CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

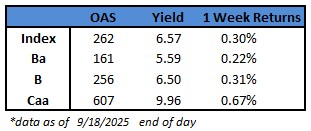

- US junk bond yields tumble to a new multi-year low and risk premium drops to a seven-month low driving gains for the seventh consecutive week, the longest winning streak since last September. Yields closed at 6.57%, also falling for the seventh week in a row.

- The broad rally extended across ratings in the US junk bond market on renewed bets that easing interest-rate policy by the Federal Reserve will bolster corporate earnings and growth. The gains spanned across all risk assets as equities hit all-time highs. CCC yields, the riskiest tier of the high yield universe, dropped below 10% for the fourth time in three weeks and are near a six-month low at 9.96%. CCCs have risen to the top again with 0.23% returns on Thursday, the best performing asset class in the US high yield market.

- The market expectations of at least two more 25 basis points cut this year and one 25 basis point cut each in 2026 and 2027 are in line with Federal Reserve’s dot plot projections driving risk assets across the board

- BB yields also plunged to a multi-year low of 5.59% and spreads fell to a more than 10-week low spurring gains for the seventh successive week

- Plunging yields, falling risk premium, and a still steady economy against the backdrop of Fed’s easing interest-rate policy, fueled a supply surge as the week is set to close with nearly $12b in new bonds, the busiest since the week ended Aug. 8. Leaving aside the last two weeks of a summer lull, the primary market has seen supply of $9b+ for five straight weeks

- Credit remains unshaken, bolstered by persistent technical strength, Barclays strategists Brad Rogoff and Dominique Toublan wrote on Friday. With the market seemingly rangebound at tight levels, identifying areas of dispersion and catalyst-driven opportunities remains key, they added

(Bloomberg) Fed Cuts Rates by Quarter-Point; Powell Cites Weakness in Jobs

- Federal Reserve officials lowered their benchmark interest rate by a quarter percentage point and penciled in two more reductions this year following months of intense pressure from the White House to slash borrowing costs.

- Chair Jerome Powell pointed to growing signs of weakness in the labor market to explain why officials decided it was time to cut rates after holding them steady since December amid concerns over tariff-driven inflation.

- “Labor demand has softened, and the recent pace of job creation appears to be running below the break-even rate needed to hold the unemployment rate constant,” Powell told reporters. He added, “I can no longer say” the labor market is “very solid.”

- Powell also signaled ongoing concern over inflation pressures resulting from tariffs. “Our obligation is to ensure that a one-time increase in the price level does not become an ongoing inflation problem,” he said.

- Looking ahead at the outlook for additional rate moves, Powell was cautious, saying the Fed was now in a “meeting-by-meeting situation.”

- In their post-meeting statement, policymakers acknowledged that inflation has “moved up and remains somewhat elevated,” but also pointed to worries over jobs. Officials said the unemployment rate had “edged up,” and the “downside risks to employment have risen.”

- The cut was widely expected amid signs the central bank’s concerns are shifting toward employment and away from inflation, following a sharp slowdown in hiring over the last several months.

- Policymakers also updated their economic projections at this meeting and now see two additional quarter-point cuts this year. That’s one more than projected in June. They foresee one quarter-point cut in 2026 and one in 2027.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.