CAM Investment Grade Weekly Insights

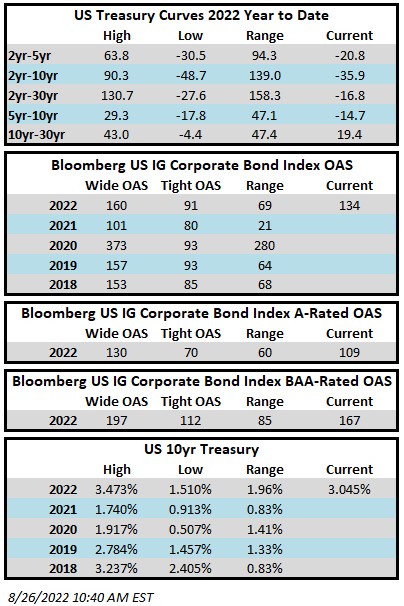

Investment grade credit spreads drifted wider in the first half of the week and then traded tighter amid low volume into Friday morning. After Fed Chair Jerome Powell spoke on Friday the street tried to take spreads wider but trading volume has remained low with the market in its end-of-summer seasonal slow-down. The Bloomberg US Corporate Bond Index closed at 134 on Thursday August 25 after having closed the week prior at 136. After the dust settles the index is likely to finish the week unchanged or close to it. The 10yr Treasury closed last week at 2.97% and is trading at 3.05% as we go to print on Friday morning. Through Thursday the Corporate Index had a negative YTD total return of -13.1% while the YTD S&P500 Index return was -11% and the Nasdaq Composite Index return was -18.78%.

Economic data this week was light relative to the last two weeks and much of the week was spent with investors anticipating Powell’s Friday morning speech. The speech was less than 10 minutes in length, but that was all the market needed to understand that the Fed is committed to using restrictive policy to reduce inflation even if it causes some pain for households and businesses. Chair Powell said 75bps is still on the table for the Fed’s September 21 FOMC rate decision.

There was no new issuance this week. It wouldn’t have been surprising if there would have been a deal or two on Monday or Tuesday but Monday was a volatile day for stocks and risk assets in general so issuers decided to pack it in for the week, and probably for the summer. We anticipate no issuance again next week before things start to pick up again after Labor Day. September is expected to see a high volume of issuance.

Investment grade credit reported a fifth straight week of inflows. Per data compiled by Wells Fargo, inflows for the week of August 18–24 were +$2.8bln which brings the year-to-date total to -$108.9bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.