CAM Investment Grade Weekly Insights

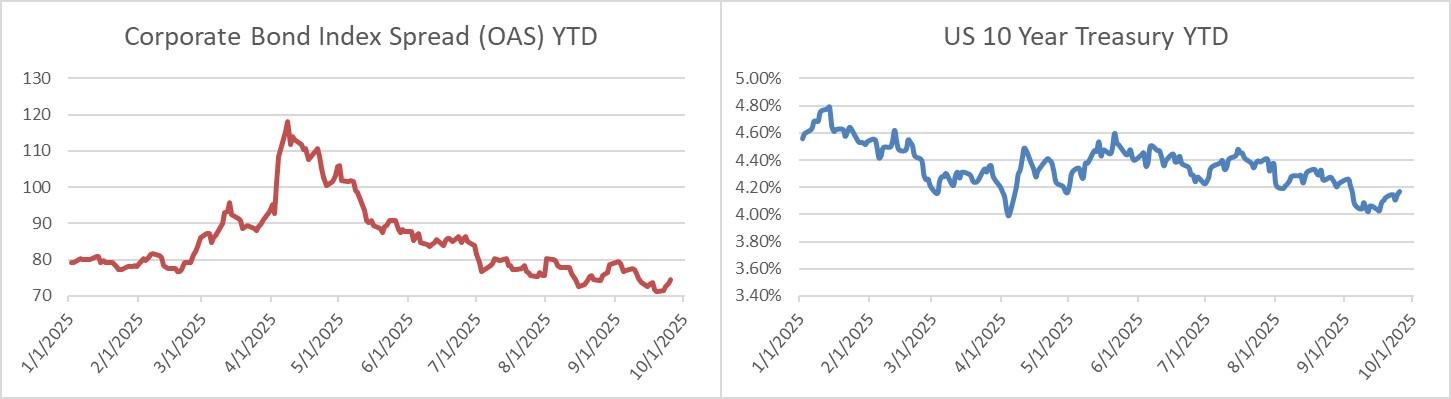

Credit spreads will finish wider this week for the first time in the past four weeks. The index has traded within a tight 9bp range since mid-July so any move tighter or wider during that time period has been incremental at best. The OAS on the Corporate Index closed at 75 on Thursday September 25th after closing the week prior at 72. Treasury yields moved slightly higher throughout the week. The 10yr Treasury yield closed last week at 4.13% and was 4.18% as we went to print on Friday afternoon. Through Thursday, the Corporate Bond Index year-to-date total return was +6.53% while the yield to maturity for the index was 4.86%.

News & Economics

The data this week echoed a familiar refrain: never bet against the U.S. consumer. Second quarter real GDP was revised up to 3.8% from 3.3% on the back of improved consumer spending. The PCE index rose 2.7% year-over-year through August while core PCE was 2.9%. While inflation is not running red hot, it remains very stubborn. The most surprising release of the week was a 20.5% surge in new home sales for the month of August. It is worth noting that this data can tend to be extremely volatile and is subject to outsize revisions so there is a widely held belief that this initial release is not entirely accurate. All told, the data this week was rather hawkish. There is still a month to go until the next FOMC meeting on October 29th, and although interest rate futures are pricing a 90% chance of a cut, we think it is far from a done deal if the data keeps indicating that the economy is holding up just fine.

Next week brings data releases for construction spending, ISM manufacturing and services and then the payroll report for the month of September on Friday morning.

Primary Market

It was a much busier week than expected as $56bln of new investment grade debt was priced this week relative to the estimate of $30bln. Oracle led the way with an $18bln print and other large issuers of note included Broadcom, Dell and Lowe’s. Next week, syndicate desks are looking for things to cool off a bit into quarter-end with estimates of about $25bln in new supply.

Flows

According to LSEG Lipper, for the week ended September 17, investment-grade bond funds reported a net inflow of +$2.18bln. This marked the 19th straight week of inflows and is the largest such streak since 2021. Total year-to-date flows into investment grade were +$47.4bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.