(Bloomberg) High Yield Market Highlights

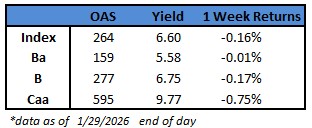

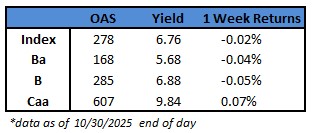

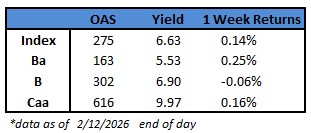

- US junk bonds tumbled, yields rose and risk premiums surged as anxieties over artificial intelligence boiled over, causing a broad reassessment of riskier assets. Yields jumped the most in three weeks to 6.63% and spreads widened the most in four months to 275 basis points.

- The selloff extended across ratings. CCC yields approached 10% after the biggest one-day increase in 10 months. Spreads rose 27 basis points to close at the year-to-date high of 616 basis points.

- Single B spreads closed at 302, a more than two-month high. Yields climbed to approach 7%

- The broad selloff started mid-week after a stronger-than-expected jobs report dashed hopes of Fed rate cuts

- The primary market paused on Thursday, with just one deal pricing

- A stable labor market and relatively strong corporate balance sheets kept the primary market busy earlier in the week; February volume is above $12b

- Four borrowers priced more than $4b on Wednesday, the busiest single-day volume in three weeks

(Bloomberg) US Adds 130,000 Jobs and Unemployment Falls After Tepid 2025

- US payrolls rose in January by the most in more than a year and the unemployment rate unexpectedly fell, suggesting the labor market continued to stabilize at the start of 2026.

- Employers added 130,000 jobs last month and the unemployment rate declined to 4.3%, according to Bureau of Labor Statistics data out Wednesday. That followed revisions to the prior year, which showed a marked slowdown in hiring. Job gains averaged just 15,000 a month last year, down from the initially reported 49,000 pace.

- The report suggests the labor market is finding its footing after the most anemic year for hiring outside of a recession since 2003. While economists expect hiring to remain generally sluggish in 2026, more clarity around the impact of President Donald Trump’s economic policies and lower borrowing costs could encourage some employers to boost headcount.

- The January data reinforces Federal Reserve officials’ inclination to keep interest rates on hold for now. Many traders appeared to push out their timeline for the next rate cut to July from June.

- In leaving rates unchanged last month, Chair Jerome Powell cited signs of steadying in the job market.

- “Coming off of a hiring recession in 2025, this is welcome news,” said Heather Long, chief economist at Navy Federal Credit Union. “I think Fed Chair Powell was right — the labor market appears to be stabilizing.”

- With the release of each January employment report, BLS benchmarks payrolls to a more accurate but less timely series called the Quarterly Census of Employment and Wages. That data is based on state unemployment insurance tax records and covers most US jobs.

- That adjustment showed job growth was nearly 900,000 lower in the 12 months through March 2025 than initially reported. The figure roughly aligned with what the BLS’s preliminary estimate suggested.

- The pickup in January hiring was led by health care, which added the most jobs since 2020 and accounted for the majority of overall job growth in 2025. Federal government payrolls continued to decline.

- “It’s great that health care is growing the way it is, but I would feel much better if we were seeing broader strength,” said Laura Ullrich, director of economic research at Indeed Hiring Lab. “It is quite lopsided growth.”

- Though layoffs remain generally constrained, there’s been a wave of job-cut announcements by companies like Amazon.com Inc. to United Parcel Service Inc. in recent weeks. And heading into this year, job openings across the economy dropped to the lowest level since 2020.

- The jobs report is comprised of two surveys, one of businesses — which produces the payrolls figures — and another of households, which is the source of the unemployment rate. Within the household survey, the participation rate — the share of the population that is working or looking for work — edged up to 62.5% in January.

- Wednesday’s release also included widespread revisions to the employer survey. With the release of the January 2026 data, the BLS updated its so-called birth-death model, which accounts for the net number of businesses opening and closing. Economists have noted this change should improve the model’s responsiveness to current economic conditions and reduce the size of benchmark revisions over time.

- Adjustments to job numbers have been bigger than usual in recent years, which some economists attribute to unique post-pandemic dynamics.

- While the January jobs report usually incorporates new population estimates from the Census Bureau into the household survey, those figures were delayed by a month due to last year’s record-long government shutdown.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.