CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

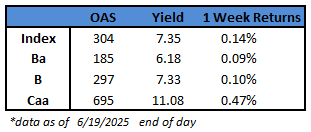

- US junk bond yields held steady, with spreads still at a three-year low fueling a wave of new bond sales to push June’s tally to nearly $22b. That’s already 23% more than the full month of June 2024 and up almost 70% on June 2023.

- The market awaits the pricing of a $5b, five-year debt sale by Elon Musk’s xAI, split into loans and bonds. Pricing and allocation expected sometime later today.

- As yields held steady and with spreads still hovering near 300 basis points, the primary market is inundated with supply, driving the week’s volume to nearly $6b

- The junk bond rally lost some momentum on Wednesday after Fed Chair Jerome Powell indicated that the impact of tariffs on prices will show up later this summer

- Fed’s new forecasts showed weaker growth, higher inflation and higher unemployment. This prompted Fed officials to project two rate cuts this year

- The gains across the high yield market are modest even as junk bonds head for a fourth week of gains

(Bloomberg) Fed Officials Hold Rates Again, Still See Two Cuts by Year End

- Federal Reserve officials continued to pencil in two interest-rate cuts in 2025, though new projections showed a growing divide among policymakers over the trajectory for borrowing costs as tariffs make their way through the US economy.

- The Federal Open Market Committee voted unanimously on Wednesday to hold the benchmark federal funds rate in a range of 4.25%-4.5%, as they have since the beginning of the year. They also released new economic forecasts — their first since President Donald Trump unveiled a sweeping set of tariffs in April — showing they expect weaker growth, higher inflation and higher unemployment this year.

- Speaking to reporters following the decision, Chair Jerome Powell repeated his view that the central bank was “well positioned to wait to learn more about the likely course of the economy before considering any adjustments to our policy stance.”

- Interest-rate projections released alongside the decision show a split: Seven officials now foresee no rate cuts this year, compared with four in March, and two others pointed to one cut. At the same time, 10 officials expect it will be appropriate to lower rates at least twice before the end of 2025.

- In the run-up to this month’s meeting, many officials signaled their preference to hold rates steady for some time as they wait for clarity on how Trump’s economic policies will affect inflation and the broader economy.

- Asked about the division in officials’ rate projections, Powell downplayed it. Given the high level of uncertainty in the economy, he said, “No one holds these rate paths with a lot of conviction.”

- In their updated economic forecasts, officials raised their median estimate for inflation at the end of 2025 to 3% from 2.7%. They marked down their forecast for economic growth in 2025 to 1.4% from 1.7%.

- They forecast an unemployment rate of 4.5% by the end of the year, up slightly from their previous estimate.

- The projections reflected the thorny situation facing Fed policymakers.

- Growing inflationary pressures typically suggest the Fed policy should restrain the economy with elevated rates, while weakening growth calls for stimulus through lower rates. Trump this year has repeatedly pushed for the Fed to cut rates, arguing the central bank under Powell has often been late to adjust policy.

- Neither employment nor inflation data have yet shown a substantial impact from tariffs. A measure of underlying consumer inflation rose in May by less than forecast, spurring Trump to renew his call for lower rates.

- Powell said the committee continued to expect tariffs to work their way into final prices, but that it would take time.

- “Ultimately the cost of the tariff has to be paid and some of it will fall on the end consumer,” he said. “We know that because that’s what businesses say, that’s what the data say from the past.”

- “We know that’s coming and we just want to see a little bit of that before we make judgments prematurely,” he added.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.