CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

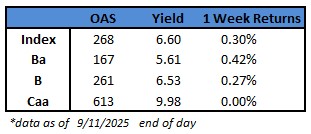

- US junk bonds are headed for their sixth week of gains, with yields tumbling to a fresh 40-month low of 6.60% and spreads returning to the six-month low of 268 basis points, spurred by expectations of Federal Reserve policy easing. The high yield market notched up gains in three of the last four sessions.

- The rally spanned the risk spectrum and gained momentum after jobless-claims data on Thursday reinforced signs of weak labor market and fueled bets that the Fed will cut rates next week. BB yields, the best of the junk bond market, plunged to near a 40-month low of 5.61% and are on track for a sixth week of declines, the longest streak since December 2023. BBs have returned 0.42% returns so far this week, the most in more than two months.

- Risk assets traded with strong bias as macro data broadly supported expectations of a Fed cut next week, Barclays strategists Brad Rogoff and Dominique Toublan wrote in a note published Thursday

- While technicals remain supportive, valuations are increasingly asymmetric, and the risk of spread widening into 4Q is rising, the wrote

- CCC yields, the riskiest segment of the high yield market, fell below 10%. Spreads tightened 10 basis points on Thursday, the most in two weeks, to 613 basis points

- Single B yields also fell to a fresh 40-month low of 6.53% and spreads closed at 261 basis points prompting gains for the sixth straight week

- Attractive yields, tight spreads, strong demand and expectations of easing interest rates spurred a supply surge in the primary market

- Twelve borrowers sold nearly $9.5b this week so far and this will be the third consecutive week of more than $9b in supply

- September volume stands at $19b

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.