2025 Q4 High Yield Quarterly

Q4 COMMENTARY

January 2026

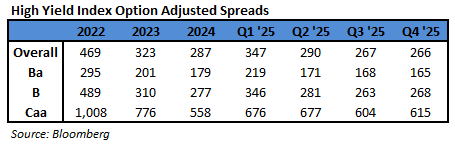

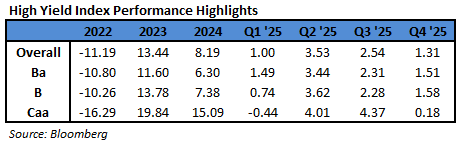

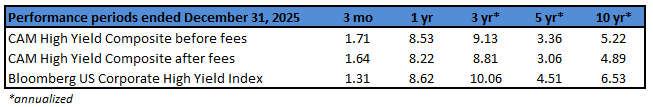

In the fourth quarter of 2025, the Bloomberg US Corporate High Yield Index (“Index”) return was 1.31% bringing the year to date (“YTD”) return to 8.62%. The S&P 500 index return was 2.65% (including dividends reinvested) bringing the YTD return to 17.86%. Over the period, while the 10 year Treasury yield increased 2 basis points, the Index option adjusted spread (“OAS”) tightened 1 basis point moving from 267 basis points to 266 basis points.

With regard to ratings segments of the High Yield Market, BB rated securities tightened 3 basis points, B rated securities widened 5 basis points, and CCC rated securities widened 11 basis points. The chart below from Bloomberg displays the spread move of the Index over the past five years. For reference, the average level over that time period was 348 basis points.

The sector and industry returns in this paragraph are all Index return numbers. The Index is mapped in a manner where the “sector” is broader with the more specific “industry” beneath it. For example, Energy is a “sector” and the “industries” within the Energy sector include independent energy, integrated energy, midstream, oil field services, and refining. The Banking, Finance, and Consumer Non-Cyclical sectors were the best performers during the quarter, posting returns of 2.14%, 2.00%, and 1.86%, respectively. On the other hand, Technology, Transportation, and Capital Goods were the worst performing sectors, posting returns of 0.77%, 0.78%, and 0.92%, respectively. At the industry level, office REIT, metals and mining, and healthcare all posted the best returns. The office REIT industry posted the highest return of 3.29%. The lowest performing industries during the quarter were railroads, packaging, and life insurance. The -2.87% posted by the railroads industry was the lowest return by any industry.

Issuance

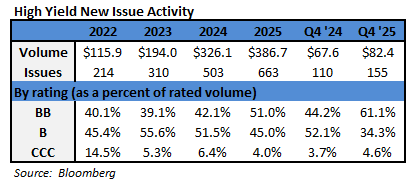

Every quarter of 2025 posted strong issuance leading to a very robust yearly total of $386.7 billion. The third quarter had the highest issuance of the year with $139.5 billion. Following that blowout, the fourth quarter totals could have fallen off the proverbial cliff; however, they did not disappoint, reaching $82.4 billion. Of the issuance that did take place during Q4, Communications took 18% of the market share followed by Healthcare and Financials, each at 14%.

The Federal Reserve did cut the Target Rate 25 basis points at the October and December meetings. There was no meeting held in November. That marked three consecutive cuts to close out 2025. Of note, three voting members were against the quarter point cut. One member wanted a half point cut and two other members were in favor of no cut. To have three dissents to a policy action is not very common. The last occurrence was back in September of 2019. While the Fed dot plot shows a median cut of 25 basis points for 2026, the voting member opinions of the rate outlook is deeply divided. The debate at the FOMC continues to be inflation above target versus labor market concerns. Currently, market participants are pricing in an implied rate move of 59 basis points in cuts for 2026.i After the December meeting, Fed Chair Jerome Powell recognized the varying opinions at the Fed and acknowledged that, given the backdrop, disagreements should be expected. “A very large number of participants agree that risks are to the upside for unemployment and to the upside for inflation, so what do you do?” Powell said. “You’ve got one tool, you can’t do two things at once. It’s a very challenging situation.”ii

Intermediate Treasuries increased 2 basis points over the quarter, as the 10-year Treasury yield was at 4.15% on September 30th, and 4.17% at the end of the fourth quarter. The 5-year Treasury decreased 1 basis point over the quarter, moving from 3.74% on September 30th, to 3.73% at the end of the fourth quarter. Intermediate term yields more often reflect GDP and expectations for future economic growth and inflation rather than actions taken by the FOMC to adjust the target rate. The revised third quarter GDP print was 4.3% (quarter over quarter annualized rate). Looking forward, the current consensus view of economists suggests a GDP for 2026 around 2.0% with inflation expectations around 2.6%.iii

Being a more conservative asset manager, Cincinnati Asset Management does not buy CCC and lower rated securities. Additionally, our interest rate agnostic philosophy keeps us generally positioned in the five to ten year maturity timeframe. During Q4, our higher quality positioning was a benefit to performance as lower rated securities underperformed. Some performance detractors included our credit selections within the consumer non-cyclicals sector, selections within the communications sector, and our underweight in the finance sector. Benefiting our performance this quarter were our credit selections in the consumer cyclicals sector and selections within the technology sector. Another benefit was added due to our overweight in the banking sector.

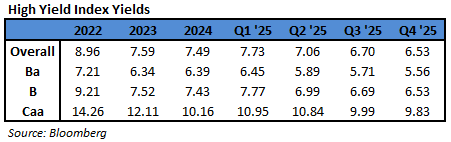

The Bloomberg US Corporate High Yield Index ended the fourth quarter with a yield of 6.53%. Treasury volatility, as measured by the Merrill Lynch Option Volatility Estimate (“MOVE” Index), has continued its move below the 80 index average over the past 10 years. The current rate of 64 is well below the spike near 200 back during the March 2023 banking scare. The most recent spike reached a high of 140 in April of 2025 as the market grappled with numerous tariff changes. The MOVE Index has maintained a downward trend since the April spike. Data available through November shows 26 bond defaults during 2025 which is relative to 16 defaults in all of 2022, 41 defaults in all of 2023, and 34 defaults in all of 2024. The trailing twelve month dollar-weighted bond default rate is 1.43%.iv The current default rate is relative to the 2.13%, 1.78%, 2.06%, 1.80% default rates from the previous four quarter end data points listed oldest to most recent. Defaults are generally stable and the fundamentals of high yield companies are in decent shape. From a technical view, fund flows were positive this year through November data at $18.3 billion.v No doubt there are risks, but we are of the belief that for clients that have an investment horizon over a complete market cycle, high yield deserves to be considered as part of the portfolio allocation.

The high yield market performed well throughout Q4 and 2025. The market has been characterized by declining spreads, positive returns each quarter, strong issuance, steady defaults, sturdy fundamentals, and positive flows. Of course, there is another side of the coin. The government shutdown for 43 days marking the longest on record. The previous record being 35 days. The shutdown completely impacted timely economic surveys and report dissemination. GDP in 4Q is forecast to be meaningfully lower than the 3Q print. Consumers, particularly those in the lower income brackets, are beginning to experience more affordability challenges. The labor market continues to slow and inflation remains elevated above the Fed target. This is the side of the coin that is showing up in sentiment indicators like US Consumer Confidence, which recently declined for the fifth consecutive month. There will certainly be plenty to evaluate as we move through 2026. Our exercise of discipline and credit selectivity is important as we continue to evaluate that the given compensation for the perceived level of risk remains appropriate. As always, we will continue our search for value and adjust positions as we uncover compelling situations. Finally, we are very grateful for the trust placed in our team to manage your capital.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results. Gross of advisory fee performance does not reflect the deduction of investment advisory fees. Our advisory fees are disclosed in Form ADV Part 2A. Accounts managed through brokerage firm programs usually will include additional fees. Returns are calculated monthly in U.S. dollars and include reinvestment of dividends and interest. The index is unmanaged and does not take into account fees, expenses, and transaction costs. It is shown for comparative purposes and is based on information generally available to the public from sources believed to be reliable. No representation is made to its accuracy or completeness. Additional disclosures on the material risks and potential benefits of investing in corporate bonds are available on our website: https://www.cambonds.com/disclosure-statements/.

i Bloomberg January 1, 2026: World Interest Rate Probability

ii Bloomberg December 11, 2025: ‘Silent Dissents’ Reveal Growing Fed Resistance to Powell’s Cuts

iii Bloomberg January 1, 2026: Economic Forecasts (ECFC)

iv Moody’s December 16, 2025: November 2025 Default Report and data file

v Bloomberg January 1, 2026: Fund Flows