CAM Investment Grade Weekly Insights

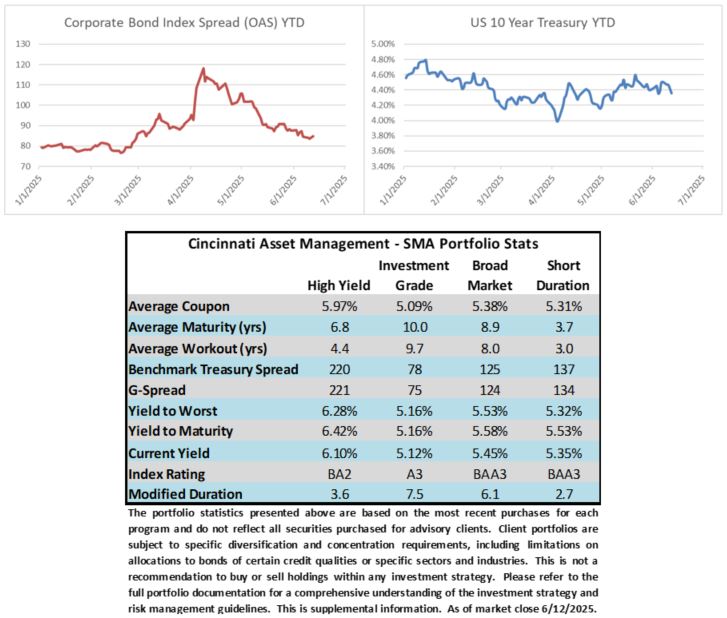

Credit spreads were slightly tighter this week through Thursday but tensions are high this Friday morning as the market processes recent developments in the Middle East. The US Corporate Bond Index closed last week at 85 and it was at 84 when the market closed this Thursday. The market is generically 1-2 bps wider Friday mid-morning as we go to print and equities were also getting hit in a risk-off move related to Israel and Iran. The 10yr Treasury yield was solidly lower (-15bps) on the week, moving from 4.51% at the end of the last week to 4.36% through Thursday. Rates have moved steadily lower since May 21 when the 10yr closed at 4.60% but the current yield is still very close to the YTD average of 4.41%. Through Thursday, the Corporate Bond Index year-to-date total return was +3.14% while the yield to maturity for the Index closed the day at 5.14%.

Economics

The data was mixed this week but for the most part it continued to show that the U.S. economy has held up well in the face of uncertain trade policy. The Consumer Price Index showed an increase of +0.1% for May and +2.4% year over year. This CPI print was a benign one for inflation indicating that tariffs have not yet had the impact that many expected, although it is still early days. The US Producer Price Index was also a bit softer than some investors had feared showing an increase of +0.1% in May. Finally on Friday, consumer sentiment data showed improvement and inflation expectations also eased. Bottom line, it was a pretty good week for inflation.

Next week brings a busier calendar with most of the action taking place on Tuesday and Wednesday. Retail sales numbers for May will be released on Tuesday as well as data on import prices and industrial production. Housing starts will be released Wednesday morning and then the FOMC rate decision will occur that afternoon. We are firmly in the pause camp for this meeting and expect that the Fed will elect to hold its policy rate steady.

Away from economics, investors will continue to monitor the situation in the Middle East as Israel has carried out airstrikes against some of Iran’s nuclear and military facilities. Escalation could be negative for risk assets and it would likely send oil prices higher.

Primary Market

Issuance was just a bit light relative to expectations this week as companies priced $20.5bln of new debt while the street had been looking for $25bln. It wasn’t a terribly exciting week of issuance in our view as it was mostly comprised of less frequent, less attractive issuers with concessions that were not overly appealing. YTD issuance stands at $835.2bln just slightly ahead of 2024’s pace. Next week is expected to be on the quiet side with dealers looking for $15-$20bln of new supply concentrated on Monday and Tuesday. With the FOMC meeting on Wednesday and a market holiday for Juneteenth on Thursday, it adds up to a light week.

Flows

According to LSEG Lipper, for the week ended June 11, investment-grade bond funds reported another strong week of inflows at +$2.29bln. Total year-to-date flows into investment grade were +$16.3bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.