CAM Investment Grade Weekly Insights

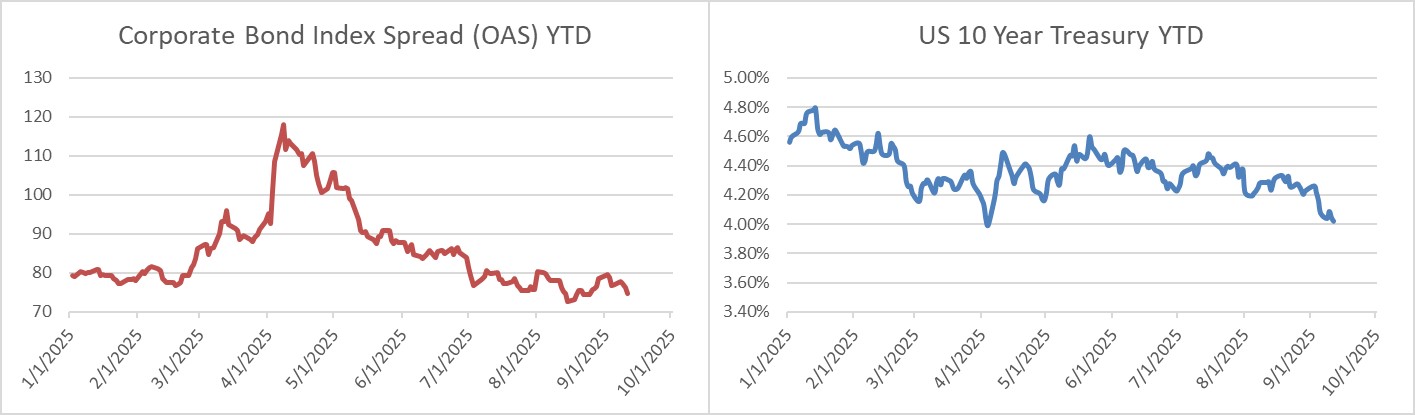

Credit spreads inched tighter again this week as they have remained in a relatively tight 5bp range over the course of the past month. The OAS on the Corporate Index closed at 75 on Thursday September 11th after closing the week prior at 77. Treasury yields exhibited little change over the past week through Friday morning. The 10yr Treasury yield was 4.07% as we went to print. Through Thursday, the Corporate Bond Index year-to-date total return was +7.31% while the yield to maturity for the index was 4.72%.

News & Economics

Economic highlights this week included PPI and CPI, both of which came within the realm of expectations. Consumer sentiment data released on Friday morning was softer than expected. The economic releases this week did little to derail the prevailing market narrative that the Fed will look to deliver a cut next Wednesday. On Friday morning, interest rate futures were pricing a >100% chance of a 25bp move lower in Fed Funds with a high probability of additional cuts at the October and December meetings. Next week will also bring economic releases for retail sales, industrial production and housing starts.

Primary Market

The primary market was busy again this week as $38bln was priced through Thursday with up to another $1bln looking to price on Friday. This figure was lighter than dealer forecasts of $45-$50bln. Next week syndicate desks are looking for around $30bln of new supply shaded toward Monday and Tuesday. Wednesday FOMC releases are almost always a “no-go” for new supply as issuers prefer to stand down in the wake of the potential rate and spread volatility that can accompany the FOMC post-meeting presser.

Flows

According to LSEG Lipper, for the week ended September 10, investment-grade bond funds reported a net inflow of +$2.7bln. Total year-to-date flows into investment grade were +$45.2bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.