2025 Q4 Investment Grade Quarterly

Fourth Quarter Commentary & 2026 Outlook

January 2026

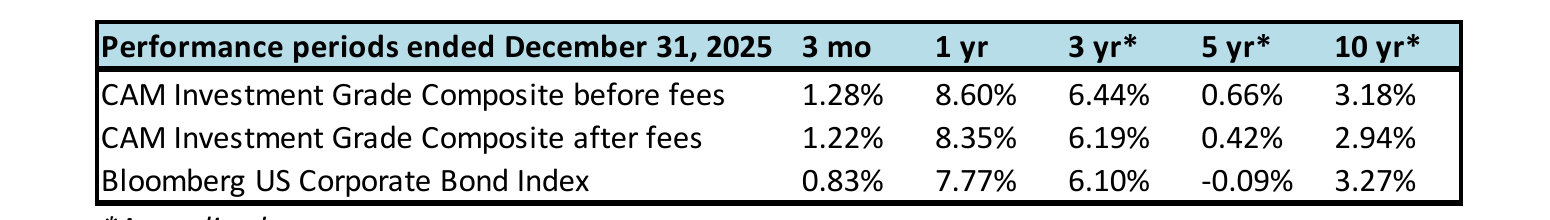

Investment grade credit posted strong returns in 2025 thanks to tighter spreads, declining Treasury yields and income generation. Coupon income carried the day, accounting for more than half of the index total return. The economy continued to grow throughout the year even amid tariff-related volatility and investor concerns around a slowing labor market.

2025 in The Rearview

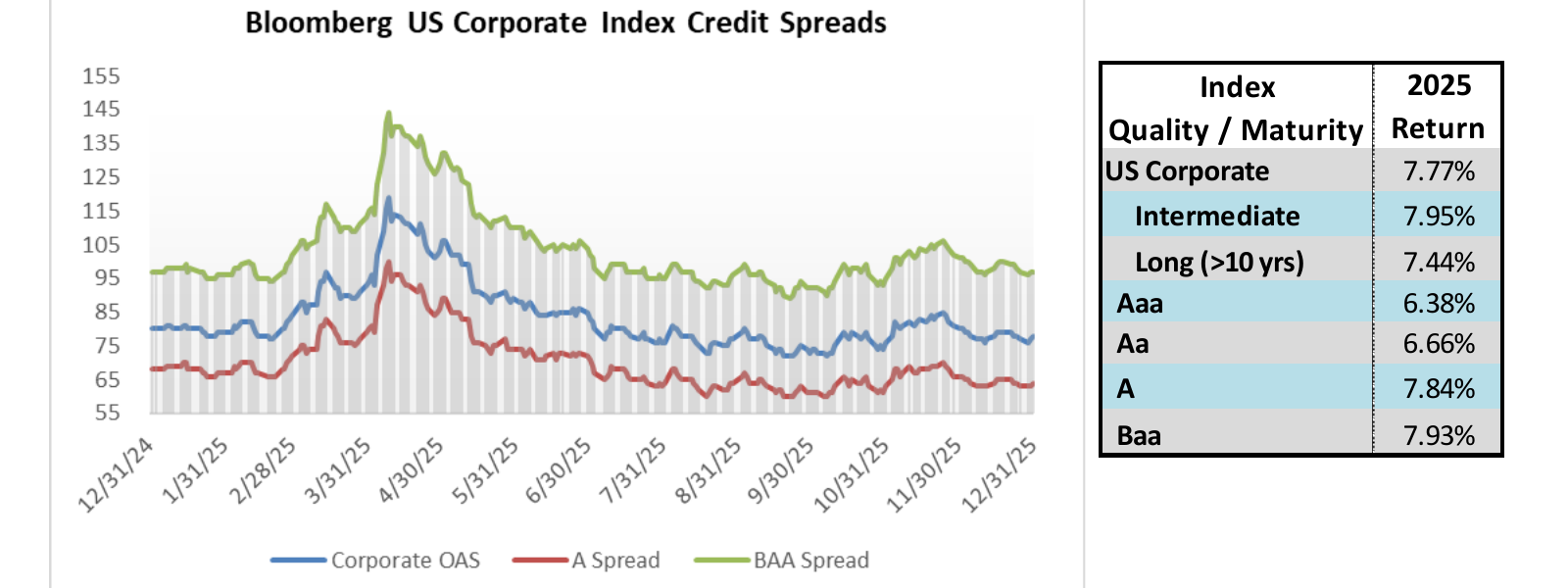

During 2025, the option adjusted spread (OAS) for the Bloomberg US Corporate Bond Index (The Index) tightened by 2 basis points to 78 after opening the year at 80. The Index OAS closed as wide as 119 in early April following Liberation Day tariffs but the move wider was short-lived and The Index was back below 100 by early May. Lower quality credit modestly outperformed higher quality due to the incrementally higher coupons that are available in the market as quality decreases. Intermediate credit outperformed longer dated credit as short and intermediate Treasury yields moved lower throughout the year.

Looking at major industries, the three best Index performers in 2025 from a total return perspective were Metals & Mining, Aerospace/Defense and Tobacco. The three worst performing industries were Media Entertainment, Leisure and Chemicals. There were no industries with a negative total return.

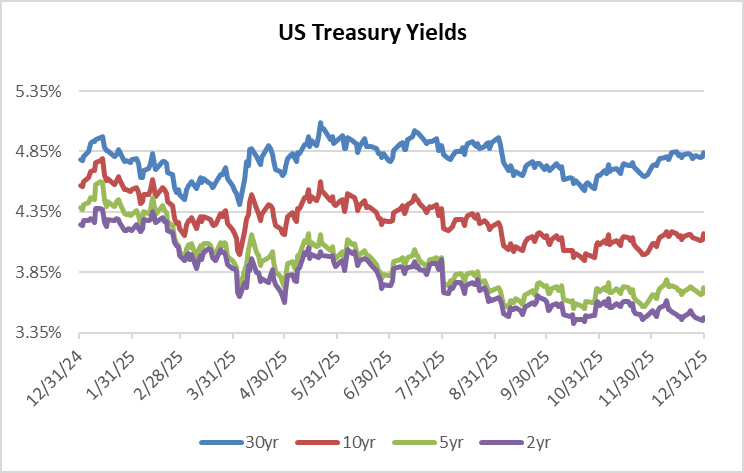

Lower Treasury yields were a boon for intermediate investment grade performance in 2025. The 2yr, 5yr and 10yr Treasuries finished the year 77, 66 and 40 basis points lower, respectively. It is no surprise that shorter-dated Treasury yields decreased in concert with the FOMC lowering its policy rate by 75 basis points in the second half of the year. On the other hand, the 30yr Treasury remained stubbornly elevated, finishing the year 6 basis points higher than where it began. Recall that the CAM Investment Grade Strategy is an intermediate maturity program that does not invest in longer dated securities or engage in interest rate anticipation. In our view, it is simply too difficult to accurately predict rates over long time horizons, especially further out the curve.

2026 Outlook

There are several major themes and outright questions that we are watching as we turn the page to the year ahead.

Who will be the next Fed Chair? Jerome Powell’s term as Chair expires in May and President Trump has said he could announce the replacement as soon as January.i According to prediction market-maker Polymarket, it is a close race between Kevin Hassett and Kevin Warsh. While both of these choices would likely be acceptable to financial markets, there are some key differences. Warsh has more experience, having served as a Fed Governor from 2006-2011 while Hassett is viewed as more dovish and less independent due to his close ties to President Trump as an economic adviser. We also cannot rule out the possibility that Trump’s nomination could be someone entirely unexpected, which could have ramifications for risk assets.

Monetary Stimulus: How many cuts in 2026? The median forecast from the Fed’s most recent Dot Plot showed an expectation of just one 25 basis point rate cut next year. This is in contrast to investor expectations, which are pricing 58 basis points worth of policy rate reductions before year end.ii Here at CAM, we currently lean toward two 25 basis point cuts. Although the Fed is supposed to remain independent, we have to acknowledge the intense dovish pressure from the Oval Office as well as the ability of the President to nominate a Chair that he feels will abide by his goal of lowering rates. We find it difficult to pencil in more than two cuts due to the amount of fiscal stimulus the economy will experience in 2026, which brings us to our next concern.

Fiscal Stimulus: Repeating past mistakes? The One Big Beautiful Bill Act applies retroactively to 2025 tax returns, so its impact will be felt early in 2026. Among the provisions included are no tax on tips, no tax on overtime, no tax on car loan interest and an additional deduction for senior citizens. The OBBBA also raises the cap on the state and local tax deduction and includes a permanent increase in the child tax credit. Many other components of this legislation are too exhaustive to cover here but the net effect is that the majority of taxpayers will receive meaningfully larger tax refunds in early 2026 that will function as a significant economic stimulus. While this is good for taxpayers in principle, we are concerned about the impact that this will have on inflation that has already proven to be sticky above the Fed’s 2% long term target.

Will the labor market continue to erode? Monthly payroll growth slowed throughout 2025 and the unemployment rate hit a four-year high of 4.6% in November. The unemployment rate subsequently decreased to 4.4% in December, but it was accompanied by anemic payroll growth. Although unemployment is still low by historical standards, we see little reason for a return to the days of a booming job market. We expect that the labor market will remain sluggish in 2026 as companies remain cautious with their hiring plans due to margin pressures, uncertainty around trade policy and a continuing decline of foreign-born workers. In our view, a lackluster job market could serve to blunt some of the effects of the aforementioned economic stimulus.

How Does This Impact Investment Grade Credit?

Given the lower risk profile and relatively minimal default risk, we would not expect the above themes to have a significant impact on credit spreads in isolation. If the labor market were to experience a precipitous decline that pushes the economy into recession then wider credit spreads are virtually guaranteed but this would also trigger a move by the Federal Reserve to rapidly lower interest rates. Similarly, if fiscal and/or monetary stimulus results in a red-hot economy and interest rates move higher then that would sap some momentum from investment grade total returns but we would expect to see spreads move even tighter in an economic boom scenario, offsetting some of the pain from higher rates. We are comfortable with the all-in yields that are available in the market as they provide a margin of safety. There are multiple paths to solid total returns for the investment grade asset class in the year ahead regardless of the myriad of economic outcomes. There are several issues specific to the investment grade market that we would like to highlight.

It’s all about supply. 2025 was the second busiest year on record for primary market volume ($1.58 trillion), trailing only 2020 ($1.75 trillion), the latter of which was fueled by extraordinarily low interest rates and COVID-induced borrowing in the face of economic uncertainty. 2026 is projected to be the busiest year yet with syndicate desks (the banks that underwrite new issuance) projecting $1.8-$2.25 trillion of new bond supply.iii In fact, January is already off to a strong start with $90.2bln of investment grade debt being issued in the first full week of the year, making it the fourth busiest week of all-time.iv There are three factors driving the deluge of issuance. First, hyper scalers (META, GOOGL, AMZN, MSFT, ORCL) have ramped capital spending in the race to the forefront of artificial intelligence. Several of these companies raised over $20bln in new debt during 2025 with more to come in 2026 and beyond. Second, M&A activity surged into year end and the environment for dealmaking remains attractive in 2026 due to accessible financing and a more relaxed regulatory environment. M&A is always extremely difficult to predict but it only takes two or three large deals to move the needle significantly and deal size has been growing. Finally, credit investors have been more than willing to lend as demand has remained strong and inflows into the asset class have been solid. This is perhaps the most important piece of the puzzle. We expect that potential debt issuers will “sell when they can” as long as market participants are willing to buy at a reasonable price. Gilt-edged hyper scalers and companies that engage in large scale M&A have a variety of options to access capital outside of the public IG markets including equity issuance, private credit, asset backed lending and loans. It is this optionality that leads us to believe that supply will not overwhelm the IG credit markets in 2026 as borrowers will turn to other options if the issuance of public debt becomes prohibitively expensive. We saw this behavior from META when it issued a $27bln private credit instrument in October to fund a massive data center project in Louisiana.

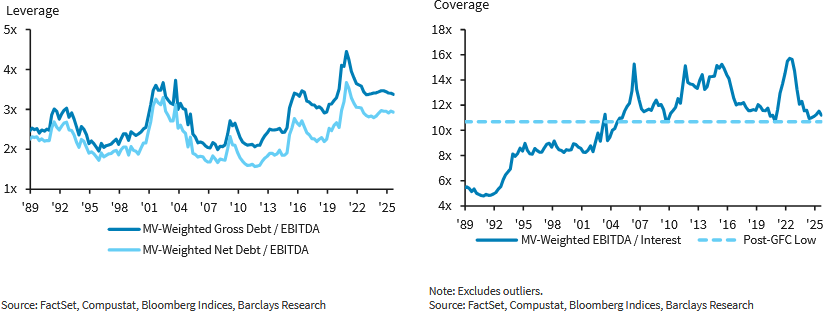

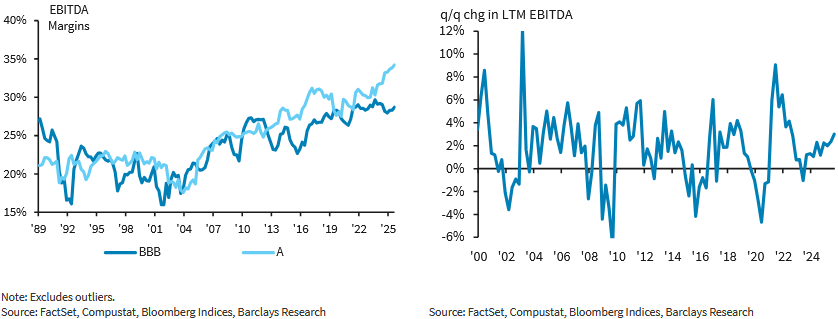

Fundamentals are stable but idiosyncratic risk is on the rise. Peak credit metrics are clearly in the rearview but the fundamental credit quality of the broad IG market is still very solid. The banking industry is leading the way in terms of credit health. Non-financial leverage is elevated relative to 2019 but it is meaningfully lower than it was in 2021 while interest coverage has trended lower for the same cohort. On the plus side of the ledger, EBITDA has continued to grow and EBITDA margins hit another all-time high at the end of the third quarter, led by large-cap highly rated credits.v What is lost in these numbers is the qualitative data that we have observed in the market recently. Our experience tells us that unique risk in the IG market has been increasing in recent quarters for certain industries and specific credits. Successful managers will need to focus on building well diversified portfolios and avoiding problematic borrowers. We are comfortable navigating these risks as a manger that is focused on the individual credit metrics of the issuers that populate our portfolio.

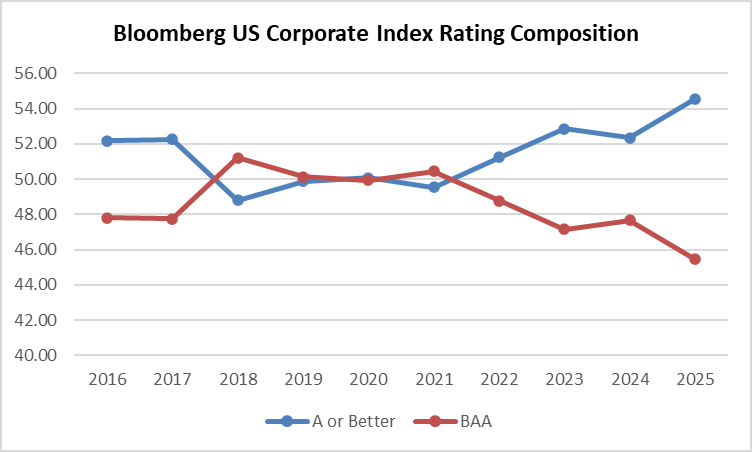

Credit Quality is Increasing. Despite credit metrics being off the peak, the quality of the investment grade universe has increased over the last few years. The BAA composition of The Index hit a high of 51.21% at the end of 2018 but this figure had fallen to 45.77% by the end of last year.

Not only is there a trend of higher quality issuance, with single-A or better companies accounting for 58% of issuance over the past several years, but there were also a record number of upgrades from BAA to single-A in 2025, while downgrades hit a record low.vi We expect that the quality of the index could continue to increase for the next several years if highly rated hyper scaler AI capital spending plans come to fruition. Recall that the CAM Investment Grade Program is structurally underweight BAA-rated credit as we look to limit portfolio exposure to a 30% weighting in the riskier portions of the IG market.

The Road Ahead

As we turn the calendar we are cautious but not necessarily fearful. Credit spreads are tight, much like they were at the beginning of 2025, and yields are not as elevated as they were 12 months ago but they are high enough to provide a margin of safety. As the credit cycle has aged, the market has increasingly moved towards more of a “credit pickers” environment where managers are rewarded for avoiding mistakes. We will continue to focus on the nuts and bolts of credit-work and we will position the portfolio as best we can to generate attractive risk adjusted returns.

We hope that your year is off to an excellent start and we look forward to continuing the conversation with you throughout 2026.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Past performance is not a guarantee of future results. Gross of advisory fee performance does not reflect the deduction of investment advisory fees. Our advisory fees are disclosed in Form ADV Part 2A. Accounts managed through brokerage firm programs usually will include additional fees. Returns are calculated monthly in U.S. dollars and include reinvestment of dividends and interest. The Index is unmanaged and does not take into account fees, expenses, and transaction costs. Index returns and related data such as yields and spreads are shown for comparative purposes and is based on information generally available to the public from sources believed to be reliable. No representation is made to its accuracy or completeness.

The information provided in this report should not be considered a recommendation to purchase or sell any particular security. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s portfolio. Fixed income investments have varying degrees of credit risk, interest rate risk, default risk, and prepayment and extension risk. In general, bond prices rise when interest rates fall and vice versa. This effect is usually more pronounced for longer-term securities. There is no assurance that any securities discussed herein have been held or will be held in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed do not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings, if any. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable, or that the investment decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein. Upon request, Cincinnati Asset Management will furnish a list of all security recommendations made within the past year.

Additional disclosures on the material risks and potential benefits of investing in corporate bonds are available on our website: https://www.cambonds.com/disclosure-statements/

i Bloomberg, December 29 2025, “Trump Says he Still Might Fire Powell as Fed Chair Pick Looms”

ii Bloomberg, January 8 2026, “World Interest Rate Probability”

iii Bloomberg, January 2 2026, “Investment-Grade Bond Sales Set for Massive January Start”

iv Bloomberg, January 8 2026, “US IG ISSUANCE: Week Crosses $90b as 3 to Raise $1.75b Thursday”

v Barclays, December 15 2025, “Q3 25 Update: No signs of concern”

vi Barclays, November 7 2025, “All aboard the BBB upgrade train”