year high for that country. The European Central Bank followed suit on Thursday by increasing its deposit rate from 0% to 0.75%. The ECB also slashed its forecast of economic growth in 2023 to a mere 0.9%. Critics believe this growth target is overly optimistic and that the European economy will find itself in recession sooner rather than later and we at CAM agree with that view.

The holiday shortened week saw 31 companies sell over $51bln of new debt. The street is looking for $35-40bln of issuance next week and with CPI at 8:30am on Tuesday we would expect a tidal wave of issuance on Monday if the market tone is receptive as companies look to get ahead of that economic print. Issuance right now is very much day-to-day depending on the market’s appetite for risk on any given day as well as being highly dependent on the increasingly volatile Treasury market.

Per data compiled by Wells Fargo, outflows moderated this week of September 1–7 to -$0.9bln which brings the year-to-date total to -$111.2bln. This was the second consecutive week of modest outflows on the back of a 5 week streak of inflows for the asset class.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.