CAM Investment Grade Weekly Insights

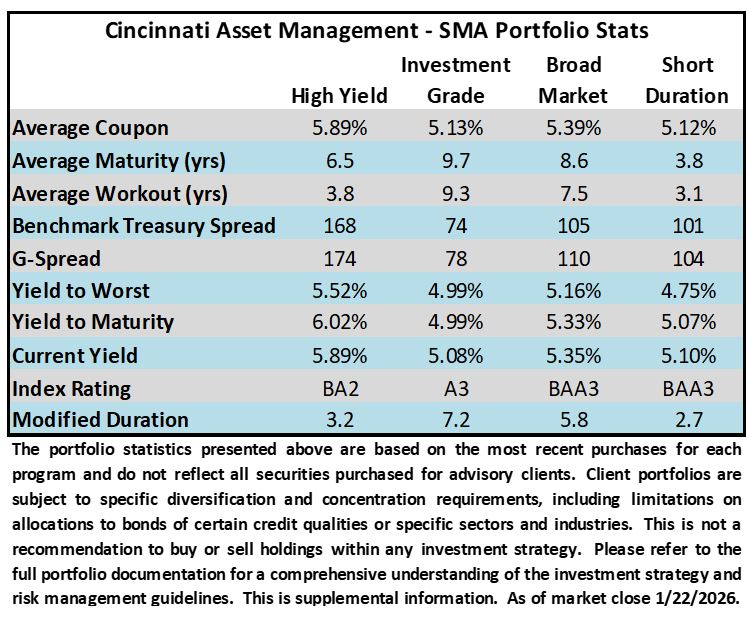

Credit spreads moved tighter this week. The OAS on the Corporate Index closed at 71 on Thursday January 22nd after closing the week prior at 74. The Index was 7 bps tighter YTD and stood at its tightest level since 1998 amid a strong technical backdrop for credit. The 10yr Treasury closed last week at 4.22% before moving to 4.25% on Thursday evening. The benchmark rate was 8bps higher YTD. Through Thursday, the Corporate Bond Index year-to-date total return was +0.26% while the yield to maturity for the index was 4.86%.

Points of Interest

The data this week was supportive of a resilient economy. GDP and personal consumption were healthy. Core PCE for the month of November remained above the Fed’s long-term target (2%) but it ticked lower from the month prior with no surprises to the upside. This is backward looking data but it has led market participants to coalesce around the belief that the economy is poised to perform well in 2026. The strong economic data has caused prognosticators to carefully consider the Fed’s need to decrease its policy rate in the year ahead. The median projection derived from the Fed’s December dot plot showed just one cut in 2026 with an additional single cut in 2027. The market started the year with a hunger for 2+ cuts year but interest rate futures were pricing slightly less than two cuts as of Friday afternoon. Economic stimulus associated with the recently enacted tax reform as well as the performance of the job market will be the two items that have the biggest impact on the policy rate in 2026 in our view.

There are a handful of economic releases next week but the highlight will be the FOMC on Wednesday. Fed fund futures are currently predicting almost no chance of a cut/raise and we agree. The more interesting story could be President Trump revealing his preferred choice for the new Fed Chair. He has consistently said that the announcement would occur in the month of January. We would not be surprised if this news were to hit the tape at the conclusion of next Wednesday’s FOMC release.

Primary Market

The primary market was slower this week as earnings season continued to progress with many issuers still prohibited from bringing new deals due to quiet periods. Through Thursday, $20.4bln in new debt was priced with a regional bank deal pending on Friday that will add $1.75bln to that total. More than $170bln of new debt has been priced so far in 2026, with much of that total ($90.2bln) coming in the first full week of the year, which ended up as the 4th busiest week of all-time. The Fed meeting should lead to a front-end loaded calendar in the week ahead. Dealers are looking for $35bln of new debt next week which would push the monthly total north of $200bln.

Flows

Demand for credit has been strong to start the year. According to LSEG Lipper, for the week ended January 21, short and intermediate investment-grade bond funds reported a net inflow of +$3.09bln. This was the 8th consecutive week of inflows dating back to last year. 2026 year-to-date flows into investment grade were +$9.60bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.