CAM Investment Grade Weekly Insights

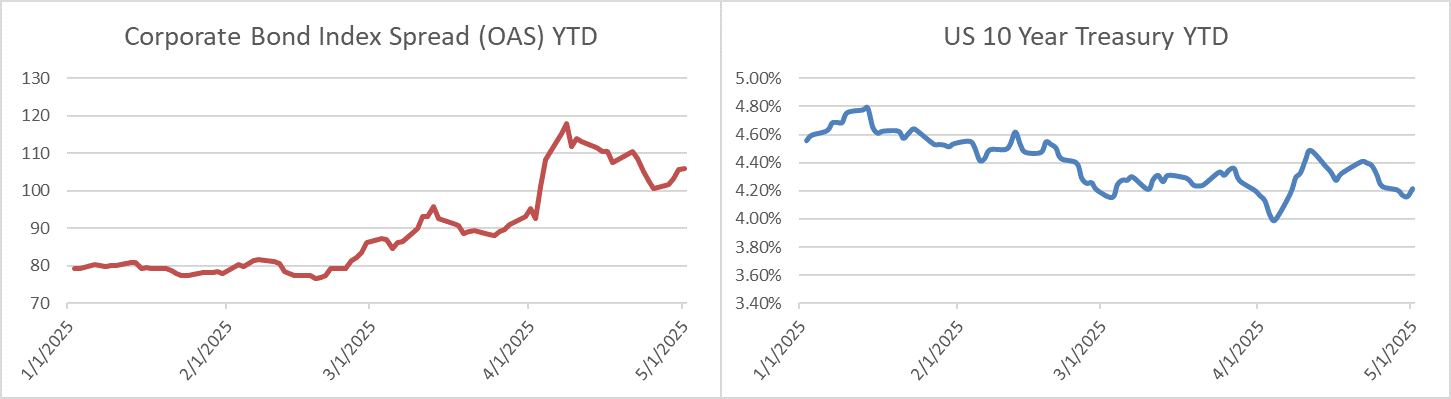

Credit spreads were listless this week, drifting wider through the first four trading days of the period before they snapped tighter Friday on the back of a stronger than expected payroll release for the month of April. The US Corporate Bond Index closed last week at 101 and had moved out to 106 by Thursday. Most bonds are 2-3bps tighter on Friday. The 10yr Treasury was in risk-off mode this week until Friday when the yield gapped higher after strong job numbers. The benchmark rate closed last week at 4.24% and is wrapped around 4.33% as we go to print this Friday afternoon. Through Thursday, the Corporate Bond Index year-to-date total return was +1.90% while the yield to maturity for the Index closed the day at 5.22%.

Economics

Economic data was very mixed this week. Consumer confidence continued to drop and details of that report showed that consumers have an increasingly negative view of the future. However, personal income and spending continue to hold up but it will remain to be seen how much of this spending was pulled forward to get ahead of tariffs. The initial GDP estimate showed that the economy contracted -0.3% during the first quarter but trade had an outsize impact on that number. Finally on Friday, the jobs report was better than expected and while the labor market is showing some signs of deterioration it is not yet in contraction and layoffs have yet to become a widespread issue. Bottom line, it is a very uncertain economic environment and backward-looking data may not be the best indicator of how the economy will behave in the future. The consumer continues to be the straw that stirs the drink so we will be watching income and spending patterns closely as they have historically gone hand in and hand as the keys to the US consumer-driven economy.

Next week the data is on the lighter side but we will hear from the FOMC on Wednesday. Interest rate futures are pricing just a 3.2% chance of a cut as we go to print but investors will be listening closely to Jerome Powell’s press conference. The market is currently pricing the July FOMC meeting as having a relatively high probability (70.8%) for the first cut of 2025.

Flows

According to LSEG Lipper, for the week ended April 30, investment-grade bond funds reported their sixth consecutive weekly net outflow, this time at -$2.2bln. Total year-to-date flows into investment grade funds remained positive at +$4.15bln.

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.