CAM Investment Grade Weekly Insights

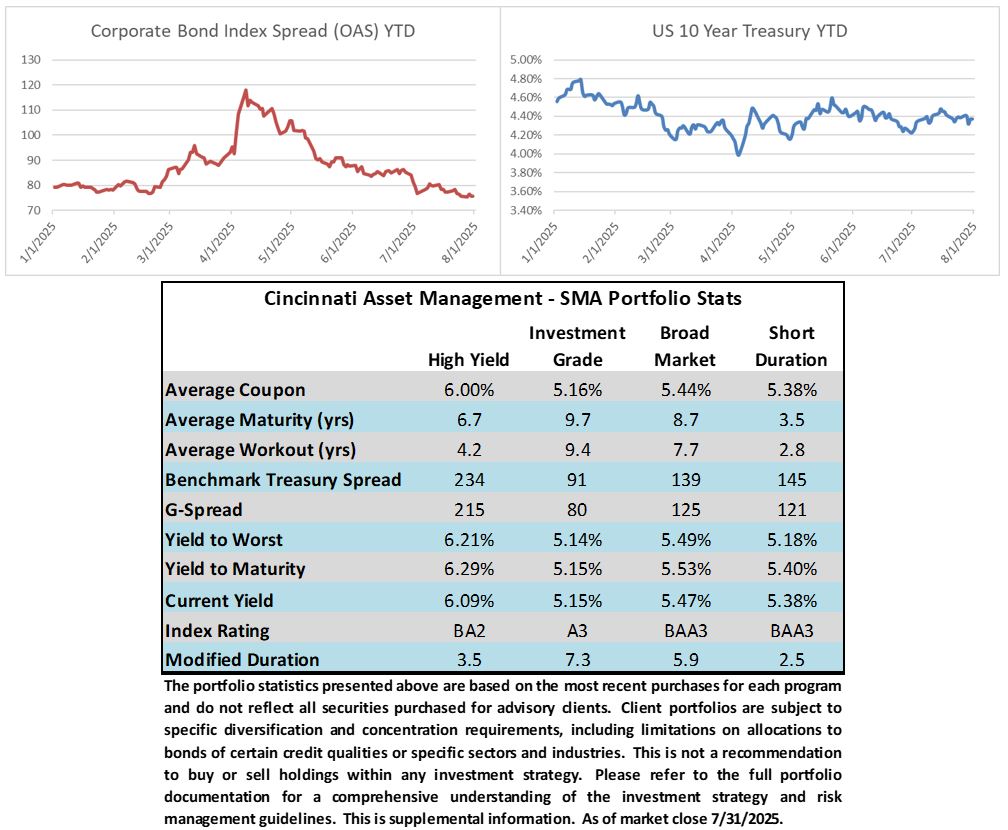

Credit spreads finished the week unchanged through Thursday, though the market was 3-4 basis points wider Friday afternoon. The move wider came in sympathy with sharply lower Treasury yields following a weak payroll report on Friday morning. The OAS on the Corporate Index closed at 76 on Thursday evening. The 10yr Treasury yield was little changed through the first four trading days of the week but was 15bps lower following the jobs report. The 2yr Treasury was 24bps lower as investors priced a higher probability of a near term cut by the Federal Reserve. Through Thursday, the Corporate Bond Index year-to-date total return was +4.24% while the yield to maturity for the Index closed the day at 5.07%.

News & Economics

It was a busy week for data as a solid GDP print took the markets by surprise on Wednesday with growth coming in solidly above expectations, however, a closer examination of the numbers showed that most of the headline beat was driven by a reversal in imports and a drawdown in domestic inventories. The purchase component of GDP painted a picture of waning demand. The Fed followed Wednesday afternoon with no change to its policy rate, as expected. In his press conference, Chair Powell continued to emphasize that the labor market was in a good enough position that the FOMC could continue to wait-and-see. With no August meeting on the calendar, the Fed has three major data points to parse following the release of the July labor report this morning: the August jobs report in early September and two inflation reports. The largest market moving print of the week was nonfarm payrolls this morning and there was no way to spin the release in a positive light. It was a weak report with July payrolls missing expectations to the downside accompanied by large downward revisions in the June and May numbers. June was revised to 14k from 147k and May to 19k from 144k. The unemployment rate also ticked higher to 4.2% from 4.1%. Stocks traded sharply lower in the aftermath and Treasury yields followed suit. As we go to print on Friday afternoon, traders were pricing an 86.1% chance of a cut at the Fed’s September meeting while they were pricing just a 39.8% chance the day prior.

Primary Market

It was another typical week for issuance in the midst of earnings season with just $12.2bln of new supply. Next week is expected to be much busier now that most companies have reported earnings with primary dealers looking for $25-35bln of new issuance. YTD new issue volume through week end was $979bln which was +1% ahead of 2024’s pace. It remains to be seen if the risk-off sentiment that was capturing the market on Friday will dissuade IG-rated companies from borrowing next week. We tend to think that they will forge ahead given that the move lower in Treasury yields has more than offset the move wider in spreads making all-in borrowing costs lower than they would have been just a few days ago.

Flows

According to LSEG Lipper, for the week ended July 30, investment-grade bond funds reported a net inflow of +$1.3bln. Total year-to-date flows into investment grade were +$28.5bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.