CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

- US junk bonds may snap a 13-day gaining streak after Israel’s strikes on Iran’s nuclear sites sparked a flight to haven assets, including US Treasuries and gold. US equity futures retreated as investors await Iran’s response amid concern the conflict could widen.

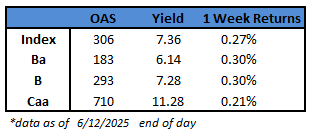

- US junk bond yields held steady at 7.36% on Thursday, and spreads were range-bound, closing at 306 basis points and pushing positive returns for the 13th consecutive session. The primary market has slowed down after a torrid pace of issuance drove supply to nearly $16b so far this month.

- The modest gains in the US junk bond market extended across ratings. CCC yields fell 10 basis points to 11.28% on Thursday. Spreads closed lower at 710, fueling small gains for the second session in a row

- BB yields closed flat at 6.14% and spreads closed at 183, driving positive returns for the fourth straight session

- The rally in the US high yield market was partly prompted by renewed bets that the Federal Reserve will cut rates twice this year as inflation moderates. It was also fueled by cash inflows into the asset class

- Credit continues to benefit from strong demand, Barclays strategists Brad Rogoff and Dominique Toublan wrote in note this morning. Current backdrop remains supportive for credit, and expect valuations to remain steady in the near term, they wrote

- Steady returns, attractive yields, and cash inflows into the asset class drove primary market supply

- The pipeline is building as borrowers stream in to take advantage of strong demand for yield

(Bloomberg) US Core Inflation Rises Less Than Forecast for Fourth Month

- Underlying US inflation rose in May by less than forecast for the fourth month in a row, suggesting companies are largely holding back on passing higher tariff costs through to consumers.

- The consumer price index, excluding the often volatile food and energy categories, increased 0.1% from April, according to Bureau of Labor Statistics data out Wednesday. From a year ago, it rose 2.8%.

- Goods prices, excluding food and energy commodities, were unchanged. New and used-car prices both declined, as did apparel. Meanwhile, services prices minus energy rose 0.2%, a deceleration from the prior month and reflecting a decline in airfares and hotel stays.

- Treasuries rallied, the dollar declined and the S&P 500 opened higher after the report. Interest-rate swaps showed traders see a 75% probability that the Federal Reserve will cut borrowing costs by September.

- The string of below-forecast inflation readings adds to evidence that consumers have yet to feel the pinch of President Donald Trump’s tariffs — perhaps because the most punitive levies have temporarily been on pause, or thanks to companies so far absorbing the extra costs or boosting inventory ahead of tariffs.

- However, if higher tariffs set in, shielding consumers from those costs will become more difficult, which is partly why economists expect firms to raise prices more meaningfully in the coming months.

- “The build-up of inventory in advance of the tariff hikes may be contributing to delayed pass through, while huge uncertainty in US trade policy may have affected the speed with which firms wish to adjust prices,” Brian Coulton, chief economist at Fitch Ratings, said in a note. “But a rise in core goods inflation in the months ahead still looks very likely.”

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.