CAM Investment Grade Weekly Insights

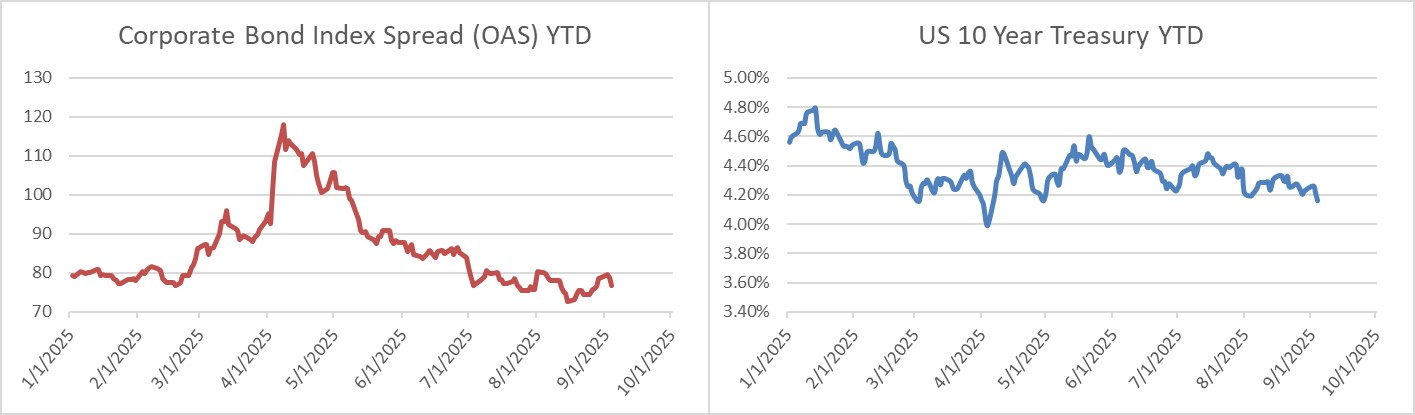

Credit spreads look poised to finish the week tighter, which is a remarkable feat given the deluge of new issue supply during the period. The OAS on the Corporate Index closed at 77 on Thursday September 4th after closing the week prior at 79. Spreads are a smidge tighter on Friday as we go to print in the late afternoon. Treasury yields are set to finish the week meaningfully lower after another weak jobs report to start the Friday trading session. The 10yr Treasury yield closed last week at 4.23% and it is wrapped around 4.07% on Friday afternoon. Through Thursday, the Corporate Bond Index year-to-date total return was +5.95%.

News & Economics

The big news this week was on Friday morning with the release of the nonfarm payrolls report for the month of August. The BLS report showed that employers added just 22,000 jobs in August while the street was looking for a gain of 75,000. This was the fourth consecutive month of less than 100,000 payroll additions. June payrolls also saw a downward revision which knocked the number for that month into negative territory, making June 2025 the first month of payroll reductions since 2020. Treasury yields moved lower on the back of the release and interest rate futures began to price more than a 100% chance of a 25bp cut when the FOMC convenes on September 17th. There is still one big datapoint ahead of the September Fed meeting next Thursday with the release of CPI. After several consecutive weak job reports accompanied with lower revisions it feels like inflation would need to come in red-hot in order to derail what is likely to be the first decrease in the Fed’s policy rate since December 2024. Futures are also pricing a high probability of cuts at both the October and December meetings as well (no meeting in November).

Primary Market

It was the busiest week of 2025 for the primary market, which is especially impressive considering Monday was a market holiday. Companies priced more than $67bln of new debt in just three trading days as there was no activity on Friday to make way for the jobs report. 2025’s pace of issuance now just slightly trails 2024 to the tune of -2%. Next week is expected to be another busy one with syndicate desks looking for companies to issue up to $50bln in new debt.

Flows

According to LSEG Lipper, for the week ended September 3, investment-grade bond funds reported a net inflow of +$2.6bln. Total year-to-date flows into investment grade were +$42.5bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.