CAM Investment Grade Weekly Insights

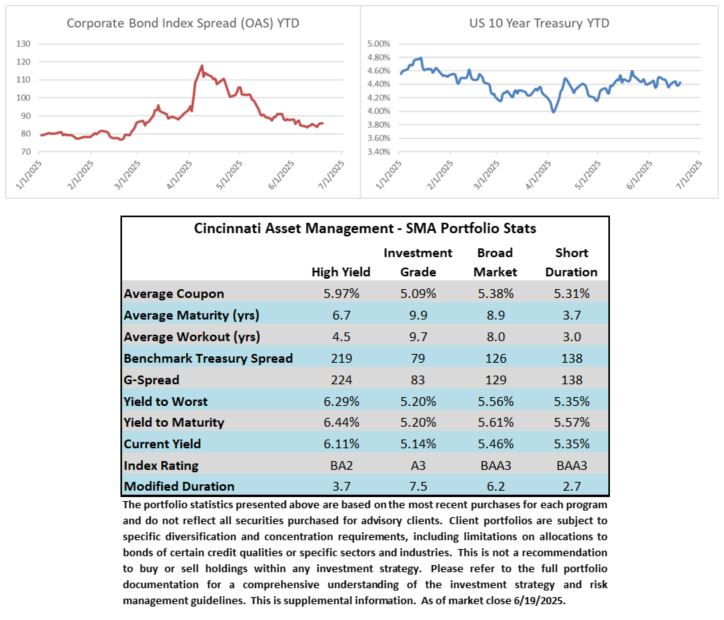

Credit spreads were unchanged this week through Wednesday, while the capital markets were closed on Thursday in observance of Juneteenth. The tone is little changed this Friday morning as we go to print with the US Corporate Bond Index wrapped around a spread (OAS) of 85. The 10yr Treasury yield moved slightly higher this week as the benchmark went from 4.40% at the end of last week to 4.43% early Friday morning. Market sentiment is cautious overall given the backdrop of geopolitical uncertainty. Through Wednesday, the Corporate Bond Index year-to-date total return was +2.92% while the yield to maturity for the Index closed the day at 5.18%.

Economics

Retail sales were soft this week, though a large part of that move was driven by a decline in auto-sales. Still, it points to continuing struggles for the retail industry driven by tariff uncertainty. The May industrial production report was better than feared as the gauge continued to muddle along with some pockets of strength. Housing starts and permits data was very soft as total housing starts fell almost 10% in May driven by multifamily. There are a multitude of headwinds for the housing sector, most especially the high cost to build, elevated cost of capital and stubbornly high mortgage rates.

The highlight of the week was the FOMC meeting where the central bank held rates steady in what was a unanimous decision by all 12 voting members. There are some diverging views of committee members when looking at the Summary of Economic Projections (dot plot). The most recent version of the dots, released every three months, showed that the median FOMC member continued to expect 50bps of cuts in 2025. There were a number of committee members that believed the FOMC should remain on hold all year and that grew from 4 members to 7 members since the last dot plot in March. We continue to expect 1-2 cuts in 2025 as our base case but 3 or 4 cuts is a distinct possibility if the economy continues to soften.

There are some interesting prints next week including PMI, existing home sales, GDP, durable goods and finally the Fed’s preferred inflation gauge on Friday morning, core PCE.

Primary Market

Issuance was in line with expectations this week as $18bln of debt priced on Monday & Tuesday. It was a somewhat disjointed week for the primary calendar with the FOMC meeting on Wednesday and a market holiday on Thursday. YTD issuance stands at $853.2bln, slightly ahead of 2024’s pace. The street is looking for $20-$25bln of issuance next week with most of that activity expected in the front half of the week.

Flows

According to LSEG Lipper, for the week ended June 18, investment-grade bond funds reported their third consecutive week of inflows at +$929.6m. Total year-to-date flows into investment grade were +$17.23bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.