CAM High Yield Weekly Insights

(Bloomberg) High Yield Market Highlights

- US junk bonds are headed for their third weekly loss after dropping in five of the last six sessions, spurred by US tariffs and the continuing trade war with China. Yields surged 32 basis points in four sessions this week, the third consecutive week of rising yields.

- The euphoria after President Trump agreed to a 90-day pause of reciprocal tariffs on dozens of trading partners was short-lived. US high-yield funds reported an outflow of $9.6 billion, the biggest since 2005.

- The losses accelerated after a bevy of Fed officials repeatedly asserted that tariff-driven inflation would delay interest-rate cuts

- “Given the paramount importance of keeping long-run inflation expectations anchored and the likely boost to near-term inflation from tariffs, the bar for cutting rates even in the face of a weakening economy and potentially increased unemployment is higher,” Minneapolis Fed President Neel Kashkari wrote in an essay released Wednesday morning. “The hurdle to change the federal funds rate one way or the other has increased due to tariffs”

- “To sustainably achieve both of our dual-mandate goals, it will be important to keep any tariff-related price increases from fostering more persistent inflation,” Dallas Fed President Lorie Logan said Thursday in prepared remarks for an event at the Dallas Fed. “For now, I believe the stance of monetary policy is well positioned,” she added

- “Renewed price pressures could delay further policy normalization, as confidence is needed that the tariffs are not destabilizing inflation expectations,” Boston Fed President Susan Collins said in remarks prepared for an event Thursday at Georgetown University in Washington

- The rapid onslaught of conflicting news will likely persist, causing ongoing volatility in the markets, Barclays strategists Brad Rogoff and Dominique Toublan wrote this morning

- Furthermore, there are still structural questions to be answered. The overall current level of tariffs for the next 90 days is still higher than 20%, they added

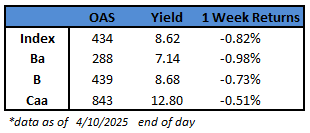

- The losses extended across the ratings spectrum, with BB yields hovering near a 16-month high and up 31 basis points in the last four sessions. This will be third straight week of rising yields

- CCCs, the riskiest tier of the junk bond market, is also poised to notch up losses for the third week in a row, the longest losing streak in 12 months

- CCC yields rose 71 basis points so far this week to close at 12.80%, set for its third successive weekly advance

- While the US paused reciprocal tariffs on some countries, the tariffs on steel, aluminum and automobiles stay at current rates

- Tariff volatility, rising yields and widening spreads brought primary market to a screeching halt

This information is intended solely to report on investment strategies identified by Cincinnati Asset Management. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. This material is not intended as an offer or solicitation to buy, hold or sell any financial instrument. Fixed income securities may be sensitive to prevailing interest rates. When rates rise the value generally declines. Past performance is not a guarantee of future results.